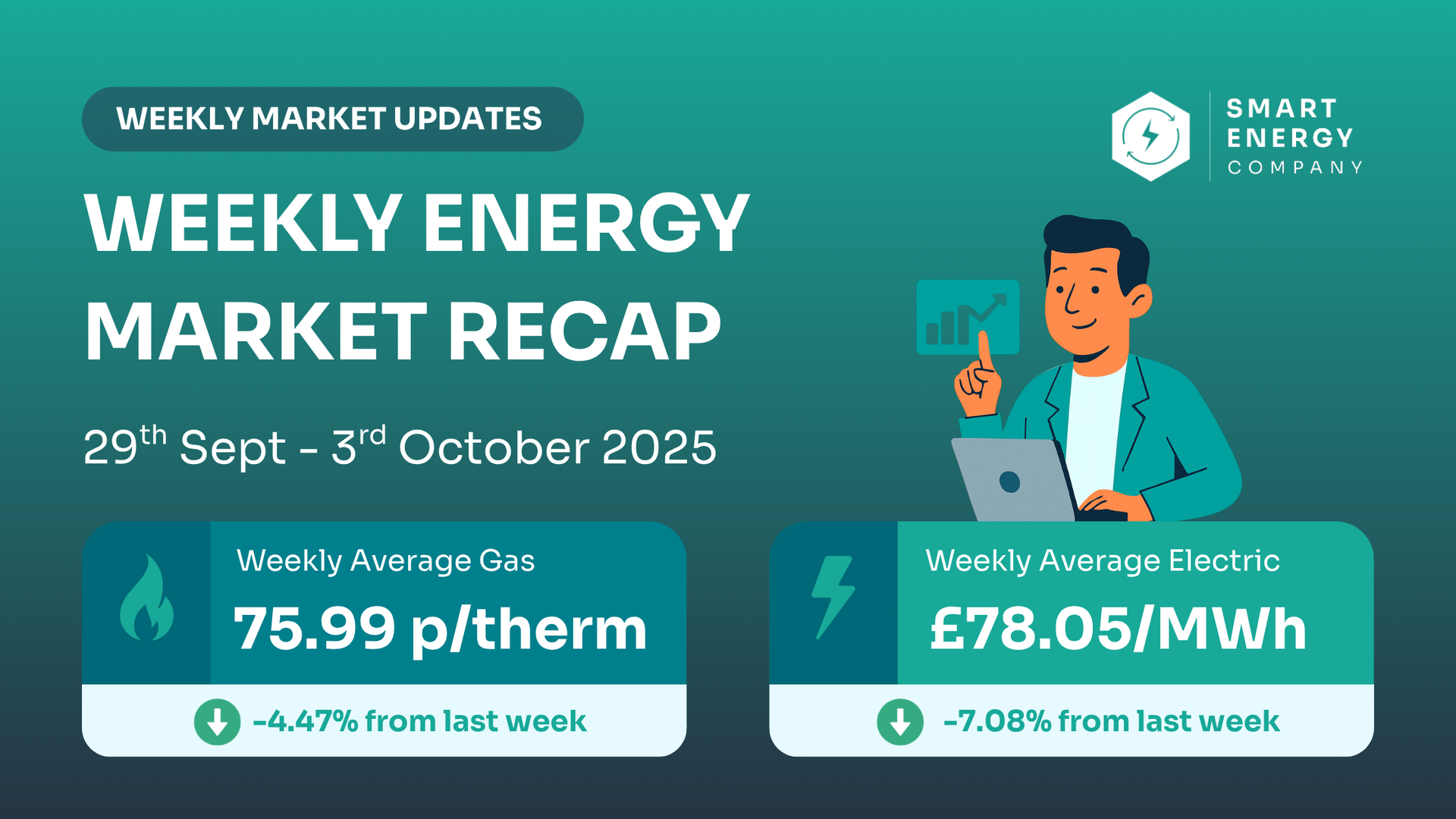

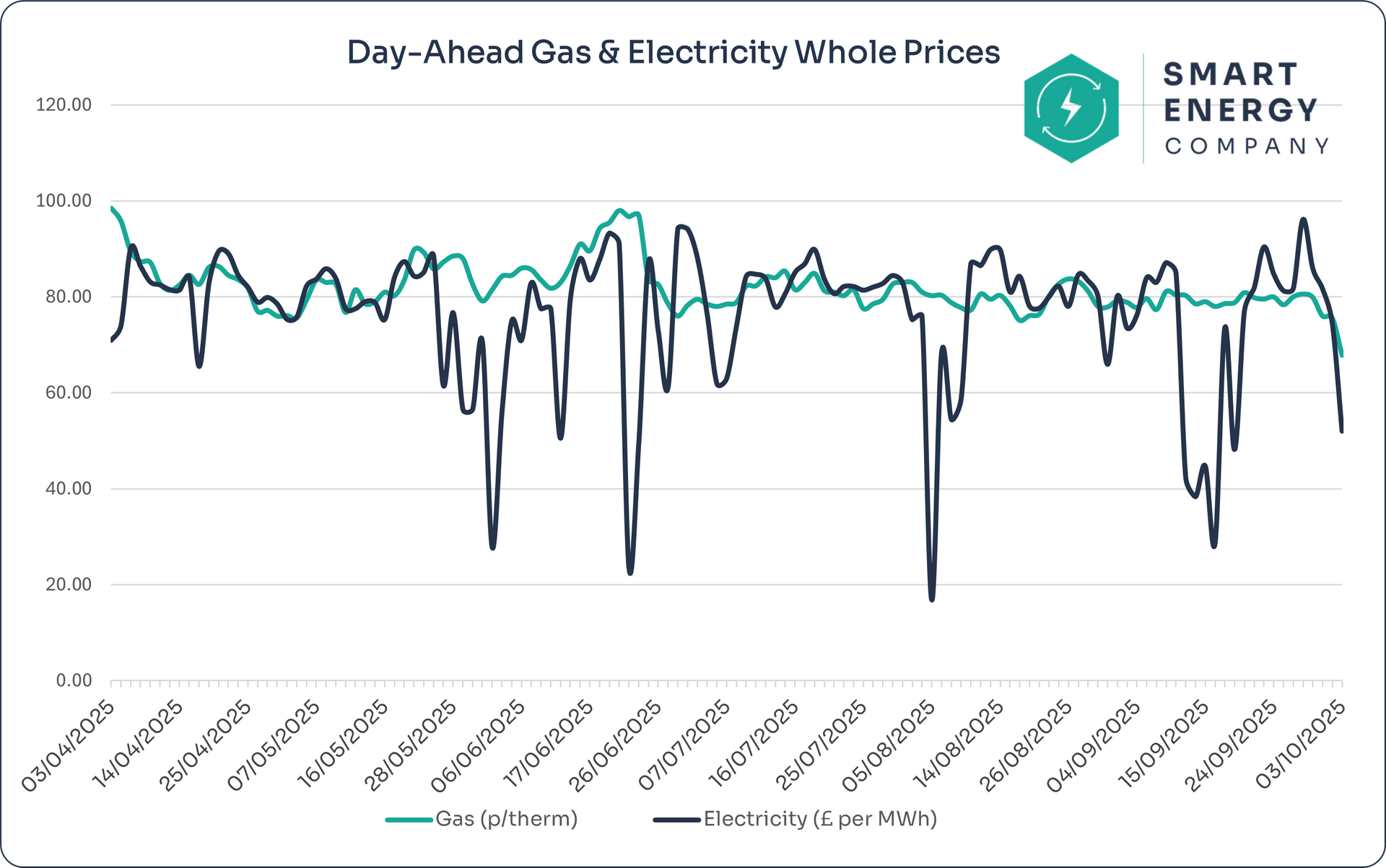

