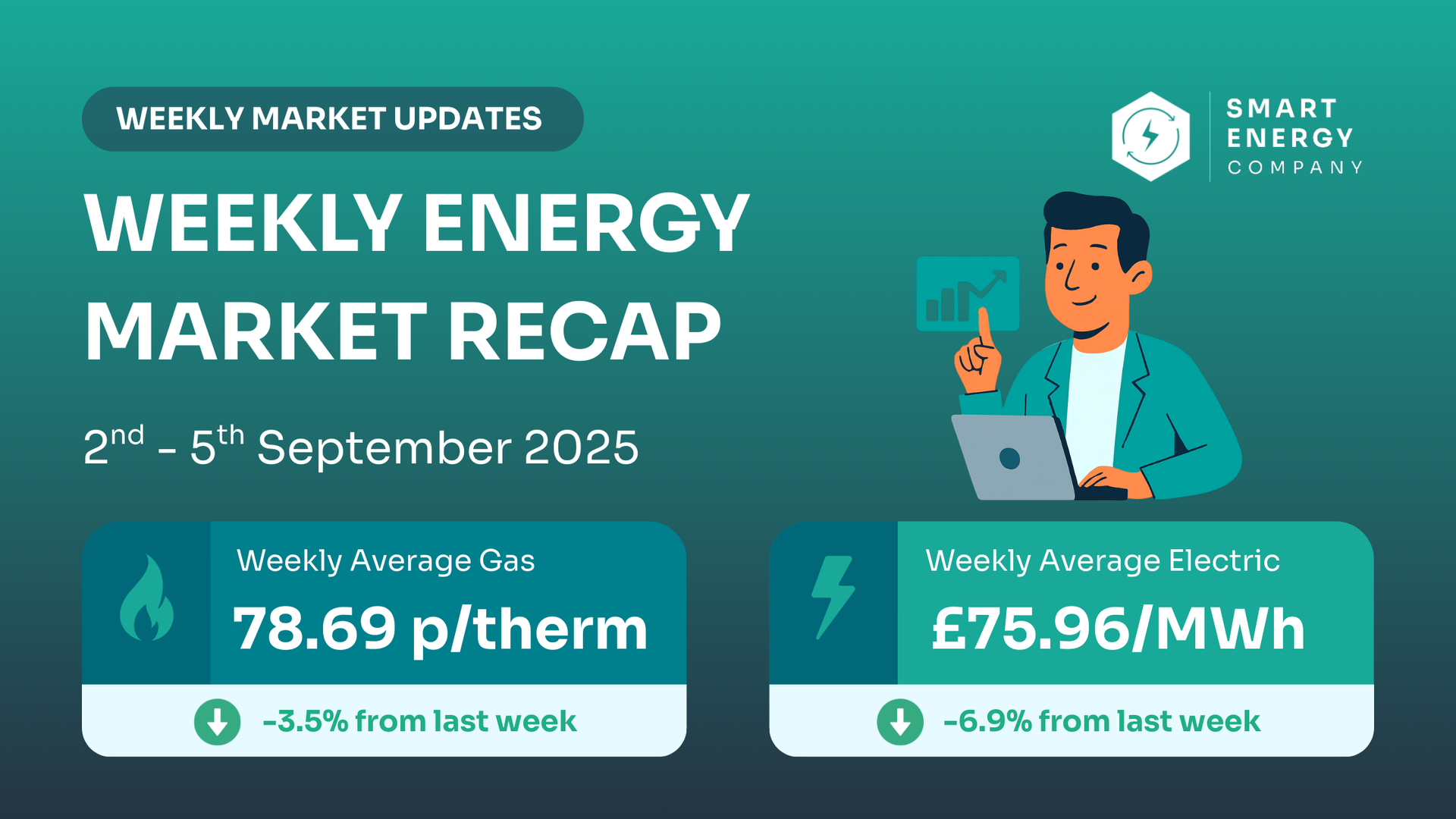

UK Energy Market Update: 2nd - 5th September 2025

A week of calm before the winter storm, with forward prices showing a clear upward trend.

A short trading week with a steady middle and a lively Friday. Day-ahead prices averaged lower week-on-week and the main forward periods ticked up a touch . If you buy fully fixed contracts, the near-winter strips are still in a reasonable place to take quotes.

