April 2025 UK Energy Market Trends: Gas, Power, and Oil

April brought another wave of price drops across gas, power, and oil – but not without volatility. Here’s what happened and what businesses need to know for May.

✅ At a Glance: What Happened in April?

April saw energy prices drop again, with both gas and electricity continuing their downward trend for a second straight month. The month was marked by global trade tensions, tariff surprises, and generally mild weather that kept demand in check.

- 🔻 Gas prices fell ~12% from March

- 🔻 Power prices fell ~10% month-on-month

- ⚖️ Oil prices fluctuated sharply, ending the month lower

🗓️ After a volatile first half of the month, markets calmed slightly—but continued economic worries and geopolitical uncertainty left traders on edge.

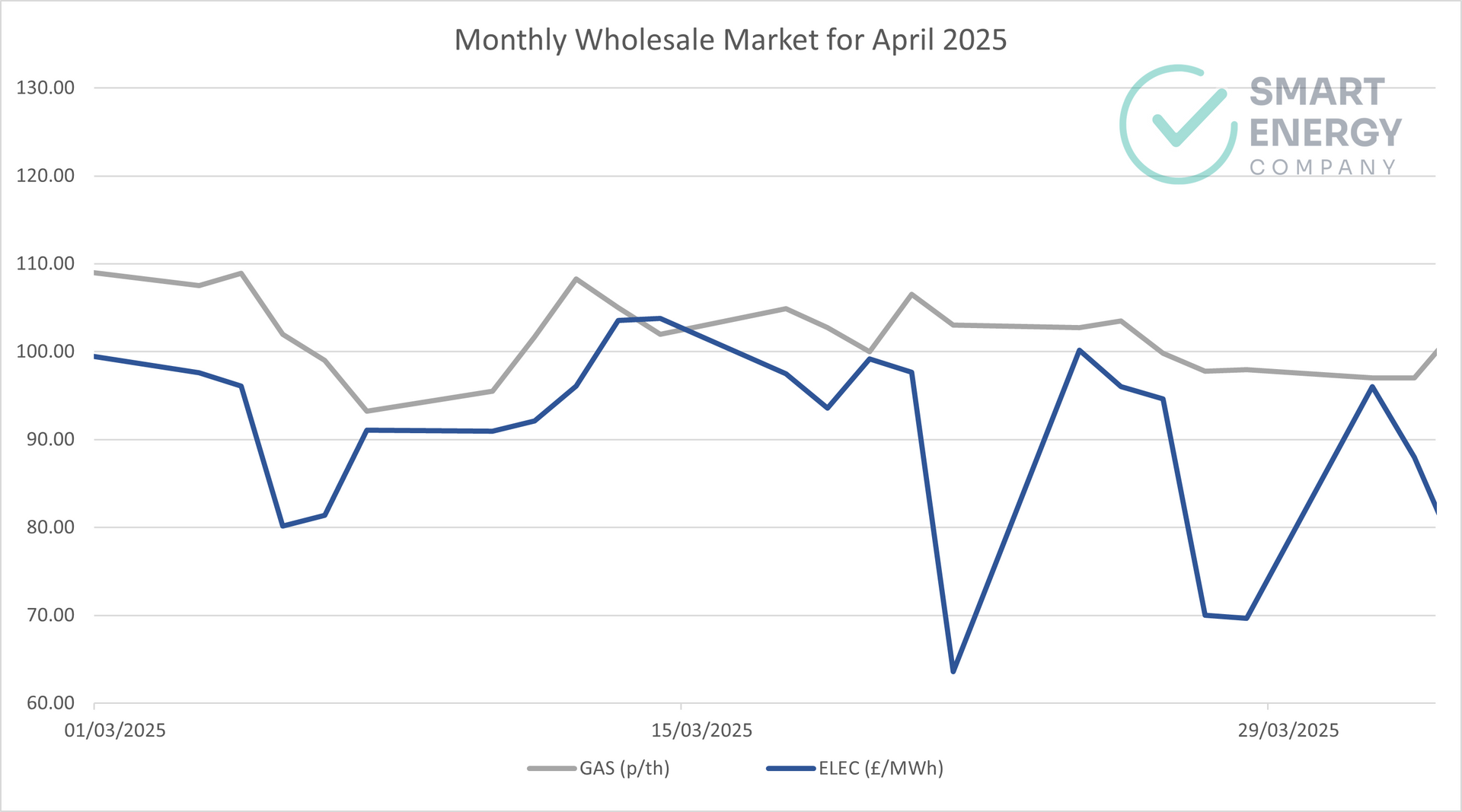

📊 Monthly Price Trends (with Chart)

This chart shows how

gas (grey line) and

electricity (blue line) prices moved throughout April:

Key Takeaways:

- 📉 Early April Drop – Prices tumbled due to trade war escalation and mild weather.

- 🔄 Mid-April Volatility – Conflicting tariff announcements caused large daily swings.

- 🔻 Late April Decline – Markets softened again as storage levels improved and demand stayed low.

✔️ The overall direction remained downward, with both commodities breaking key psychological support levels (gas under 80p/th, power under £80/MWh).

📉 Average Prices vs. March

| Commodity | April 2025 Avg | March 2025 Avg | Change |

|---|---|---|---|

| Gas (NBP DA) | 86.22 p/th | 101.86 p/th | ↓ 15.4% |

| Power (DA) | £81.48/MWh | £90.99/MWh | ↓ 10.5% |

📦 What Moved the Market?

🔹 Global Trade Tensions

The U.S.–China trade war escalated dramatically this month, triggering new tariffs and fears of a global recession. Markets reacted with:

- 📉 Sharp price drops after China retaliated on 7 April

- 📈 Temporary rallies on rumours of tariff pauses (later denied)

🔹 Mild Weather & Rising Renewables

- Consistently above-average temperatures kept heating demand low.

- Wind generation surged mid-month, easing pressure on gas-for-power demand.

- Storage injections began early and steadily, supporting lower prices.

