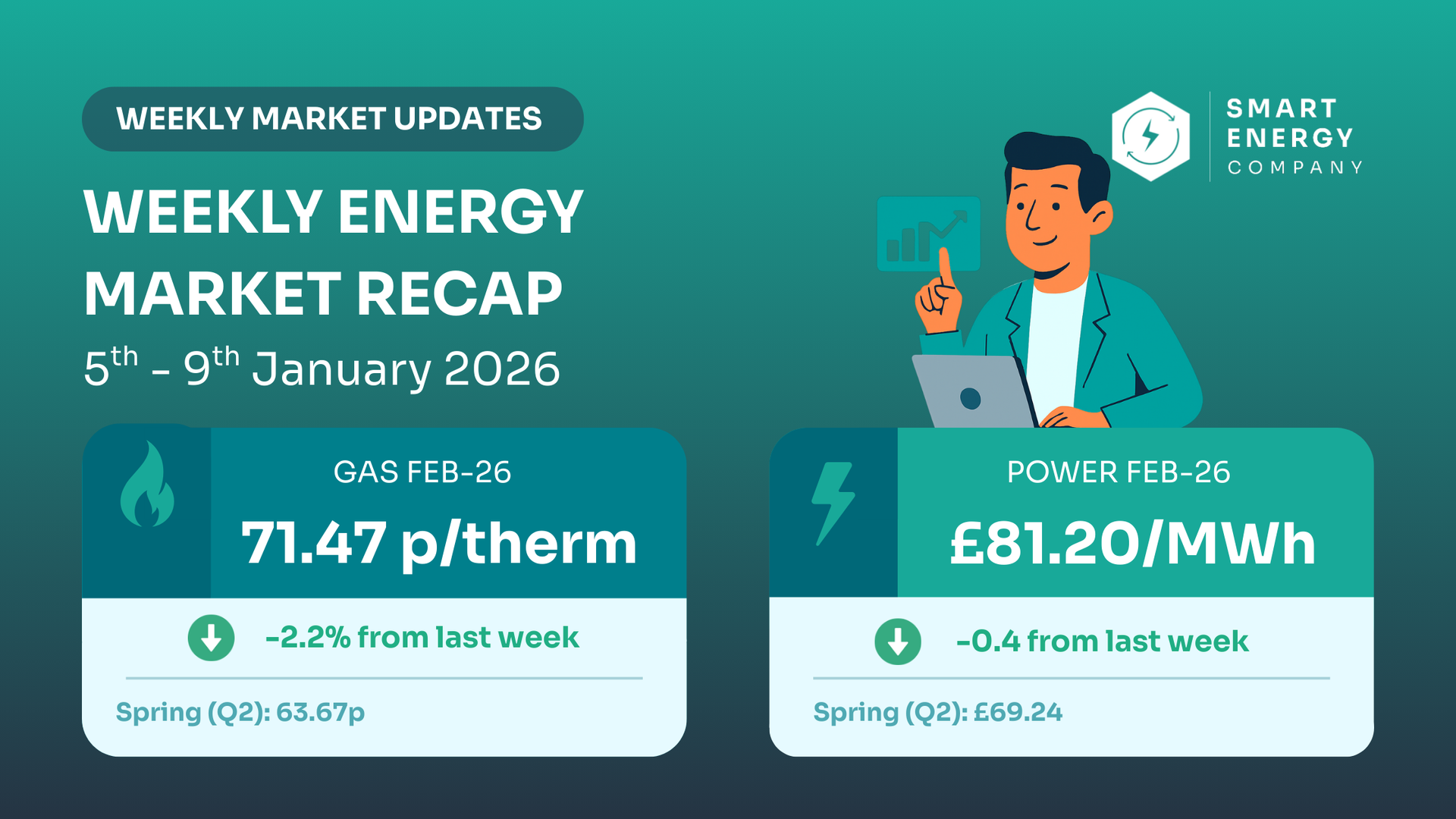

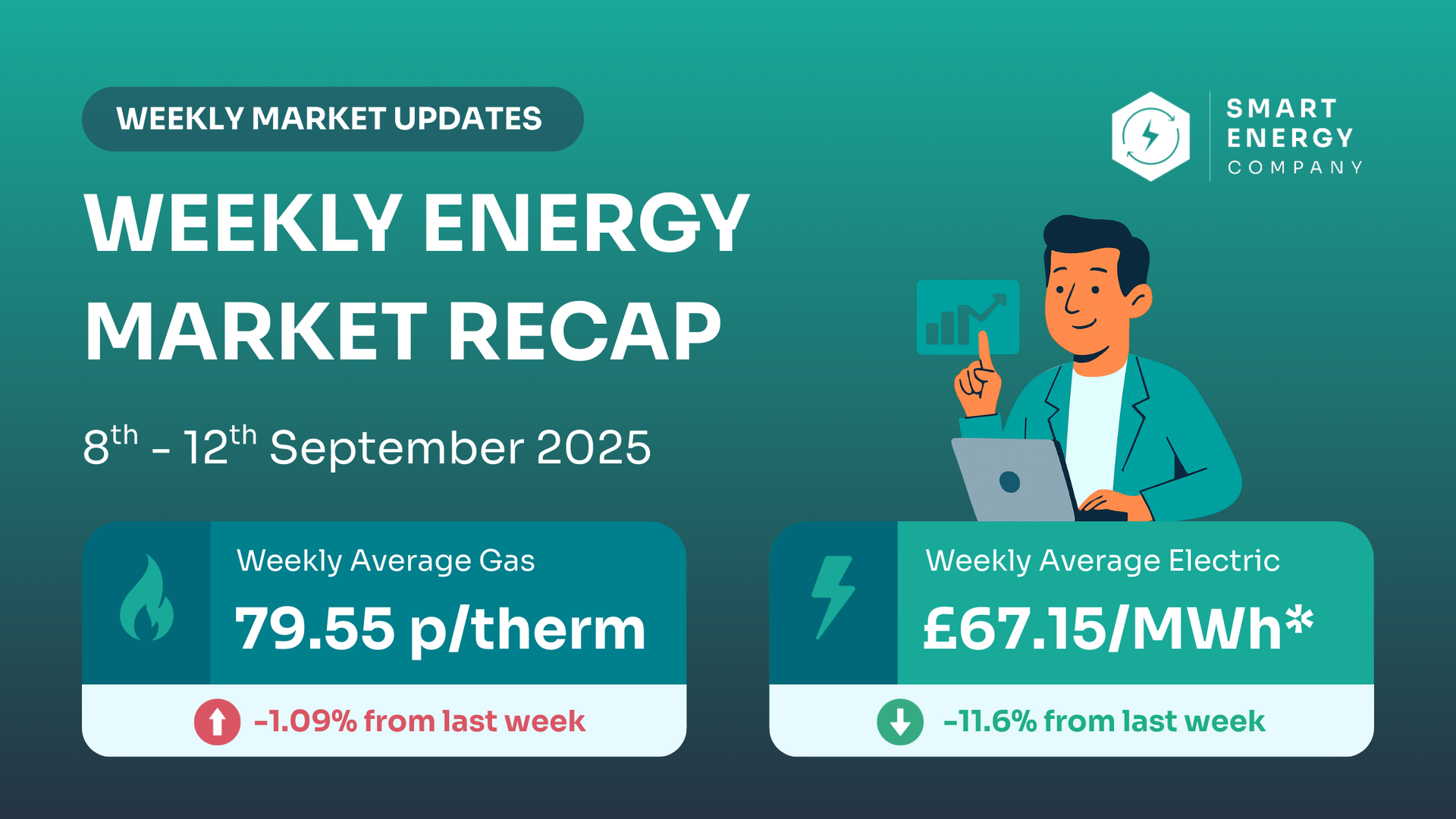

UK Energy Market Update: 8th - 12th September 2025

By Thomas McGlynn • 15 September 2025

A Week of Two Halves!

Day-ahead gas hovered in a tight band this week while day-ahead power printed two unusually low prices (Thu-Fri). Those dips reflected short-term system conditions and do not line up with the forward curve, which is what suppliers use to build your renewal quotes.

📊 Weekly Market Snapshot (Day-Ahead)

| Commodity | Weekly avg | Previous Week | % Change | Weekly High | Weekly Low |

|---|---|---|---|---|---|

| Gas (UK NBP) | 79.55 p/therm | 78.69 | Up 1.09% | 81.15 (Tue) | 77.35 (Mon) |

| Power (UK Base) | £67.15/MWh | 75.96 | Down 11.6% | £87.15 (Tue) | £38.33 (Fri) |

Why this matters: These are wholesale prices for tomorrow’s delivery. They set the tone for headlines, but your contract is priced off the forward curve, not day-ahead.

