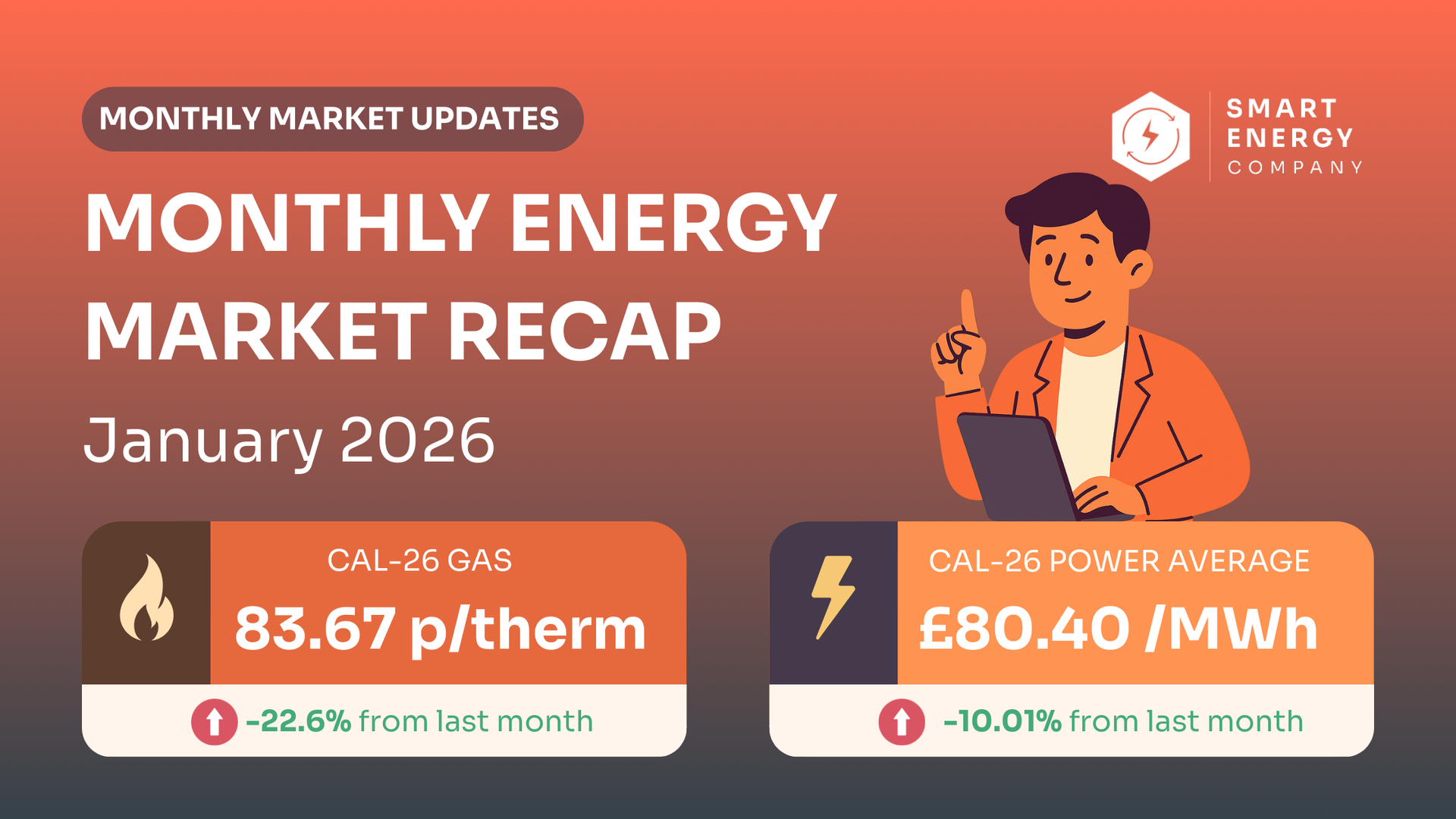

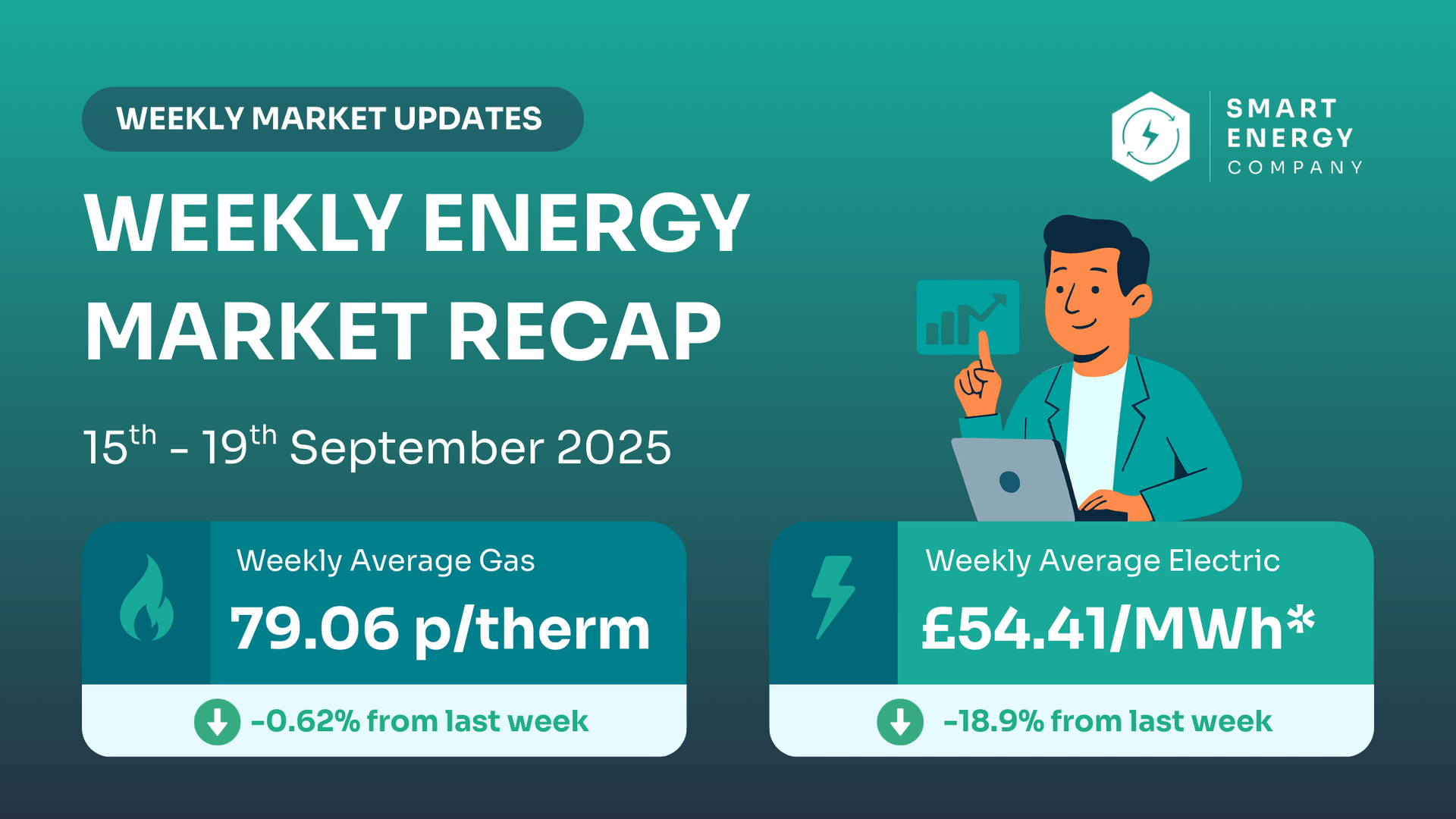

UK Energy Market Update: 15th - 19th September 2025

By Thomas McGlynn • 22 September 2025

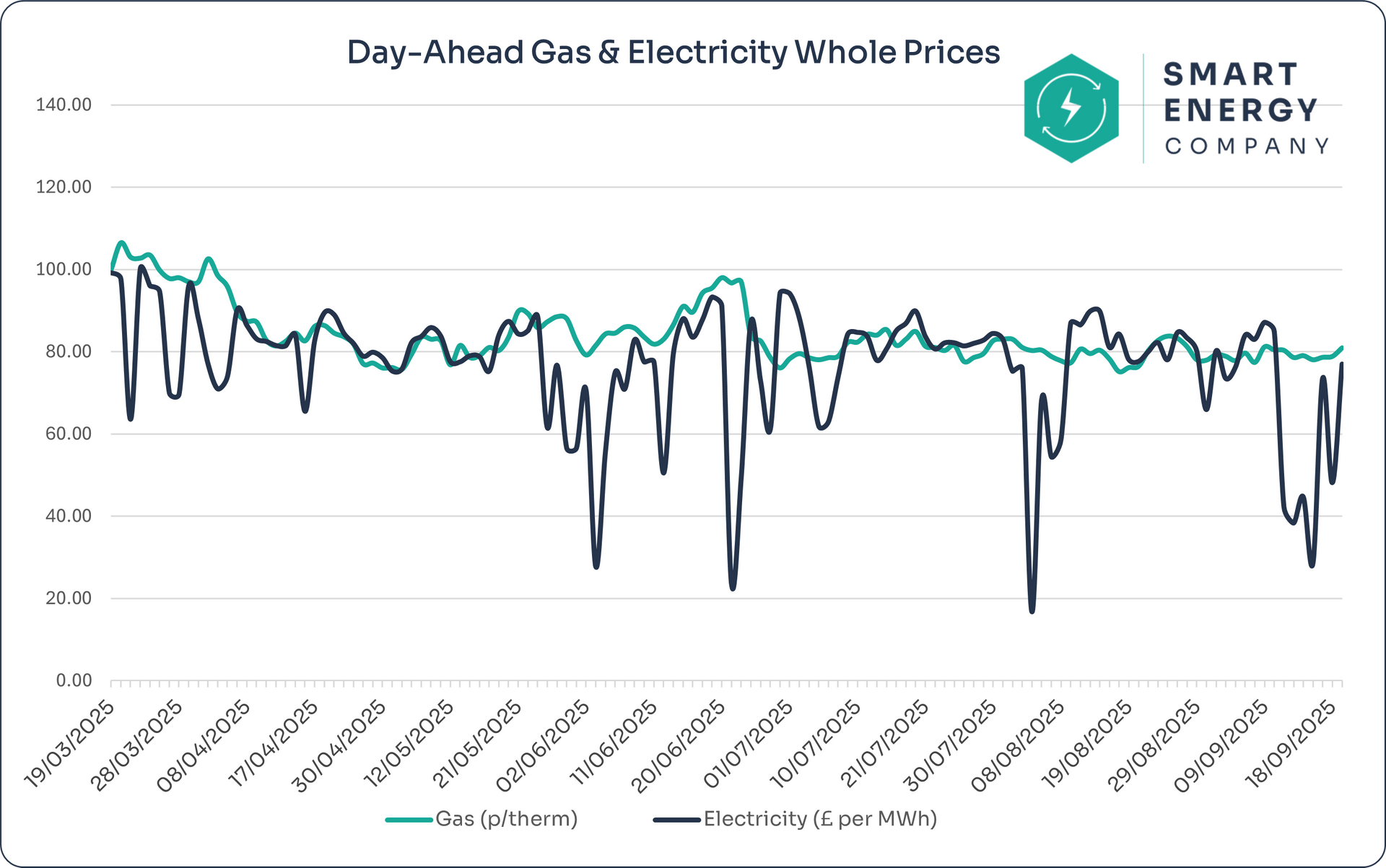

A strange week on the surface

Day-Ahead electricity plunged on two sessions then rebounded, while gas stayed fairly steady. Under the bonnet, the forward curve (what suppliers use to build your renewal prices) nudged higher across winter and into summer 2026. Translation: headline DA falls don’t automatically mean cheaper renewal quotes.

📊 Weekly Market Snapshot (Day-Ahead)

| Commodity | Weekly avg | Previous Week | % Change | Weekly High | Weekly Low |

|---|---|---|---|---|---|

| Gas (UK NBP) | 79.06 p/therm | 79.55 | Down 0.62% | 80.90 (Fri) | 78.00 (Tue) |

| Power (UK Base) | £54.41/MWh* | 67.15 | Down 18.9% | 77.00 (Fri) | 28.65 (Tue) |

Why this matters: These are wholesale cash prices for tomorrow’s delivery. They’re useful signals for short-term tightness, but your contract is priced off the forward curve, not tomorrow’s delivery.

