Weekly Energy Market Updates

Gas & Power Trends, Price Movements & Renewal Guidance

Every Monday we publish a plain English summary of UK energy prices — what moved, why it matters, and whether now's a good time to renew your contract.

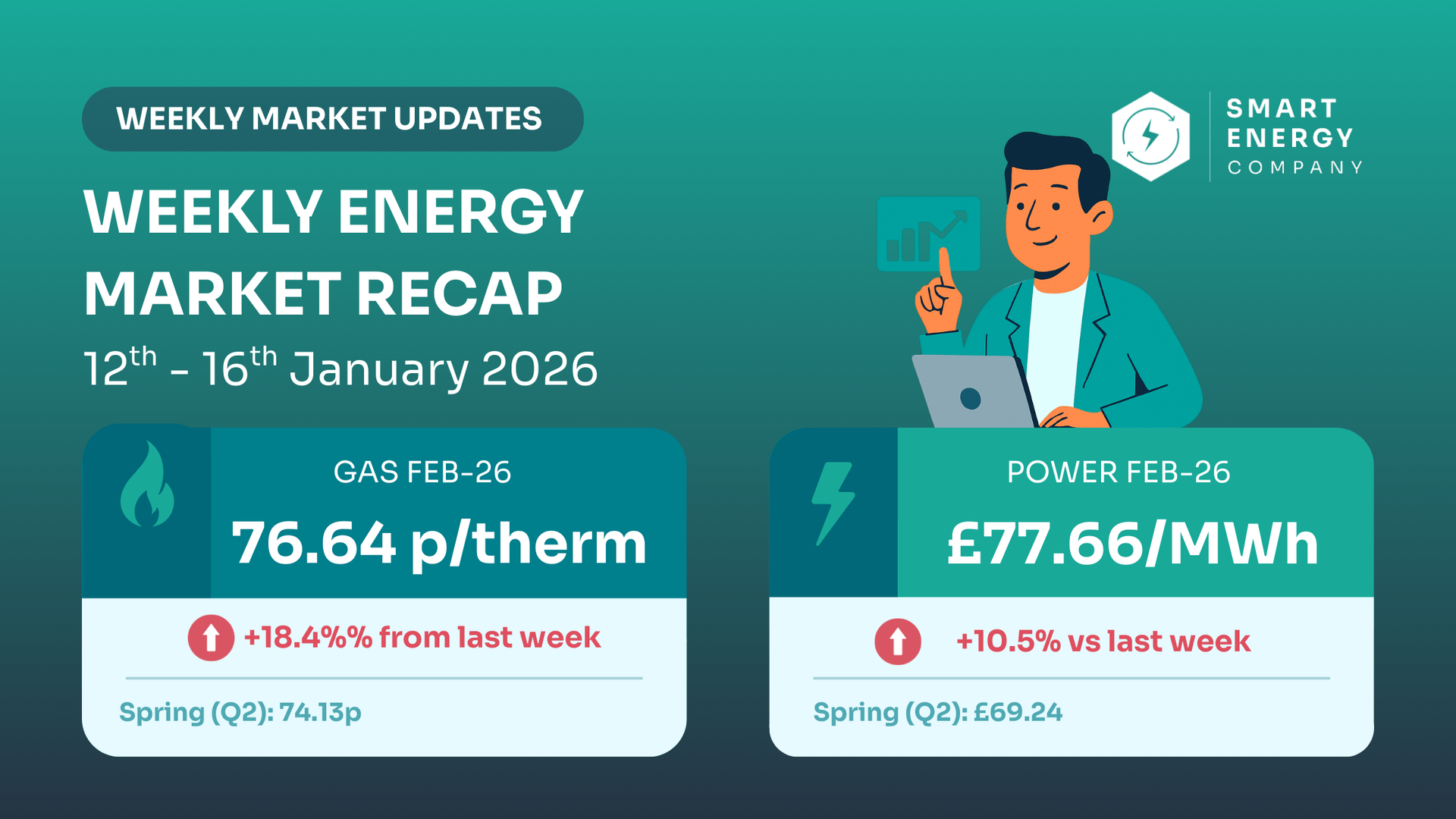

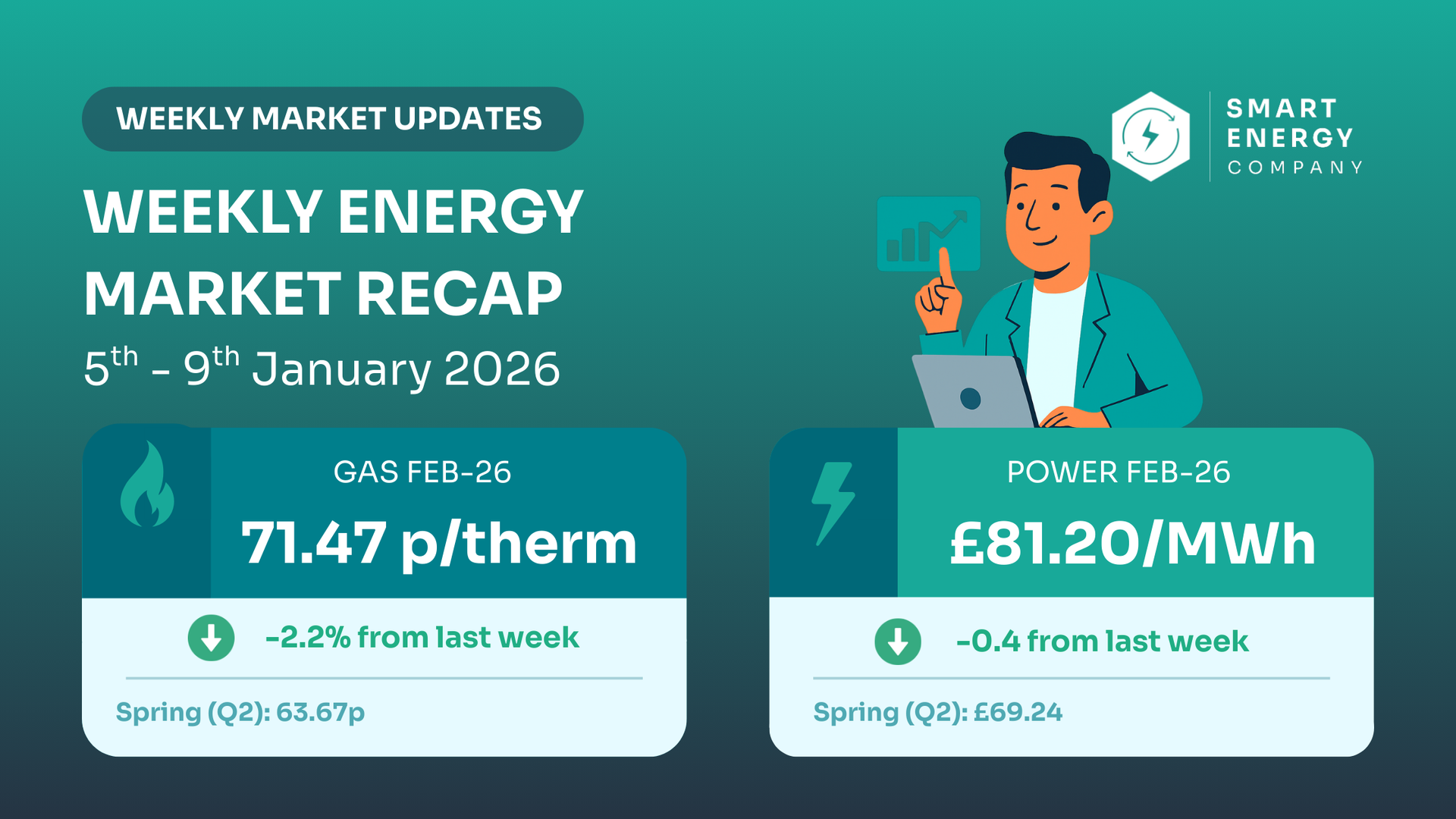

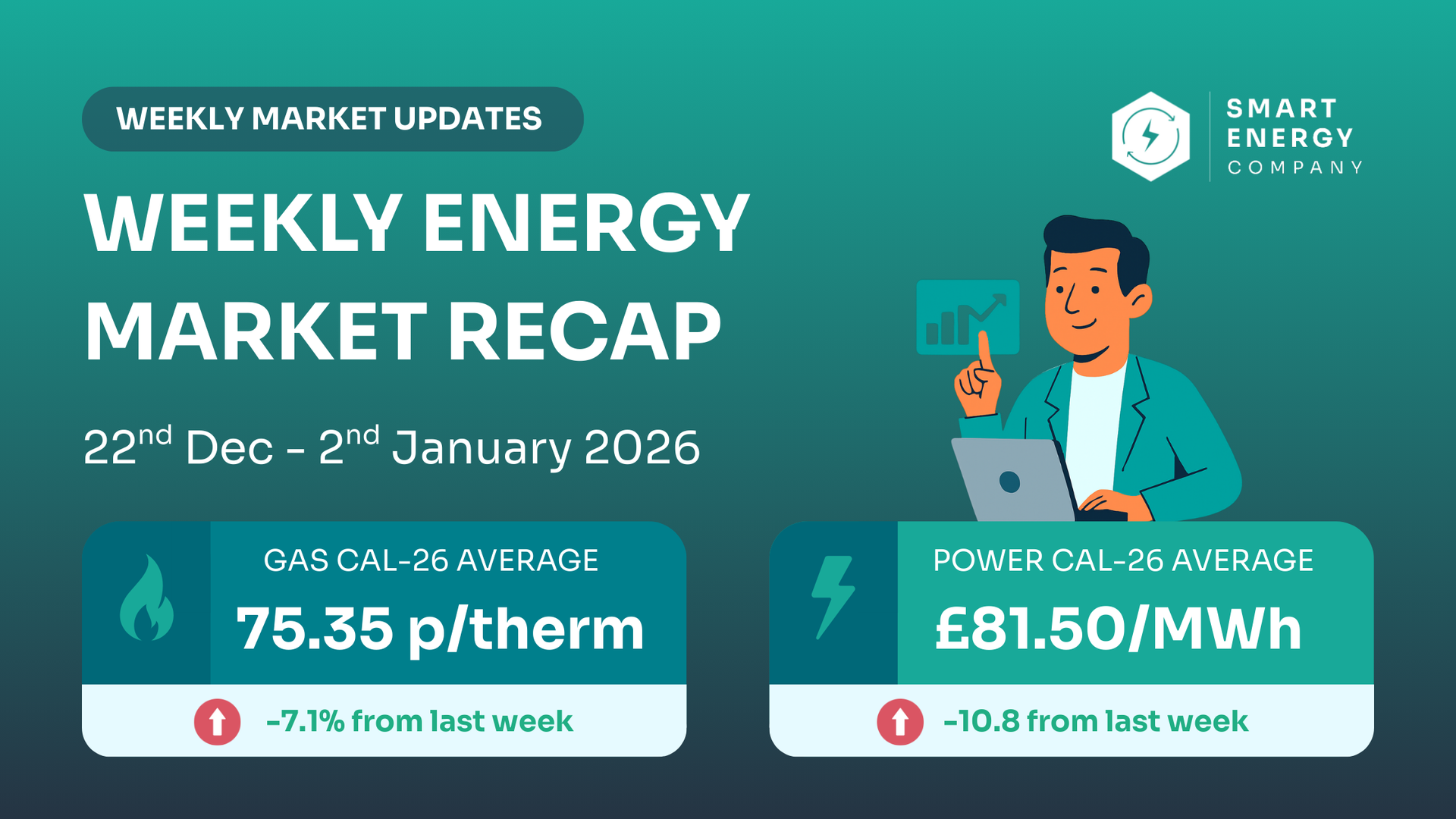

"Gas prices fell 7% this week as geopolitical tensions eased. If your contract ends in Q1, now could be a good window to lock in rates."

Browse by Category

Filter our latest insights by topic

Stay Ahead of the Market

Weekly price updates, renewal timing advice & plain English analysis — straight to your inbox.

Frequently Asked Questions

Everything you need to know about our weekly market updates and how to use them for smarter energy decisions

Energy prices directly impact your bottom line. Without market insights, you're renewing contracts blind — accepting whatever rates suppliers quote. With weekly updates, you understand where prices are heading, when it's the right time to renew, and whether supplier quotes are fair. Most businesses save 15-30% on their energy costs simply by renewing at the right moment instead of letting contracts drift into out-of-contract rates.