About those low power prints: Thursday and Friday’s day-ahead power prices were one-off dips. Forward contracts fell modestly over the week, but nothing like the 40–50% day-ahead moves—so renewal quotes won’t mirror those plunges.

📈 5 Week Price Trend

| Week Ending | Average Gas (p/th) | Direction | Avg Power (£/MWh) | Direction |

|---|---|---|---|---|

| 12/09/2025 | 79.55 | 🔺 | 67.15* | 🔻 |

| 05/09/2025 | 78.69 | 🔻 | 75.96 | 🔻 |

| 29/08/2025 | 81.55 | 🔺 | 81.56 | 🔺 |

| 22/08/2025 | 78.10 | 🔻 | 80.44 | 🔺 |

| 15/08/2025 | 79.14 | 🔻 | 86.82 | 🔻 |

*Power average includes two very low Day-Ahead days this week; these are weather/system effects and don’t reflect typical fixed-contract pricing.

In short: gas has nudged slightly higher week-on-week, while power’s weekly average dropped mainly due to those two unusually low Day-Ahead prints. Forward prices — which set renewal quotes — eased a touch into Friday but remain far above this week’s Day-Ahead lows.

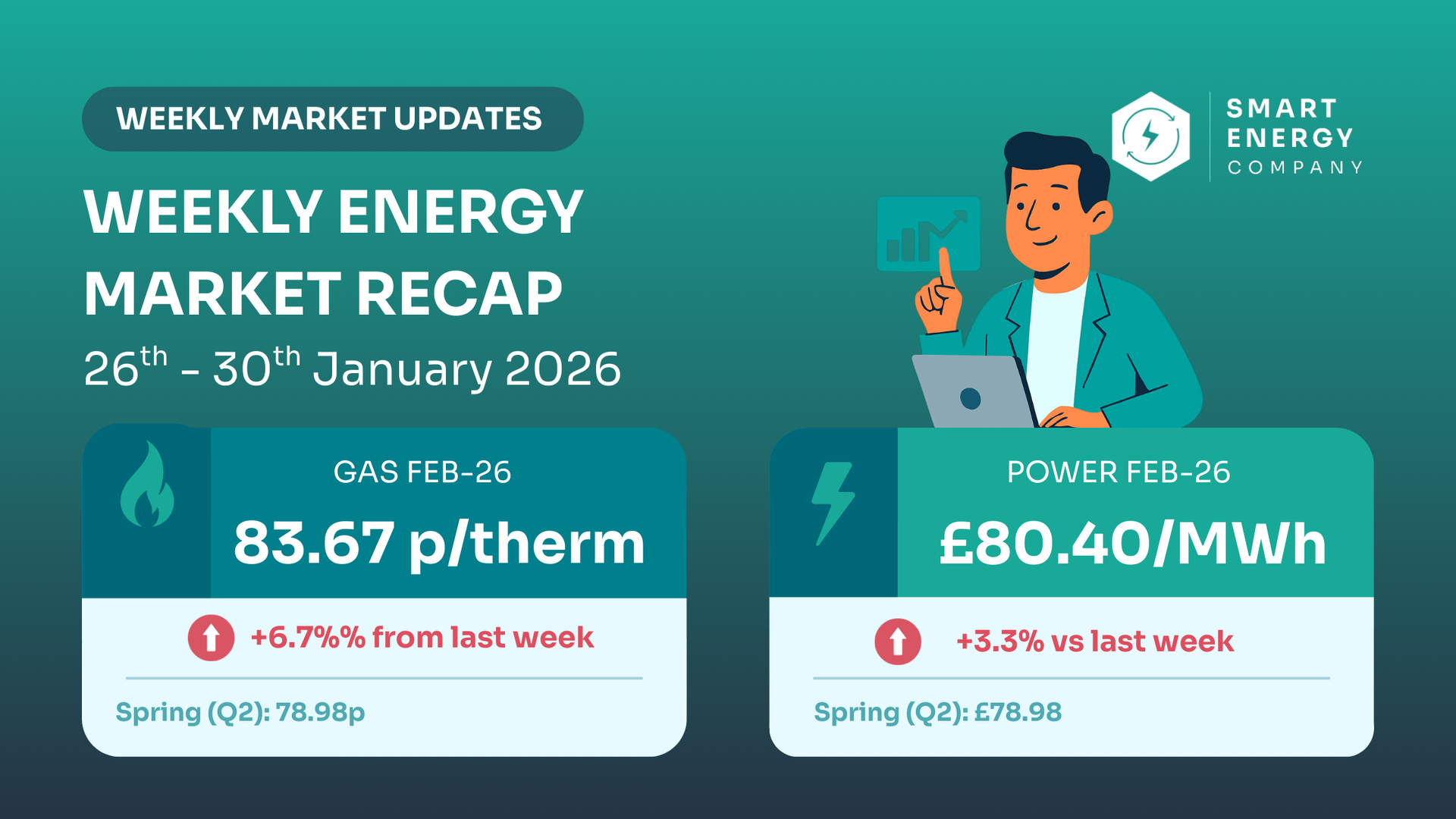

📈 Forward Market Pricing — what suppliers actually watch

While day-ahead shows tomorrow’s blips, forwards show where the market expects costs over the months you’ll actually consume energy.

UK Gas (p/therm)

- Oct-25: 79.22 (Fri) — down from 81.09 (Thu) and 80.80 (Wed)

