UK Energy Market Update: 22nd - 26th September 2025

By Thomas McGlynn • 29 September 2025

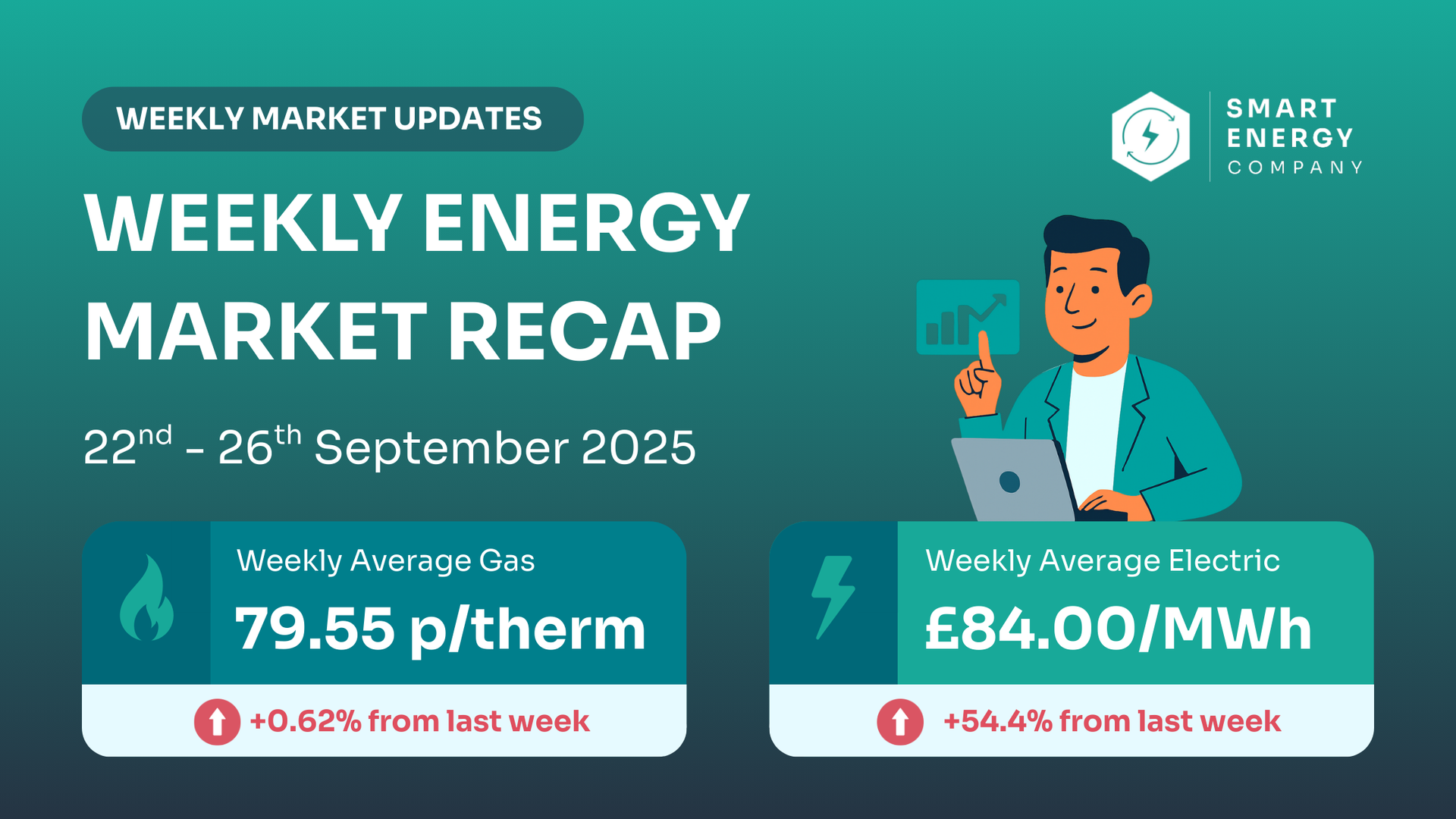

Markets steadied this week

Gas held in a narrow band around 79–80p/therm, while electricity settled back near £80–85/MWh. The weekly averages — 79.55p/therm for gas and £84.00/MWh for power — show stability compared to the anomalous swings seen earlier in the month. Forward contracts, however, remain elevated for Winter 2025 and Q1 2026, meaning renewal quotes are still carrying seasonal premiums.

