UK Business Energy News & Insights

Market Prices, Supplier Updates & Industry Analysis

Daily market reports, out-of-contract rate alerts, supplier news and regulatory updates — everything UK businesses need to make smarter energy decisions.

Market Snapshot

Loading...

Browse by Category

Filter our latest insights by topic

Stay Ahead of the Market

Weekly price updates, renewal timing advice & plain English analysis — straight to your inbox.

Frequently Asked Questions

Everything you need to know about our market insights, energy blogs, and how to use them for better decisions

Our daily updates cover UK gas and electricity wholesale prices, market trends, and what's driving price movements. You'll get real wholesale data, forward contract pricing, and plain English analysis — no jargon. We also highlight key events affecting the market (weather, outages, demand shifts) and give you actionable guidance on timing your renewals.

Armed with real market data, you can approach supplier quotes with confidence. You'll know if wholesale prices are high or low, spot when suppliers are overcharging, and time your renewals strategically. When you understand market cycles, you can push back on unfair pricing and negotiate with leverage. We also highlight "windows of opportunity" when it's the right time to lock in rates.

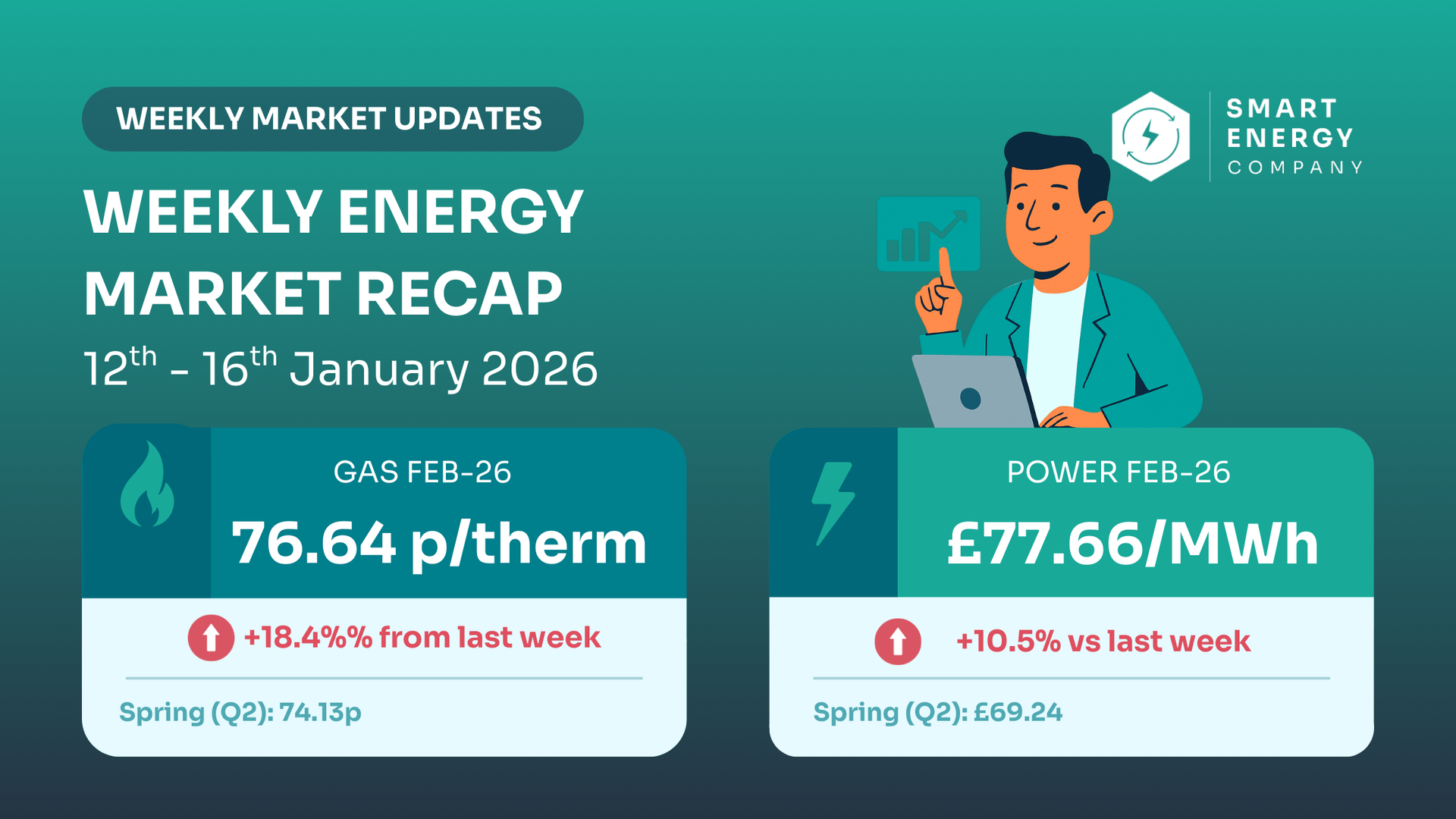

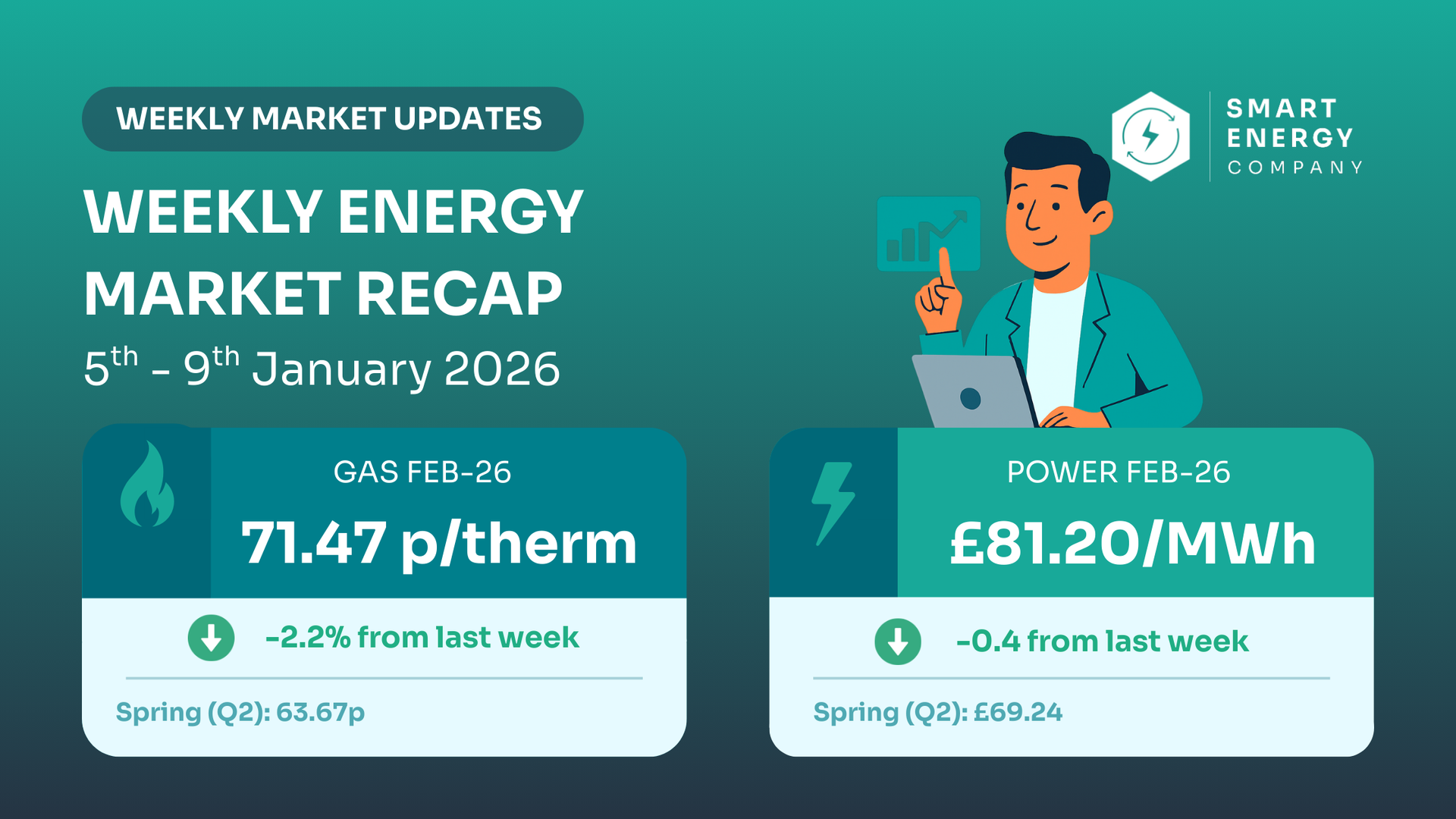

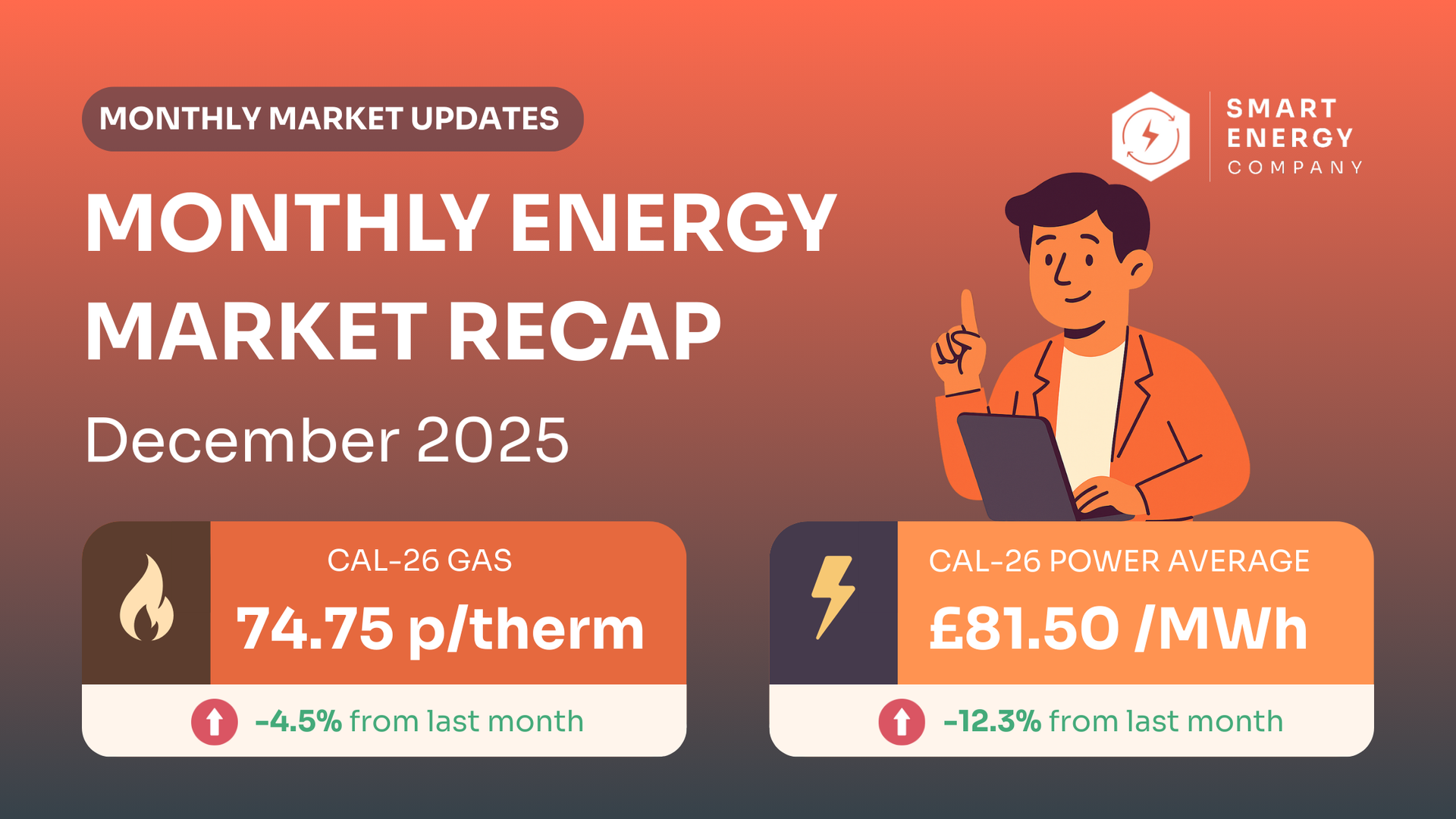

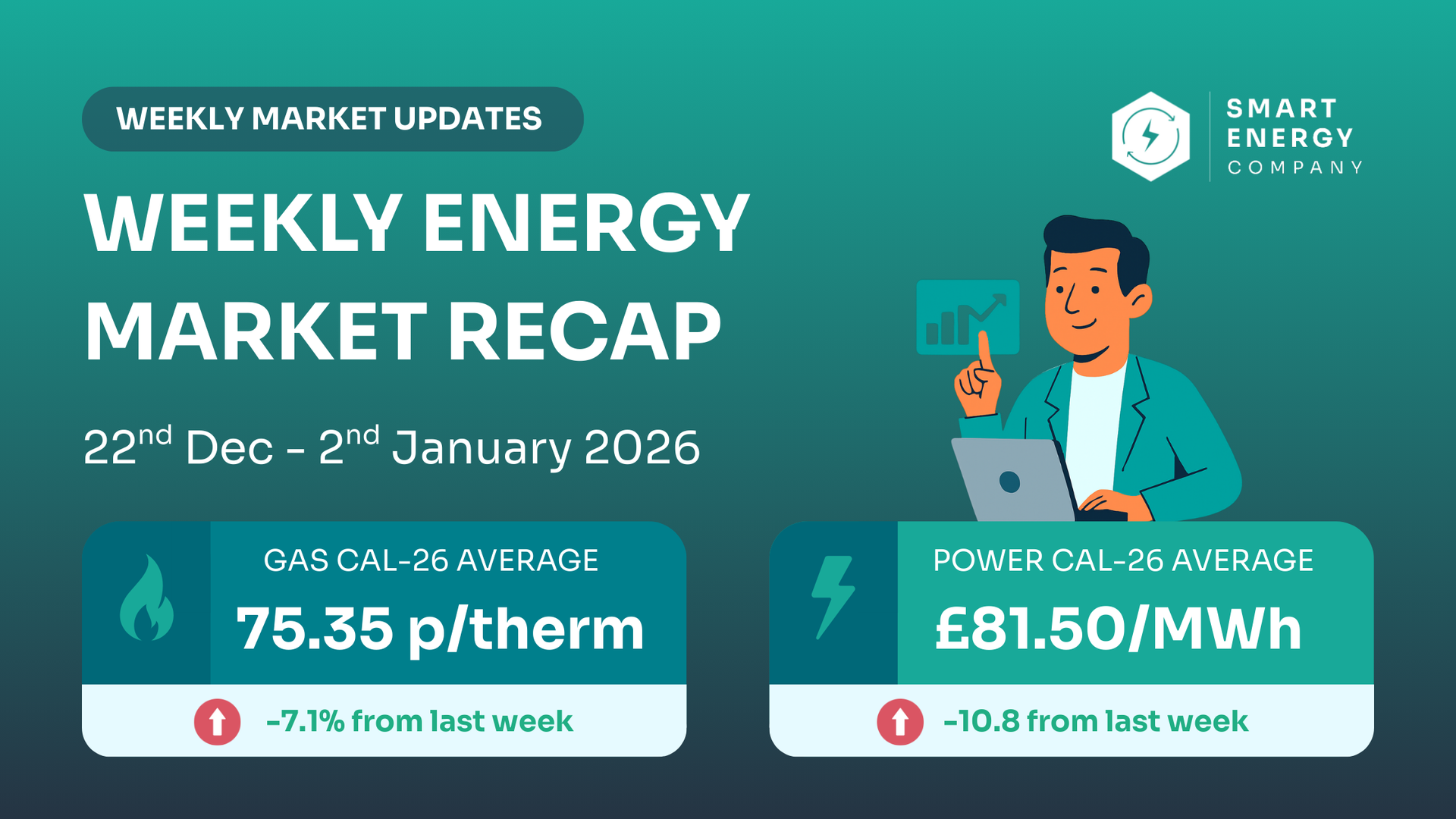

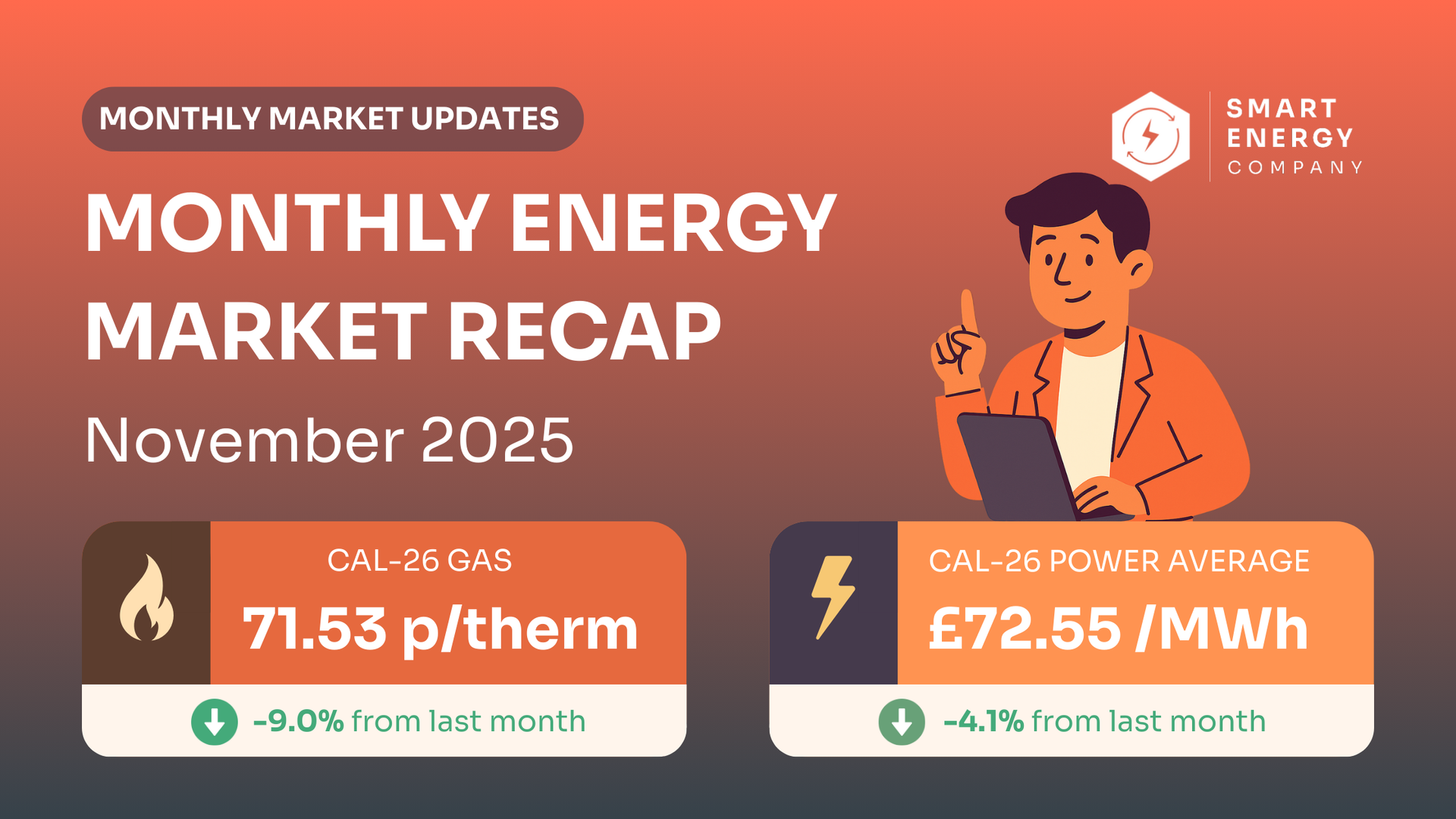