📊 Weekly Market Snapshot (Day-Ahead)

| Commodity | Weekly avg | Previous Week | % Change | Weekly High | Weekly Low |

|---|---|---|---|---|---|

| Gas (UK NBP) | 78.69 p/therm | 81.55 | Down 2.86 | 79.65 (Fri) | 77.80 (Thurs) |

| Power (UK Base) | £75.96/MWh | 81.56 | Down 5.60 | 84.00 (Fri) | 73.47 (Wed) |

Why this matters: These are wholesale prices (what suppliers pay before margins). They set the tone for quotes—but your contract is priced off the forward curve, not tomorrow’s delivery.

📈 5 Week Price Trend

| Week Ending | Average Gas (p/th) | Direction | Avg Power (£/MWh) | Direction |

|---|---|---|---|---|

| 05/09/2025 | 78.69 | 🔻 | 75.96 | 🔻 |

| 29/08/2025 | 81.55 | 🔺 | 81.56 | 🔺 |

| 22/08/2025 | 78.10 | 🔻 | 80.44 | 🔺 |

| 15/08/2025 | 79.14 | 🔻 | 86.82 | 🔻 |

| 08/08/2025 | 79.63 | 🔻 | 54.82* | 🔻 |

*Power on week of 4–8 Aug was skewed by a pricing anomaly (5 Aug); not reflective of real contract pricing.

📈 Forward Market Pricing — what suppliers actually watch

(Latest close Fri 5 Sep vs Thu 4 Sep — arrows show direction vs yesterday. “Higher” = more expensive, “Lower” = cheaper.)

| Contract (Wholesale | Gas (p/th) | Direction | Power (£/MWh) | Direction |

|---|---|---|---|---|

| Winter-25 (Oct-Mar) | 86.05 | ↑ Higher (+0.65) | 83.86 | ↑ Higher (+1.37) |

| Q4-25 (Oct-Dec) | 83.89 | ↑ Higher (+0.64) | 81.44 | ↑ Higher (+1.30) |

| Q1-26 (Jan-Mar) | 88.27 | ↑ Higher (+0.67) | 86.34 | ↑ Higher (+1.44) |

| Summer-26 (Apr-Sep) | 78.90 | ↑ Higher (+0.59) | 74.08 | ↑ Higher (+0.85) |

| Cal-26 (Full year 2026) | 82.77 | ↑ Higher (+0.54) | 79.13 | ↑ Higher (+0.90) |

🧠 Why prices moved & What's Next

- Lower Norwegian gas flows while maintenance runs through mid-September kept traders cautious.

- Weather forecasts point to above-normal temperatures into mid-October, which helps demand stay moderate.

- European gas storage is healthy and helps to keep a lid on prices.

- The

6-month chart shows both fuels trading in the middle of their recent ranges: well below June spikes, but above early-August lows. That usually means quieter daily movement—until a major supply, weather, or system headlines hit.