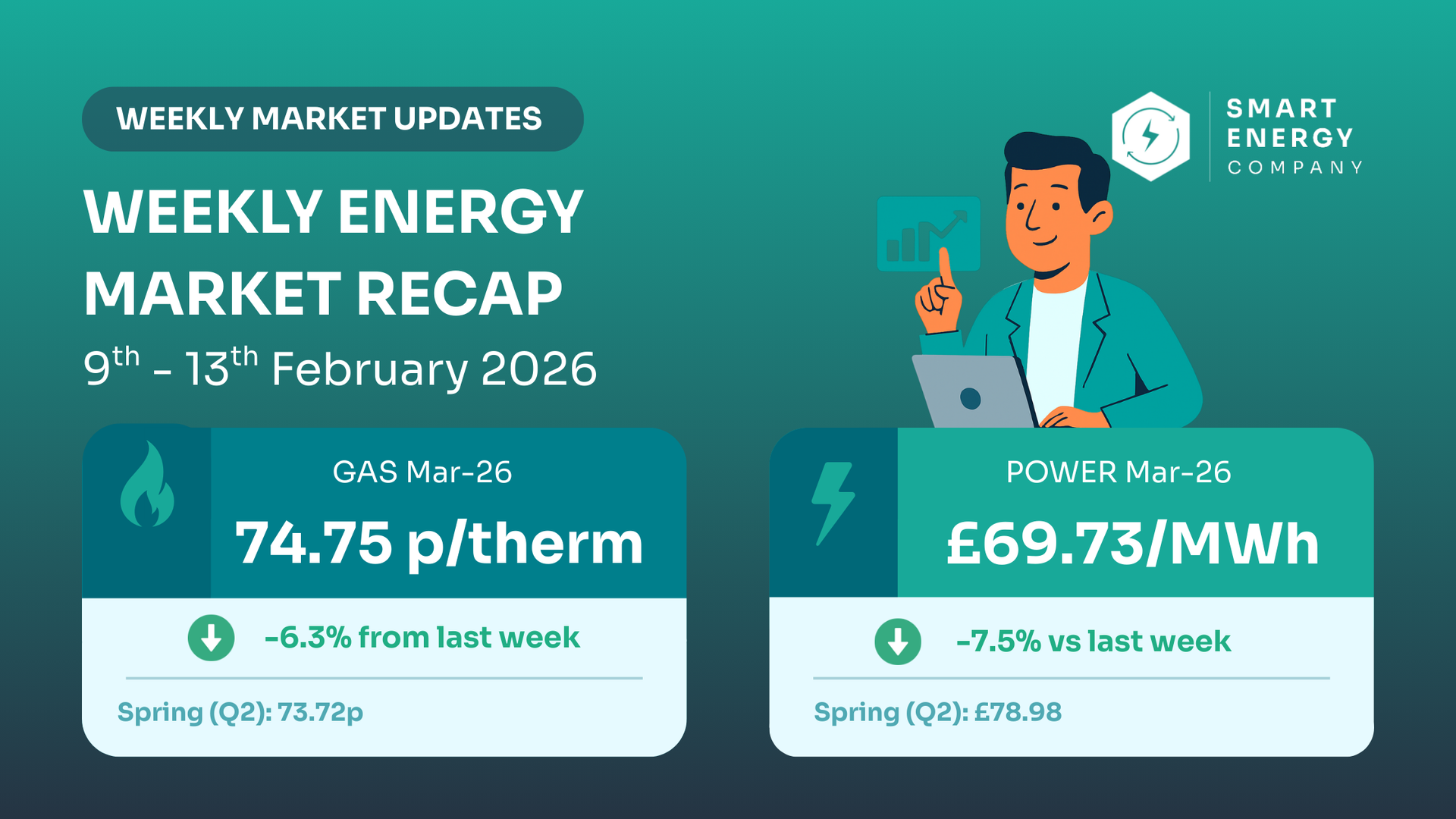

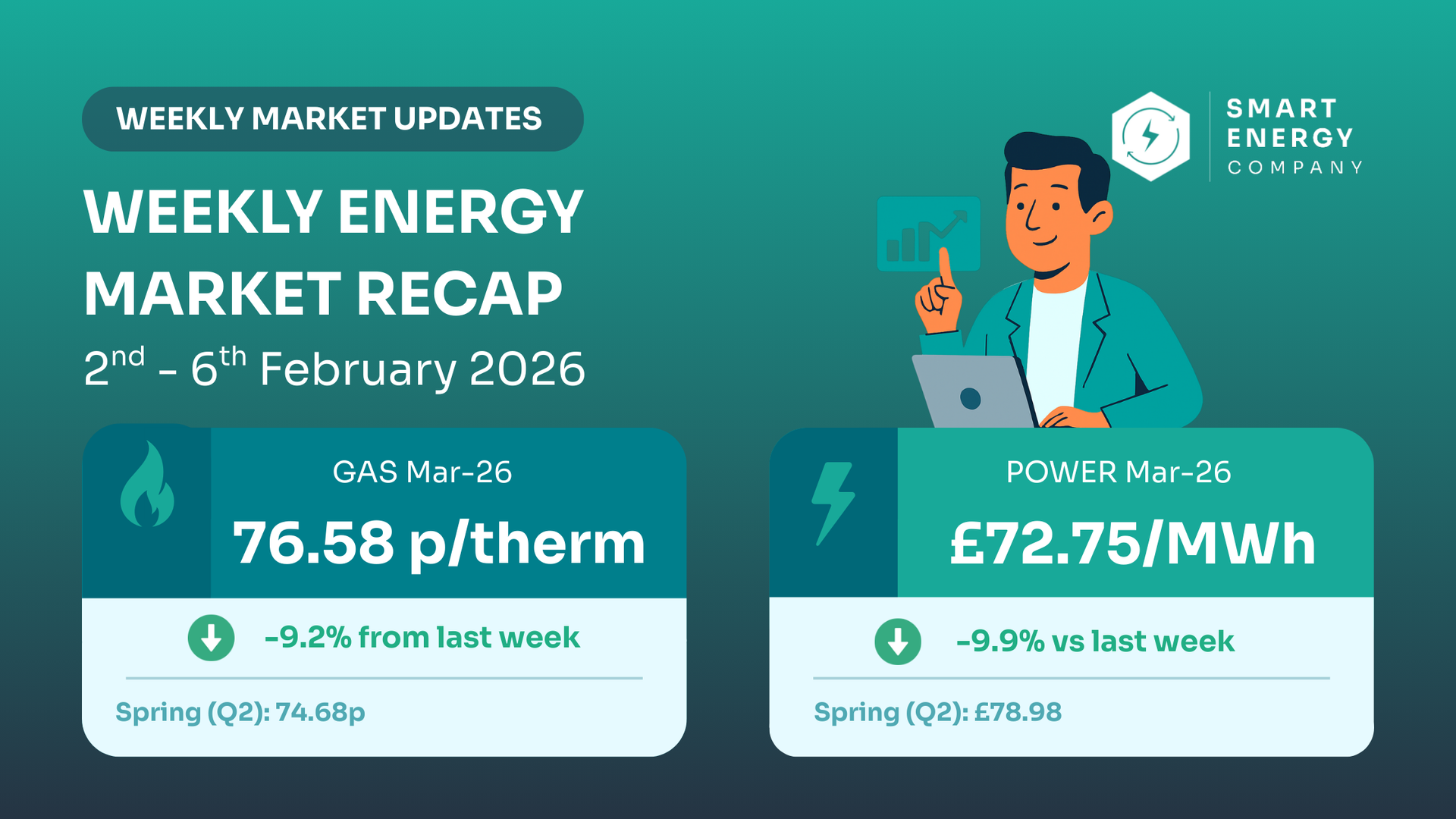