📊 Weekly Market Snapshot (Day-Ahead)

| Commodity | Weekly avg | Previous Week | % Change | Weekly High | Weekly Low |

|---|---|---|---|---|---|

| Gas (UK NBP) | 79.55 p/therm | 79.06 | Up 0.62% | 80.00 (Wed/Fri) | 78.35(Thu) |

| Power (UK Base) | £84.00/MWh* | 54.41* | Up 54.4%* | 90.41 (Tue) | 81.27 (Thu) |

Weekly Average: Gas 79.55 | Elec 84.00

🔎 Gas was broadly steady this week, fluctuating less than 2p/therm across five sessions.

🔎 Electricity settled higher, averaging £84/MWh, though daily prints were still volatile.

📈 5 Week Price Trend

| Week Ending | Average Gas (p/th) | Direction | Avg Power (£/MWh) | Direction |

|---|---|---|---|---|

| 26/09/2025 | 79.55 | 🔺 | 84.00 | 🔺 |

| 19/09/2025 | 79.06 | 🔻 | 54.41* | 🔻 |

| 12/09/2025 | 79.55 | 🔺 | 67.15* | 🔻 |

| 05/09/2025 | 78.69 | 🔻 | 75.96 | 🔻 |

| 29/08/2025 | 81.55 | 🔺 | 81.56 | 🔺 |

📌 The last two weeks were skewed by outliers in day-ahead power. This week’s return to £84/MWh brings averages closer to forward market reality.

📈 Forward Market Pricing — what suppliers actually watch

UK Gas (p/therm)

- Oct-25: 79.49 (▲0.55% vs last week)

- Q4-25: 83.11 (▲0.30% vs last week)

- Q1-26: 86.74 (▲0.09% vs last week)

- Summer-26: 78.55 (▲0.33% vs last week)

- Cal-26: 82.27 (▲0.27% vs last week)

UK Power (£/MWh)

- Oct-25: 75.21 (▲0.45% vs last week)

- Q4-25: 80.49 (▲0.02% vs last week)

- Q1-26: 85.60 (▲0.15% vs last week)

- Summer-26: 74.13 (▲0.08% vs last week)

- Cal-26: 79.20 (▲0.11% vs last week)

💡 Forward contracts are edging higher week-on-week, even while day-ahead gas looks stable. Winter 25 and Q1 26 remain the most expensive.

🧠 Why prices moved & What's Next

Gas: Steady LNG arrivals provided balance, but Norwegian maintenance continued to limit pipeline flows.

Power: Day-ahead stabilised near £80–85/MWh after early-month distortions, reflecting tighter gas-for-power demand.

Outlook: Seasonal premiums are embedded. Markets will now focus on October weather forecasts, LNG delivery schedules, and whether Norwegian flows improve post-maintenance.