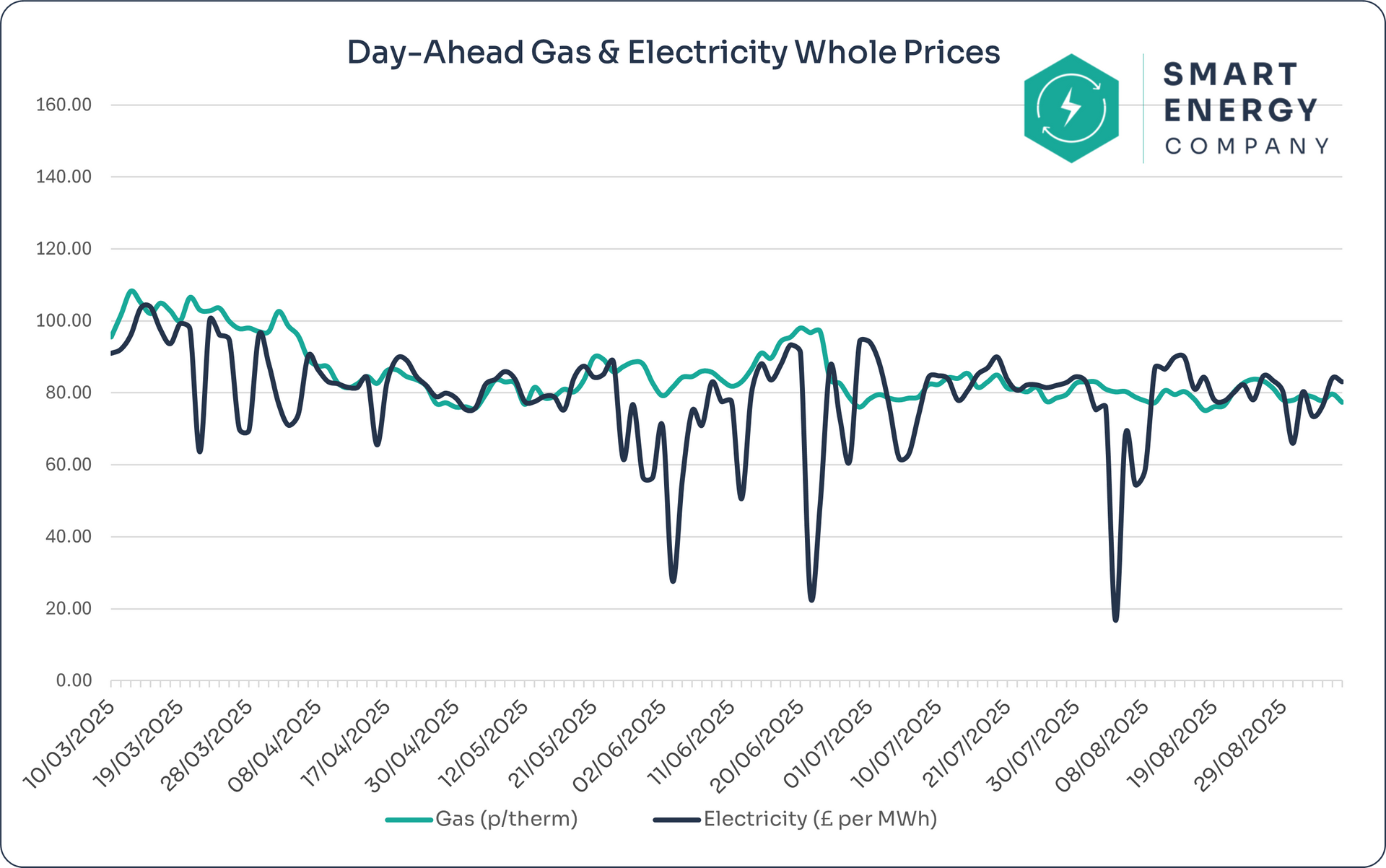

📉 6-Month Market Trend

Looking at the past six months of wholesale energy prices reveals important patterns:

The 6-month chart shows both fuels trading in the middle of their recent ranges: well below June spikes, but above early-August lows. That usually means quieter daily movement—until a major supply, weather, or system headline hits.

💡 Is now a good time to get prices?

Yes — worth getting fully-fixed quotes in hand.

Day-ahead averages fell this week and the key forward strips only inched higher. If your renewal touches Oct–Mar, getting a quote now puts a ceiling on winter risk while maintenance and early-autumn weather play out.

What to do by renewal window

| Contract Renewal Period | Advice |

|---|---|

| Renewing within 3 months | Proceed to fix. Prioritise cover across Winter-25. Small daily upticks on the forwards can add real cost to a 12-month term. |

| Renewing in 3 - 6 Months | Shortlist now and set a trigger. If Win-25 or Q1-26 move up by ~£2–£3/MWh (power) or ~1–2 p/th (gas) from today’s levels, be ready to lock. |

| Renewing +6 month out? | Monitor monthly and focus on Cal-26 (both fuels). Early discipline usually beats late-winter buying. |

Why this stance today:

Flows from Norway are restricted during maintenance (easing later in September), European storage is healthy, and temperatures are trending a bit warmer than normal — supportive, but not guaranteed, into winter.

💷 What this means in ££ for your business

- Gas: This week’s average is

2.86 p/th cheaper than last week.

For a site using 200,000 kWh/year, that’s roughly £570/year less versus last week’s level (rule-of-thumb ≈ £200 per 1 p/th change).

- Power: Weekly average is

£5.60/MWh

cheaper than last week.

Using 200,000 kWh/year, that’s about £1,120/year less (rule-of-thumb ≈ £200 per £1/MWh change).

(Your contract will be set off forwards, not day-ahead, but this shows the scale.)

👉 Avoid Overpaying on Your Next Renewal

Forward markets are trending up again. A single geopolitical or supply shock could accelerate this trend.

Act now to lock in a price before it rises further.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

👀 If you’re not ready to sign yet—watch these

- Daily updates on Norwegian maintenance and interconnector flows.

- Wind output & temperatures into mid-September.

- Any shifts in Winter-25 / Q1-26 forwards.

🧠 Final thoughts

Locking a fully fixed price now can protect you from a supply wobble or a colder-than-expected October.

Need help timing it?

Not Ready to Lock In?

Subscribe for Daily, Weekly, Monthly or Quarterly insights - no pressure, just clarity!