*Power average was pulled down by two unusually low sessions (Tue & Thu), which is not reflective of the broader contract market.

Daily prints this week (DA):

Mon 79.00p/44.69 | Tue 78.00p/28.65 | Wed 78.60p/73.53 | Thu 78.82p/48.16 | Fri 80.90p/77.00

📈 5 Week Price Trend

| Week Ending | Average Gas (p/th) | Direction | Avg Power (£/MWh) | Direction |

|---|---|---|---|---|

| 19/09/2025 | 79.06 | 🔻 | 54.41* | 🔻 |

| 12/09/2025 | 79.55 | 🔺 | 67.15* | 🔻 |

| 05/09/2025 | 78.69 | 🔻 | 75.96 | 🔻 |

| 29/08/2025 | 81.55 | 🔺 | 81.56 | 🔺 |

| 22/08/2025 | 78.10 | 🔻 | 80.44 | 🔺 |

*Recent DA power averages include one-off dips; use for direction only, not for contract planning.

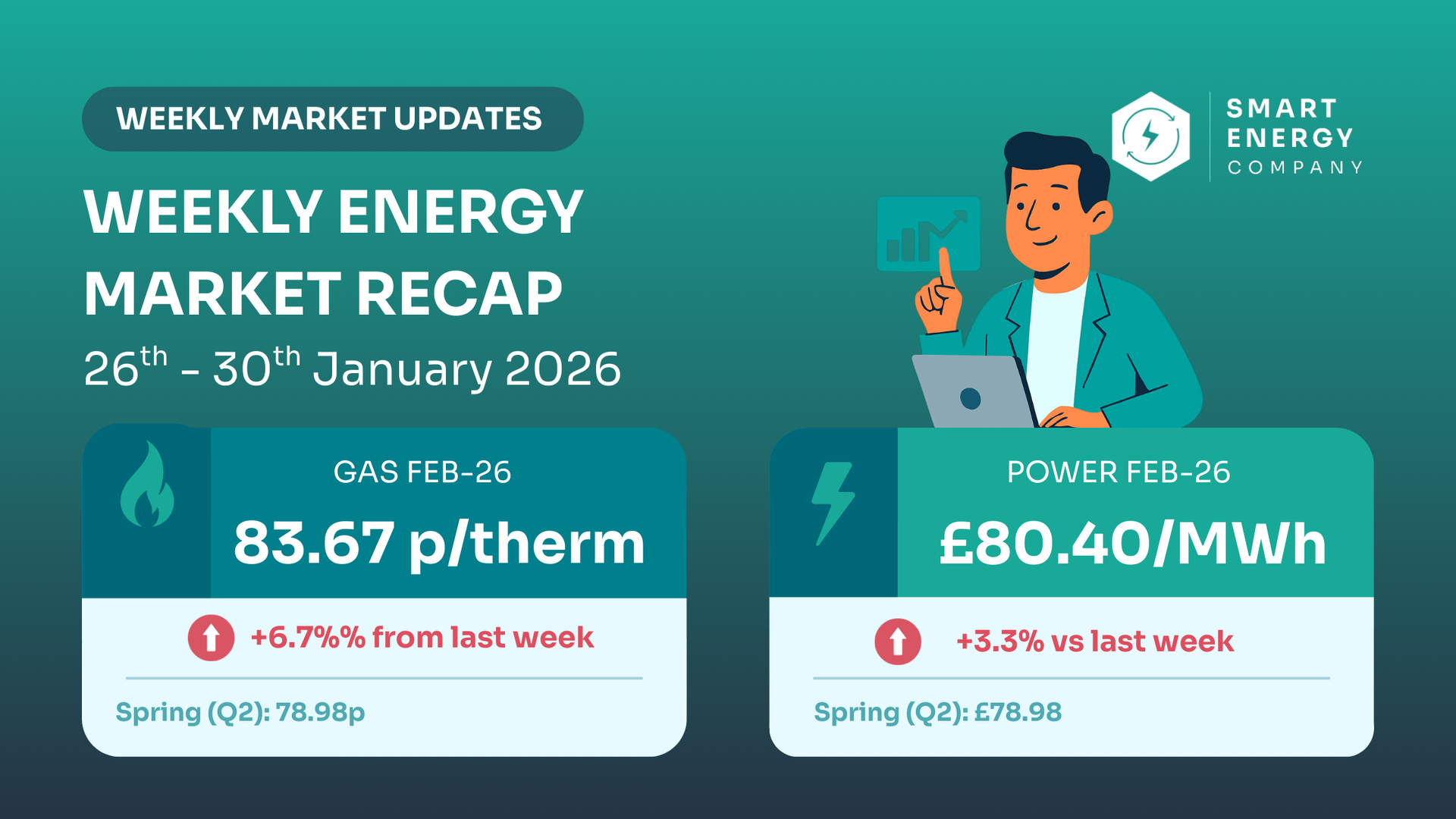

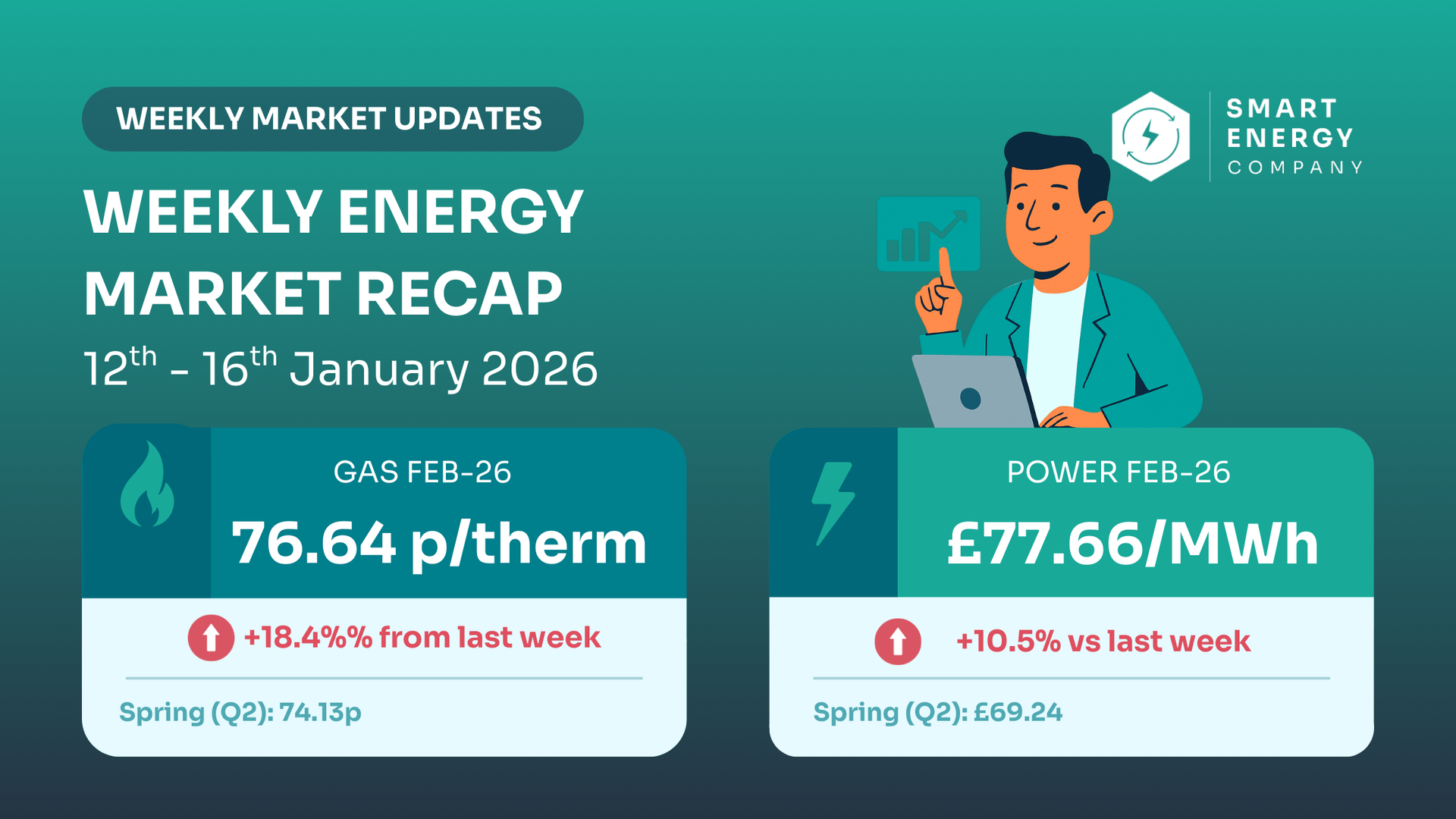

📈 Forward Market Pricing — what suppliers actually watch

While DA shows the weather-and-system noise, forward contracts show where suppliers expect prices to be. Week-on-week (vs 12 Sep) most key strips ticked up 2–4%.

UK Gas (p/therm)

- Oct-25: 81.50 (from 79.22) ▲ +2.9%

- Q4-25: 85.35 (83.52) ▲ +2.2%

- Q1-26: 89.15 (87.82) ▲ +1.5%

- Summer-26: 79.99 (78.23) ▲ +2.3%

- Cal-26: 83.80 (82.15) ▲ +2.0%

UK Power (£/MWh)

- Oct-25: 77.18 (74.02) ▲ +4.3%

- Q4-25: 82.77 (80.76) ▲ +2.5%

- Q1-26: 87.16 (85.48) ▲ +2.0%

- Summer-26: 75.74 (73.76) ▲ +2.7%

- Cal-26: 80.59 (78.80) ▲ +2.3%