If you renew when prices are at a market peak, you lock in inflated rates for 1-3 years. If your contract expires and you haven't renewed, you fall onto "out-of-contract" or "deemed" rates — typically 30-50% more expensive than negotiated contracts. Missing renewal deadlines is one of the costliest mistakes businesses make. Our weekly updates help you spot the right renewal window and avoid expensive mistakes.

Without market data, you can't. Suppliers know most businesses don't track prices, so they quote high and count on you accepting. When you understand current market rates and trends, you can instantly tell if a quote is fair or inflated. You'll know when to negotiate, when to walk away, and when to lock in. This visibility gives you real leverage in contract negotiations.

Savings depend on your business size and current contract terms, but most companies save between 10-30% simply by renewing at the right time instead of whenever their contract expires. For a business paying £50,000/year on energy, even a 15% saving is £7,500 annually. Over 5 years, that's £37,500. For larger businesses, the savings are even more dramatic. The insights pay for themselves many times over.

Just a few minutes per week. Our insights are delivered to your inbox every Monday in an easy-to-scan format. You don't need to be an energy expert to understand them — they're written for business owners, not specialists. Most people spend 5-10 minutes reading the key points and tracking whether prices are rising, falling, or stable. That's it. You don't need to obsess over energy markets to benefit from staying informed.

Yes. Even if your renewal is 12 months away, tracking market trends now helps you plan ahead. You'll see if prices are likely to rise significantly, understand regulatory changes coming down the pipeline, and have months to prepare. Businesses that start watching markets early make better renewal decisions than those who wait until 6 weeks before expiry. Plus, you might spot an unexpected opportunity to renegotiate early and save money.

Yes, completely free. We publish weekly energy market insights because we believe businesses deserve transparency about energy markets. There's no hidden agenda — we're not trying to upsell you. We do offer professional brokerage services if you want expert support with your renewals, but the market insights themselves are freely available to everyone. The goal is simple: help businesses make smarter energy decisions.

Ready to Lock In a Better Rate?

Use our market insights to time your renewal perfectly. We'll compare 28+ suppliers and tell you honestly if now's the right time to switch.

No obligation No hidden fees Independent advice