- Q4-25: 83.52 (Fri) — down from 85.35 (Thu)

- Q1-26: 87.82 (Fri) — down from 89.50 (Thu)

- Summer-26: 78.23 (Fri)

- Cal-26: 82.15 (Fri) — eased across the week

UK Power (£/MWh)

- Oct-25: £74.02 (Fri) — lower vs mid-week

- Q4-25: £80.76 (Fri) — down from £82.39 (Thu)

- Q1-26: £85.48 (Fri) — down from £87.17 (Thu)

- Summer-26: £73.76 (Fri)

- Cal-26: £78.80 (Fri) — drifted lower into week’s end

💡 What this means:

Forward strips softened modestly by Friday (generally a 1–3% slide from mid-week). That’s very different to the eye-catching day-ahead power drops, reinforcing that renewal quotes will move a little lower, not collapse.

🧠 Why prices moved & What's Next

Gas

- Europe’s storage sits high for the time of year (c. 80%), keeping a cap on risk even as we edge toward winter.

- Norwegian maintenance is still restricting flows, nudging near-term risk premia.

- A steady slate of LNG cargoes into North-West Europe is providing balance.

Power

- Wind output swung around: mid-week softness, then stronger bursts—these swings helped create those short-lived low day-ahead power prices.

- Gas-for-power demand tracked the wind profile: higher when wind eased, lower when it rebounded.

- Continental interconnectors and nuclear availability remained important background stabilisers.

