September 2025 UK Energy Market Trends: Gas, Power & Oil

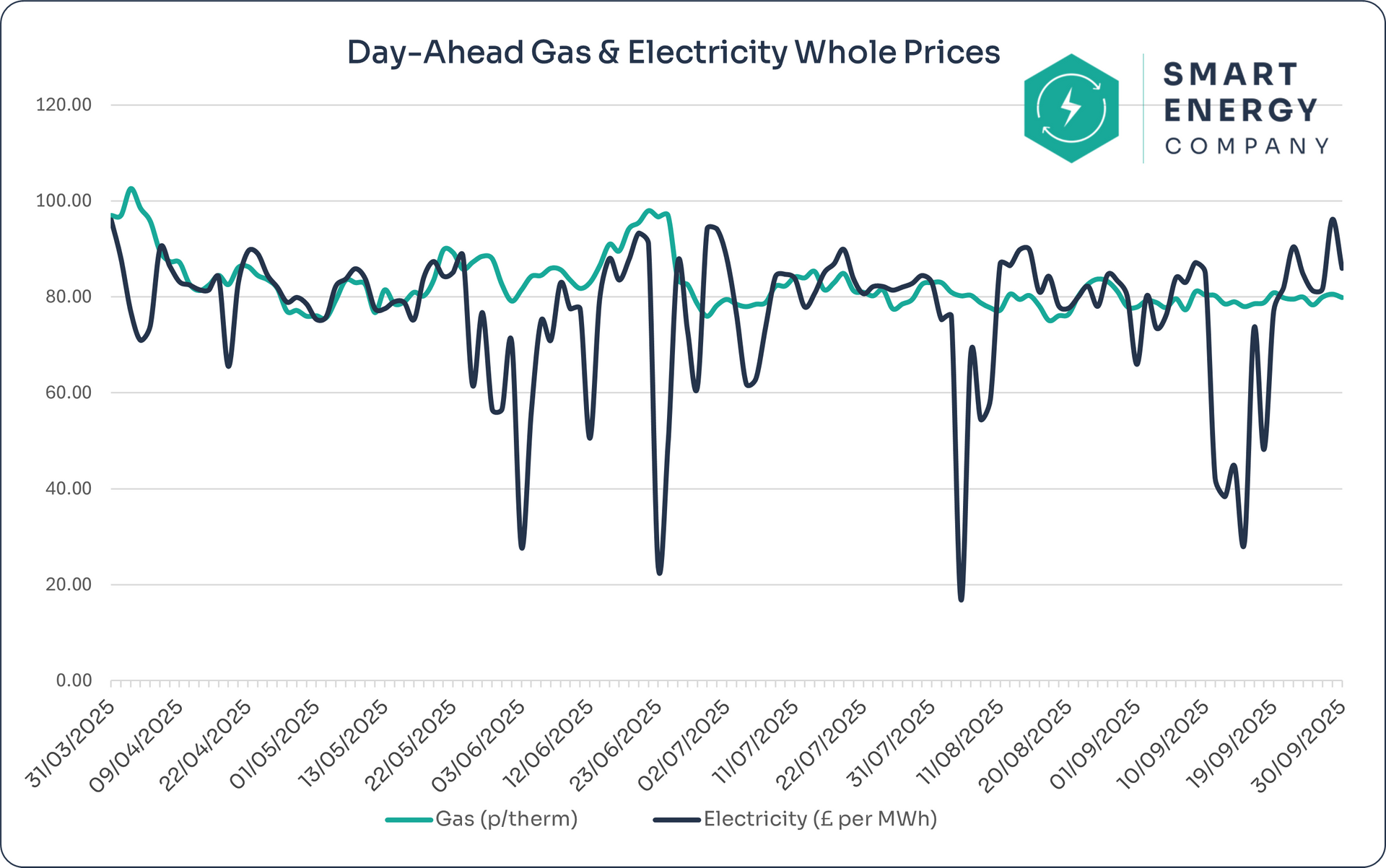

Gas remained steady on average through September, while electricity was distorted by extreme anomalies. The underlying trend shows contract pricing levels sitting higher than summer but still below last year’s extremes.

⚡ Key Takeaways for Businesses

- Gas remained in a tight 78–81p/therm range for most of the month.

- Power data was skewed by extreme dips mid-month, but real contract levels were stable in the low £80s/MWh.