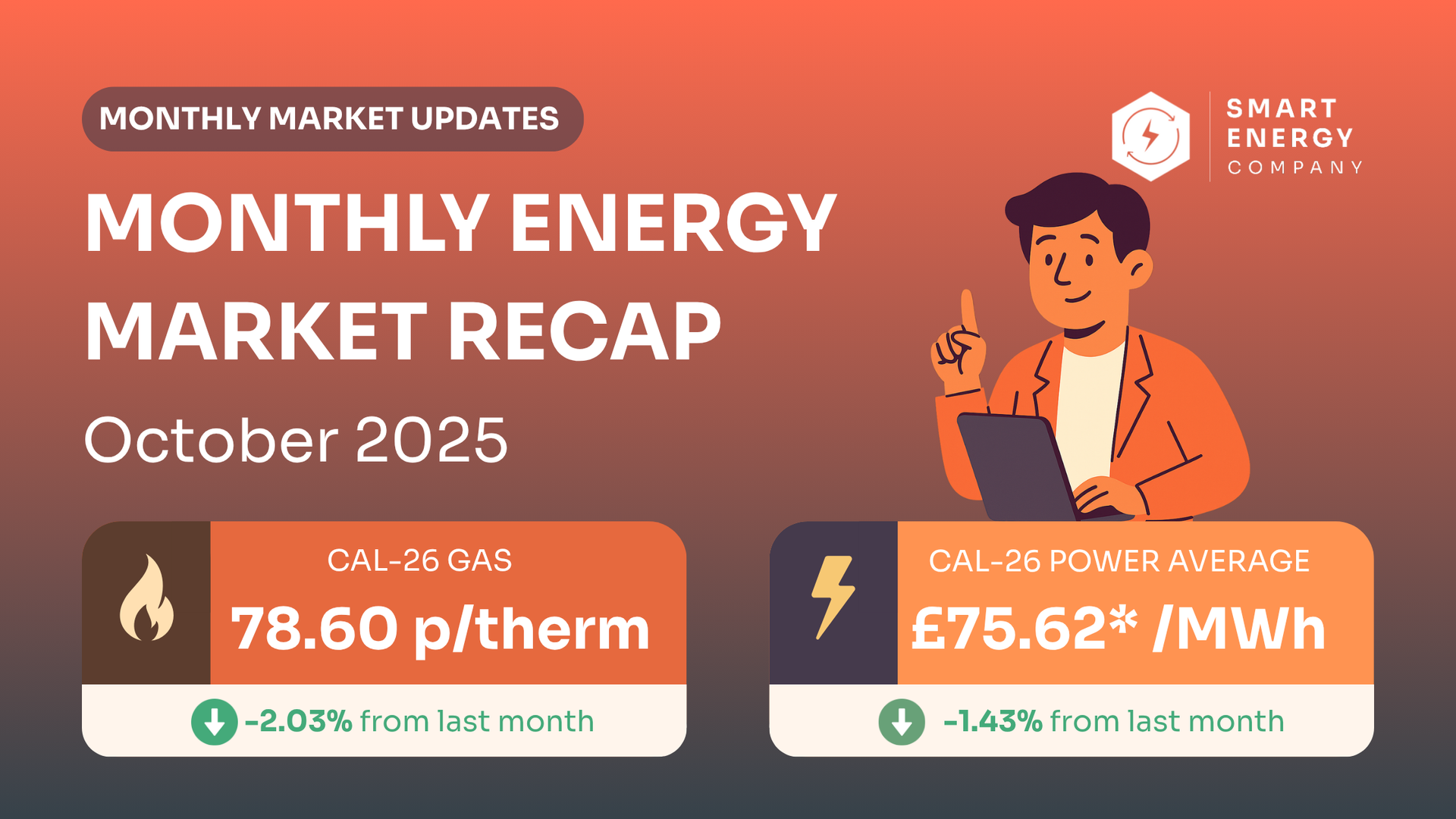

Daily updates give you the latest prices and quick market movements. Weekly reports step back and show trends — where the market is heading over 5-7 days. Monthly analysis covers bigger patterns, seasonal factors, and strategic implications for the quarter ahead. Use daily for tactical decisions, weekly for trend spotting, and monthly for long-term planning.

Our renewal timing guidance shows you when market conditions are favourable and when to avoid locking in. We track forward contract prices for months ahead, seasonal patterns, and regulatory changes. Our insights help you avoid renewing at market peaks and identify windows when prices are more competitive. The goal is to renew at the right moment — not just any moment.