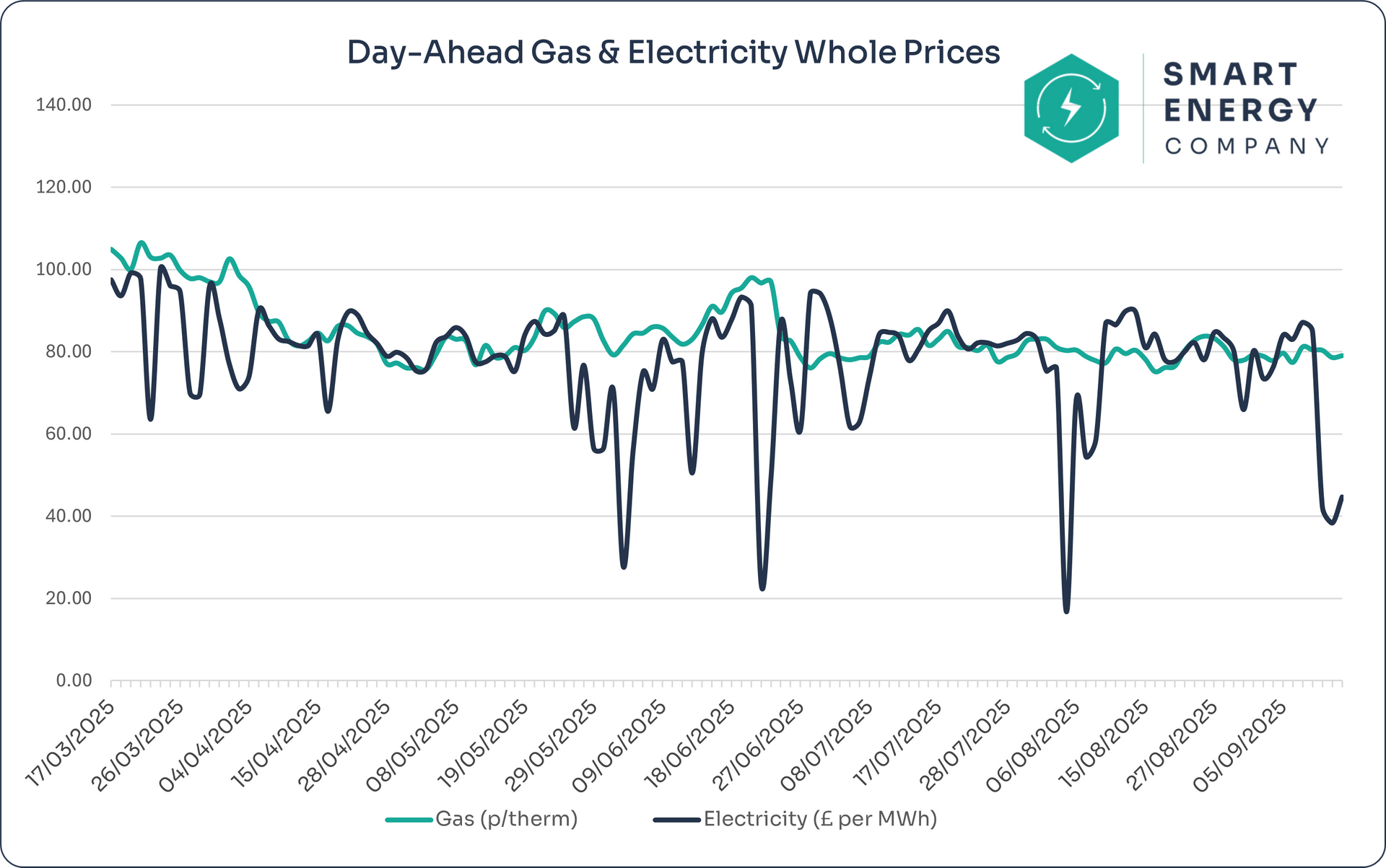

📉 6-Month Market Trend

Looking at the past six months of wholesale energy prices reveals important patterns:

- Gas has been broadly stable in a tight 75–90 p/th band since late spring, easing off the early-June highs and sitting mid-range right now.

- Power has been far more volatile, with several sharp dips driven by windy days and weekend demand. This week’s very low Day-Ahead readings look like another of those short, weather-led jolts rather than a shift in the longer trend (the forward curve hasn’t fallen by the same magnitude).

- Net takeaway: day-to-day swings are common, especially for electricity, but suppliers base quotes on the forward strips, which have only edged lower into the weekend.

💡 Is now a good time to get prices?

Yes—worth getting fully-fixed quotes in hand.

Day-ahead averages fell week-on-week and the forward curve eased into Friday. If your renewal touches Oct–Mar, fixing now caps winter risk while Norwegian maintenance and early-autumn weather play out.

👉 Catch the dip, not the blip

Forward prices finished the week a touch lower. If you’re due this winter,

use this window to get a

fully-fixed quote while the curve is softer.

What to do by renewal window

| Contract Renewal Period | Advice |

|---|---|

| Renewing within 3 months | You’re heading into winter quoting season. With forwards softer into week-end, lock a fixed now to avoid any cold-weather bounce. |

| Renewing in 3 - 6 Months | Most of your window still sits in winter. Today’s curve is lower than mid-week, so pricing now is sensible. Waiting leaves you exposed to late-Q4/Jan risk. |

| Renewing +6 month out? | Summer-26 remains the cheaper part of the curve. You can time a fix if you prefer, but trends nudged lower this week—get indicative quotes and sign up to weekly market updates so you’re ready to strike if the curve turns. |

💷 What this means for your business

- Day-ahead gas steady; power printed two one-day lows—not a true trend.

- Forward gas & power eased 1–3% into Friday, improving fixed-price optics.

- Winter-focused products (Q4-25/Q1-26) are still the priciest part of the curve, so early action helps control budget risk.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

Not Ready to Lock In?

Keep an eye on these:

- Norwegian flow outlook: as maintenance winds down, prompt risk could fade a touch.

- LNG timings: scheduled arrivals into N.W. Europe should keep the system comfortable—delays could firm the prompt.

- Wind pattern: forecasts show choppy output; sharp dips can still throw up day-ahead power swings.

🧠 Final thoughts

It was a week of headline-grabbing day-ahead power prints, but the signal that matters—the forward curve—eased modestly. That’s a constructive backdrop for anyone renewing through winter.

Need help timing it?

SHARE THIS