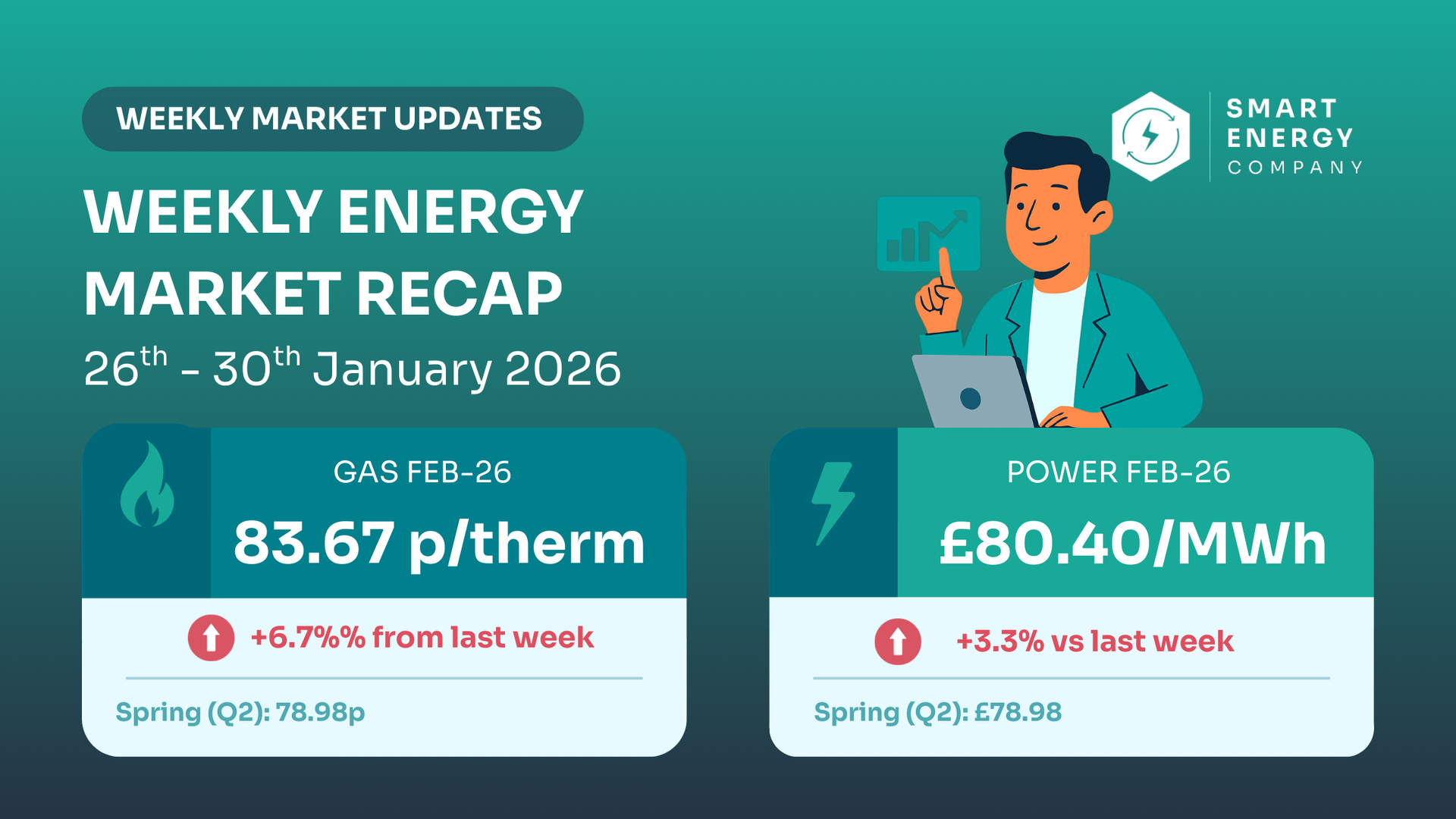

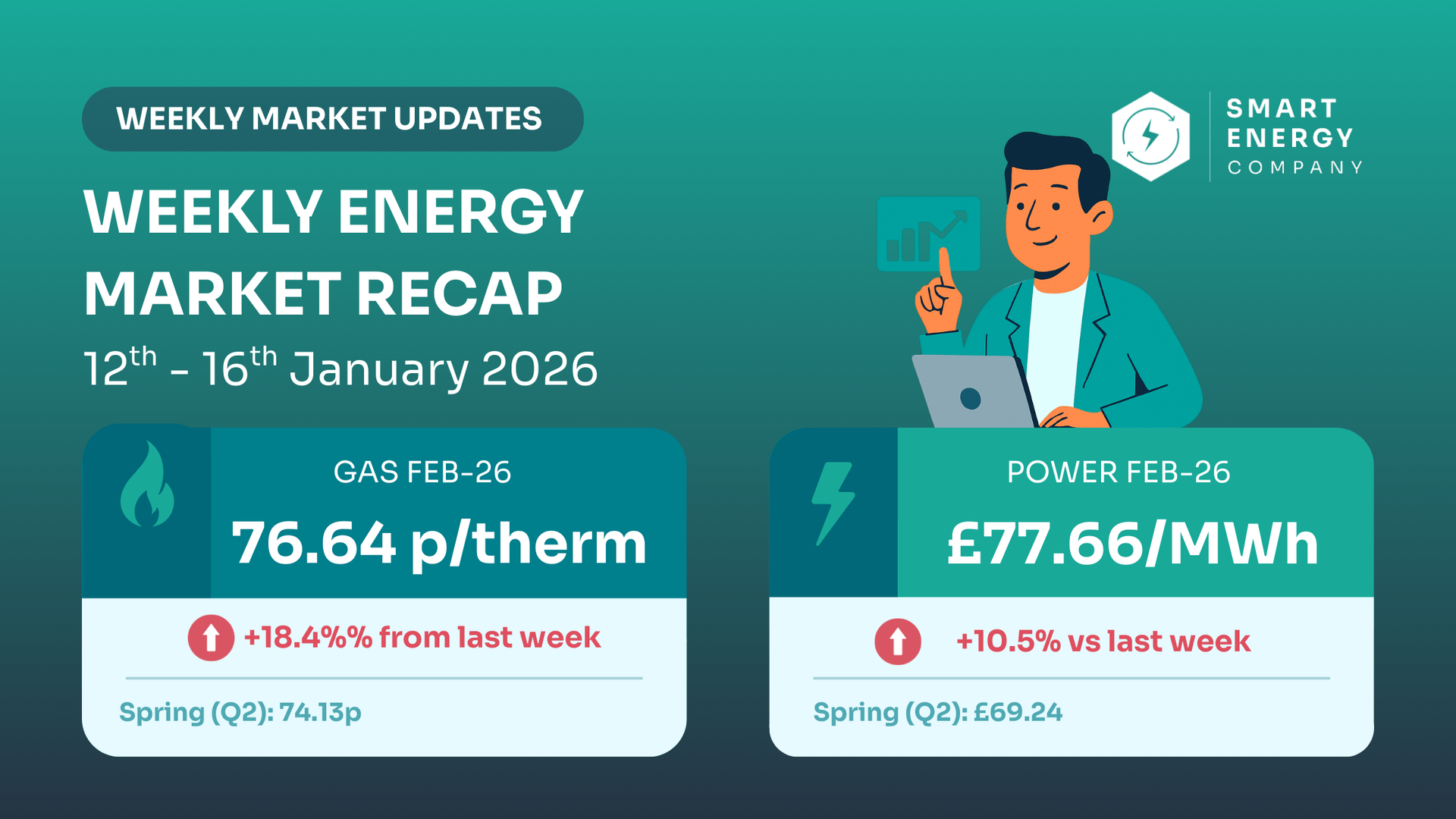

Act this week. Winter-25 and Q1-26 fell 3–5% this week. With spot now at 75.99p/th (gas) and £78.05/MWh (power), forwards look sensible protection.

You’re in the critical window — fixing now removes the risk of further rises as colder weather approaches.

Get Your Quote Now