What this means: Despite soft DA power, the curve firmed into winter and modestly for Summer-26. Renewal quotes will reflect these forward levels, not the short-term DA dips.

🧠 Why prices moved & What's Next

- Short-term system swings: Mid-week DA power fell on lighter demand and renewable surges, then rebounded as conditions normalised.

- Winter risk still priced in: Forwards for Q4-25/Q1-26 gained ~2%, keeping a premium over summer strips.

- Near-term watch-outs: late-September weather turning cooler, timing of planned maintenance finishing, and LNG arrival schedules. Any wobble here can lift the winter curve quickly.

📉 6-Month Market Trend

Looking at the past six months of wholesale energy prices reveals important patterns:

- Gas: range-bound ~75–85 p/th for months, drifting slightly higher late September.

- Power: far more volatile with several sharp drops, but the

underlying forward market has stayed

well above the deepest DA troughs.

Translation: use DA to sense near-term balance, but plan off forwards.

💡 Is now a good time to get prices?

Yes — get fully-fixed quotes in hand.

DA power is noisy, but the forward curve nudged up again this week, especially for winter. Having live quotes now helps you cap risk if the curve climbs further.

👉

Don’t let winter premiums creep up on you.

We’ll compare Oct–Mar vs longer terms and lock in if the curve moves against you

What to do by renewal window

| Contract Renewal Period | Advice |

|---|---|

| Renewing within 3 months | Lock in. Winter strips rose again this week; waiting invites higher quotes if supply tightens or weather turns colder. |

| Renewing in 3 - 6 Months | Lean towards fixing. You’re still mostly in the winter window and Q1-26 moved higher. Secure a cap now; we’ll re-shop if dips appear. |

| Renewing +6 month out? | You have options. Summer-26 and Cal-26 also edged up ~2–3%. Consider placing a fixed now for budget certainty, or join our weekly market updates and be ready to strike on any pullbacks. |

💷 What this means for your business

- DA power was artificially low at times, but supplier quotes follow the curve, which rose.

- Winter 25 / Q1-26 remain the priciest periods; later strips are cheaper but nudging up.

- If your renewal touches winter, acting early typically beats chasing short-term DA dips.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

Not Ready to Lock In?

Get a one-line nudge when prices move. Subscribe to weekly market updates and we’ll flag real opportunities — no jargon.

🧠 Final thoughts

Headline DA power falls looked friendly, but the contract-relevant market firmed. If your renewal is within the next six months, fixing now protects you from winter risk and creeping forward gains. Longer-dated customers should stay engaged and be ready to move on dips.

Get My Free Quote — or call us and we’ll run options the same day.

SHARE THIS