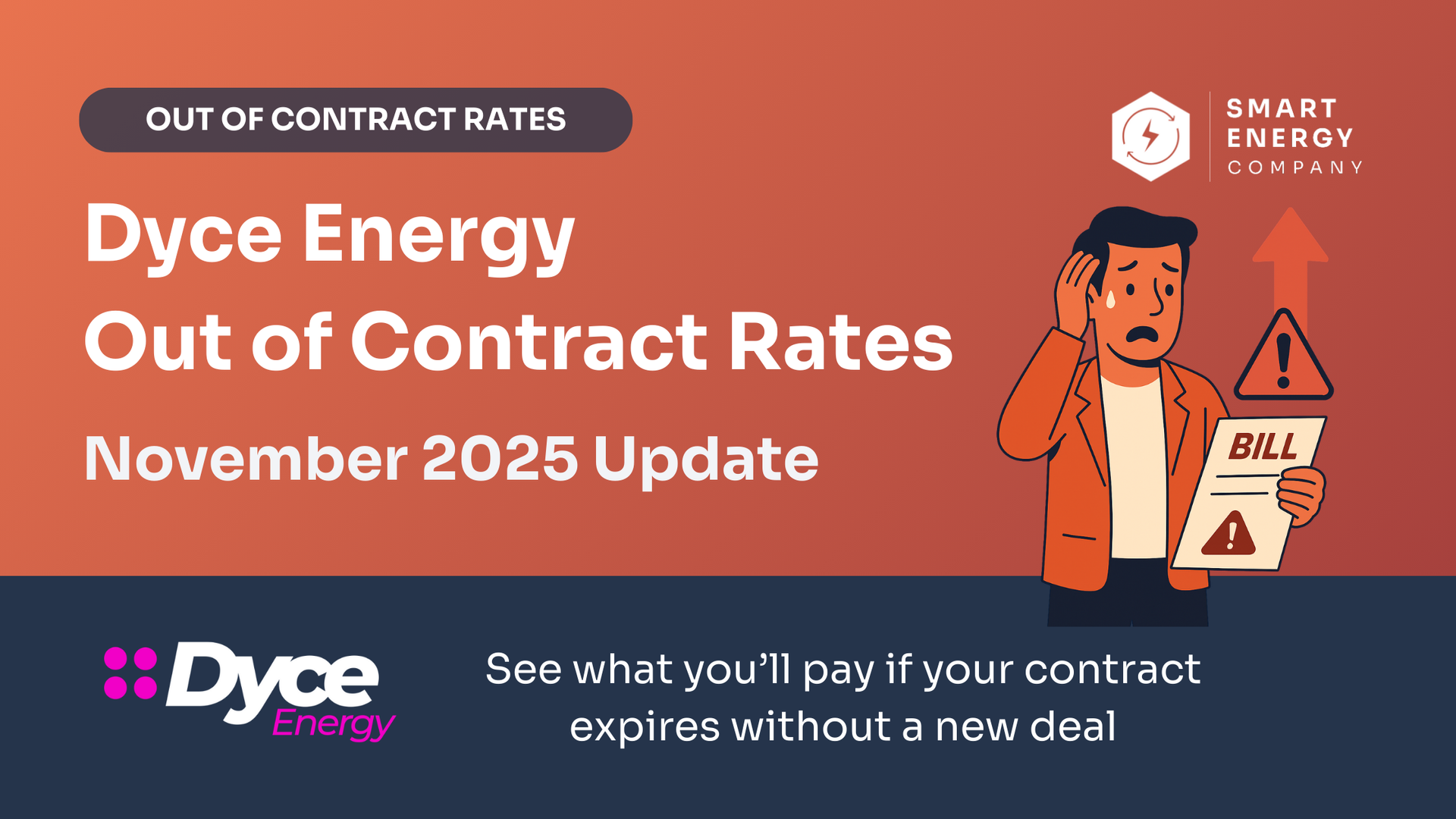

Out-of-contract (or "deemed") rates are what suppliers charge when your fixed contract ends and you haven't renewed. These rates are typically 30-50% higher than negotiated contracts — sometimes much more. Our out-of-contract rate tracking shows you what you'd pay on default terms, giving you urgent motivation to renew before expiry. This is one of the biggest cost traps for businesses.

Our industry changes section covers updates like the Nuclear RAB Levy, TNUoS standing charges, Network Charges, and other regulatory impacts. These can significantly affect your bills — sometimes overnight. We explain what's changing, when it takes effect, and how much it might cost you. Armed with this info, you can factor costs into renewal decisions and avoid nasty surprises.

We track news on supplier stability, market exits, strategy changes, and service issues. If a supplier is facing problems or exiting the market, that affects your renewal options and timing. We also highlight when suppliers are actively competing in your segment, giving you leverage to negotiate. Knowing the supplier landscape helps you make smarter switching decisions.

If you're actively considering a renewal, check daily or weekly reports to spot trends. If your renewal isn't imminent, monthly analysis is plenty. Most businesses benefit from signing up for our email alerts — you'll get daily or weekly summaries delivered without needing to check the site. This way you stay informed without spending time tracking markets manually.

Yes. All our market insights, daily updates, and blog content are completely free. We publish them because we believe businesses deserve transparency about energy markets. When you're armed with good information, you make better decisions — and that benefits everyone. We do offer personalised guidance through our brokerage service if you'd like professional support with your contract.

Absolutely. Sign up for our market insights emails and you'll get daily or weekly summaries delivered to your inbox. You choose the frequency and topics (daily prices, weekly trends, industry changes, supplier news, etc.). This way you stay informed without spending time on the website. Most businesses find this is the best way to stay on top of market movements without it feeling like a chore.

Ready to Lock In a Better Rate?

Use our market insights to time your renewal perfectly. We'll compare 28+ suppliers and tell you honestly if now's the right time to switch.

No obligation No hidden fees Independent advice