🔹 Oil Market Swings

Oil saw its

biggest one-month drop in years before rebounding late in the month.

Key drivers:

- 🛢️ OPEC+ output announcements

- 🔄 U.S.–Iran sanctions

- 💥 Global economic uncertainty

📅 12-Month Market View: Are Prices Falling?

🟦 Graph: Last 12 Months – Gas & Power Prices

Energy prices peaked around the turn of the year but have since trended steadily downward. April marked the second month of consistent declines for both gas and electricity.

- 📈 Late 2024 to Jan 2025: Prices surged amid winter demand and global tensions

- 📉 Since Feb 2025: Clear downward trend – encouraging for businesses

This could represent a key buying window before summer volatility returns.

📈 What This Means for Contracts

💡 Renewing in May–June?

Now is a strong time to consider fixing. Prices are near 6-month lows, but market risks remain.

💡 Renewing later in 2025?

Monitor closely. This dip may not last if storage targets change or Asian demand picks up.

💡 Not sure what to do?

Let current price levels guide short-term strategy, while keeping flexible plans for long-term needs.

🔮 What to Watch in May

- Ongoing tariff tensions – Will trade talks resume or escalate?

- Storage levels – EU is ahead of schedule, but Asia may compete for LNG by summer.

- Middle East developments – Iran and U.S. negotiations continue.

- OPEC+ supply decisions – Further output increases may weigh on oil.

📝 Final Takeaway

April delivered another round of price drops – good news for UK businesses reviewing energy contracts. But while the overall trend is down, uncertainty is still high.

📉

Prices are low, but the market is nervous.

📅

May could be a great time to lock in contracts before demand returns.

📞 Need help making the most of the current prices?

👉

Request a fixed quote now

📩

Subscribe for alerts and expert insights

Need Tailored Advice for Your Business?

Contact us today at 0151 459 3388 or request your free energy quote and stabilise your energy costs. At Smart Energy Company, we specialise in finding the best utility contracts for your business, ensuring you never miss a renewal and always get the best deals.