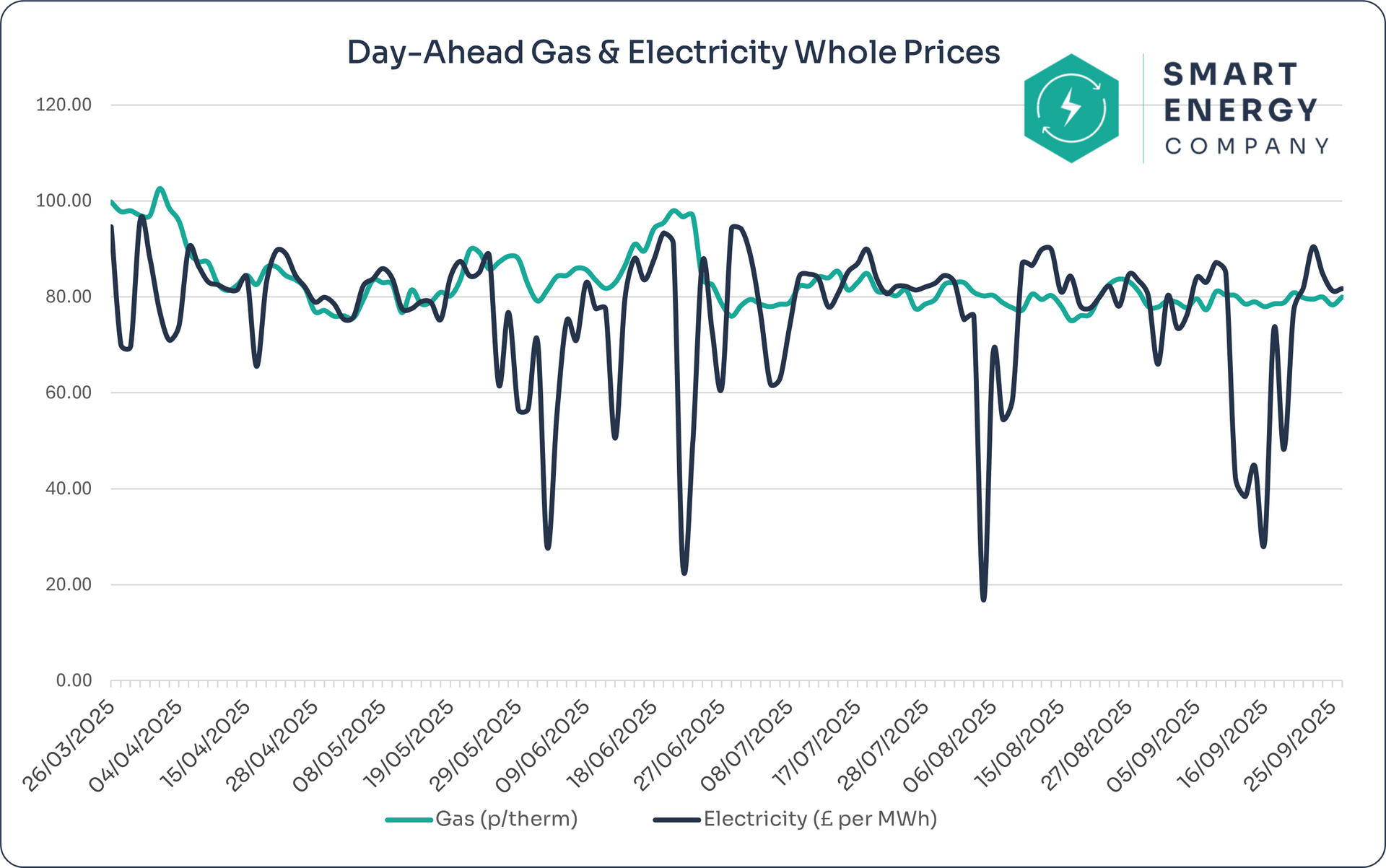

📉 6-Month Market Trend

Looking at the past six months of wholesale energy prices reveals important patterns:

- Gas has remained rangebound (78–85p/therm) since April, suggesting stability despite European supply challenges.

- Power shows more volatility, but this week’s £84/MWh sits firmly within the 6-month mid-range.

💡 Is now a good time to get prices?

Yes, especially for near-term renewals.

Forward Winter 25 and Q1 26 contracts are already high — delaying could expose businesses to higher October and November premiums. Longer-term contracts (Summer 26 onward) remain cheaper but could shift quickly.

👉

Don’t Wait for October Premiums

October is just around the corner, and forward strips for Winter remain firm. Don’t get caught out by seasonal risk.

What to do by renewal window

| Contract Renewal Period | Advice |

|---|---|

| Renewing within 3 months | Fix now — winter pricing is elevated and unlikely to ease. |

| Renewing in 3 - 6 Months | You’re still in the winter premium period. Quotes now will reflect that, but fixing early protects against further spikes. |

| Renewing +6 month out? | Summer 26 remains cheaper — monitor closely and subscribe to weekly updates. |

💷 What this means for your business

- Day-ahead averages show stability, but renewal quotes remain dictated by forward premiums.

- Businesses renewing in winter months face higher costs — early action is key.

- Longer-term renewals can still capture relative value in Summer 26 and beyond.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

Not Ready to Lock In?

Get a one-line nudge when prices move. Subscribe to weekly market updates and we’ll flag real opportunities — no jargon.

🧠 Final thoughts

The week ending 26th September highlights why averages can be misleading. Day-ahead gas looked steady, but forward markets crept higher — and that’s what drives supplier quotes. With October premiums looming, businesses due to renew this winter should act quickly, while longer-term clients should monitor Summer 26 and beyond for opportunities.

Get My Free Quote — or call us and we’ll run options the same day.

SHARE THIS