- Forward contracts for Winter ’25 and Q1 ’26 eased slightly, but remain premium-priced compared to Summer ’26.

- Businesses renewing before March should still secure fixed quotes early to avoid seasonal uplift.

📊 September at a Glance: Average Prices vs. Previous Months

| Month | Avg Gas (p/th) | Avg Elec (£/MWh) |

|---|---|---|

| July | 81.06 | 81.44 |

| August | 79.68 | 75.59 |

| September | 79.31 | 72.26 |

📈 Market Movement Summary

- Early September – Gas held around 78–80p/th, with power broadly stable in the mid £70s.

- Mid September – Outlier electricity dips (down to £28/MWh on 16/09) pulled averages down artificially, not reflective of supplier offers.

- Late September – Both gas and power rebounded into their familiar ranges, ending the month near £80p/th and £85/MWh.

📆 Week-by-Week: What Happened in August?

| Week | Avg Gas (p/th) | Avg Elec (£/MWh) | Comment |

|---|---|---|---|

| 01-05 Sept | 78.69 | 75.96 | A steady start to the month. |

| 08-12 Sep | 79.55 | 67.15 | Power skewed lower by sharp anomalies. |

| 15-19 Sept | 79.06 | 54.41 | Power anomalies distorted averages sharply downward. |

| 22-26 Sept | 79.55 | 84.00 | Return to more realistic levels. |

| 29-30 Sept | 78.83 | 87.92 | Power climbed sharply to close the month. |

⚠️ Note: The weekly electricity averages in mid-September don’t reflect real contract prices — they were pulled down by one-off distorted prints. Renewal quotes are based on the forward curve, not these anomalies.

💡 Is Now a Good Time to Fix My Energy Contract?

Yes – forward curves for Winter ’25 and Q1 ’26 remain elevated, but are showing signs of softening. Businesses with renewals due in the next 6 months should act now to cap risk, while those further out can monitor conditions closely.

Renewing in 0-3 months (Oct-Dec 2025)

Lock in now. You’re entering peak winter pricing, and suppliers are already loading premiums.

Renewing in 3–6 months (Jan–Mar 2026)

This is still winter — better to secure now rather than gamble on a late-season drop.

Renewing in 6–12 months (Apr–Sep 2026)

Summer 26 remains more competitive. Keep monitoring but set up quotes early.

Renewing 12+ months out:

Sign up to our weekly insights to track forward shifts. Being ready means you can strike when dips appear.

👉 Don’t Let Winter Premiums Catch You Out

Winter contracts are already pricing higher. If your renewal is due soon, acting early could protect your business from seasonal spikes.

📊 What’s Driving Prices?

Gas:

- Strong LNG arrivals and steady Norwegian supply.

- Storage remains above seasonal averages.

- Winter demand expectations keeping near-term premiums in place.

Power:

- Mid-month volatility linked to renewables and system balancing.

- Real supplier pricing stayed aligned with gas and carbon costs.

- Oil and carbon markets added mild upward pressure late in the month.

📉 6-Month Price Trend Overview

Gas has held between

78–85p/th for six months, showing relative stability. Power has been more volatile, with sharp day-ahead swings pulling averages down, though forwards stayed consistently higher.

📈 Forward Market Pricing – What Suppliers Are Watching

Suppliers build quotes on forward contracts, not daily averages. As of late September:

- Gas: Winter 25 and Q1 26 remain elevated (mid-to-high 80s p/th), while Summer 26 trades around the high 70s p/th.

- Power: Winter 25 contracts sit in the low–mid £80s/MWh, with Summer 26 cheaper in the mid-£70s/MWh.

- Trend: Forwards eased slightly in early September, but recovered later, showing resilience despite day-ahead softness.

🔎 Looking Ahead to October

- Winter demand will begin to build.

- Watch LNG arrivals and weather forecasts for early cold snaps.

- Forward pricing for Winter ’25 could tighten further if supply disruptions emerge.

- Businesses should review renewal dates now to avoid higher quotes in Q4.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

💬 Final Thoughts

Despite anomalies in the electricity data,

September confirmed stability in underlying contract pricing, with gas flat and power realigning to the £80–85/MWh band. The key message:

act before October–March premiums take hold.

Secure a better rate.

Or stay informed with free updates.

We'll help you make the right decision at the right time — no pressure, just expert advice.