Energy Market Update: 22nd - 25th April 2025

With Easter Monday behind us, trading resumed on Tuesday. Below is a straightforward recap of how wholesale gas, power and oil prices moved last week, why they moved, and what that might mean when you’re thinking about a fully-fixed contract.

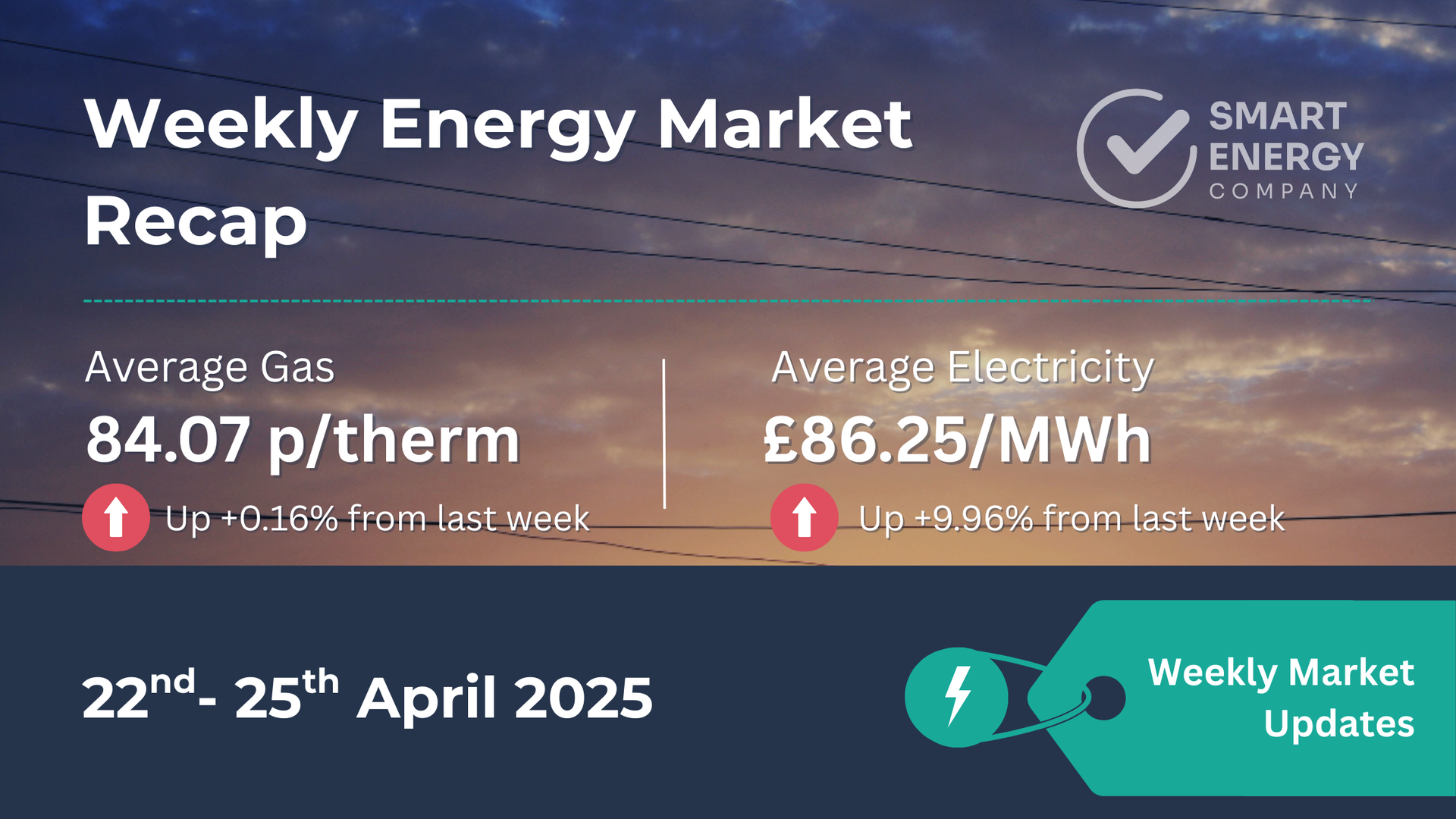

Weekly Energy Market Recap

✨ Quick Snapshot

- 🔥

Average Gas (Day-Ahead): 84.07 p/therm

(Up 0.16 % from 83.94 p/therm the previous week)

- ⚡

Average Electricity (Day-Ahead): £86.25/MWh

(Up 9.96 % from £78.44/MWh the previous week)

- 🛢️ Brent Crude: Traded around $66 bbl, swinging on fresh Iran sanctions news and mixed OPEC+ signals.

Snapshot takeaway:

Gas was broadly flat, but power jumped nearly 10 % as wind output dipped early in the week and demand ticked up after the long weekend.

⚡ Market Overview

Post-Easter Catch-Up

- Tuesday: Markets reopened to firmer prices on cooler forecasts and lower renewables over the holiday.

- Mid-week: Sentiment flipped as recession worries and strong storage injections pulled both NBP and TTF lower.

- Thursday: Gas slid again when U.S.–China talks showed no breakthrough, and Europe remained comfortably supplied.

Storage & Supply

- EU injections out-paced the five-year average (≈ 1.6 bcm last week).

- The Commission ditched an outright Russian-LNG ban and will publish a broader 2027 “energy-exit” roadmap in May.

Volatility Without Direction

- Intraday swings of 2–3 % were common: traders are still headline-driven and reluctant to set long-term positions while tariff policy changes daily.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 86.35 p/therm (22 Apr) | £89.50/MWh (22 & 23 Apr) |

| Lowest | 81.81 p/therm (25 Apr) | £82.00/MWh (25 Apr) |

| Weekly Average | 84.07 p/therm | £86.25/MWh |

| Change vs Last Week | +0.16 % | +9.96 % |

Power’s gain reflects early-week renewable dips and a modest demand pick-up after the Easter break, whereas gas barely moved week-on-week.

🔎 Key Factors This Week

- Tariff Uncertainty – Conflicting White House comments on easing China duties kept markets jumpy.

- Storage Pace

– Strong injections reassured traders Europe can reach 80 – 90 % stock before winter, capping upside.

- Renewables Pattern – Low wind early in the week lifted power prices; output recovered by Thursday, easing the rise.

🏢 Implications for Your Business

- Contracts Ending Soon (0–3 Months)

- Gas is steady, but power is higher. If electricity is a big share of your bill, consider locking in now to avoid further spikes—especially with tariff news still volatile.

- Medium-Term (3–6 Months)

- Keep an eye on EU storage progress and May’s energy-roadmap details. Any supply hiccup or hotter summer forecast could move prices quickly.

- Long-Term (6+ Months)

- Watch global growth signals. A sharper downturn could soften prices, but LNG competition with Asia in Q3 may tighten things later in the year. Setting price alerts still makes sense.

🛢️ Oil Market Brief

- Brent bounced between $65 and $67/bbl:

- Up on fresh U.S. sanctions targeting Iran’s exports.

- Down when OPEC+ floated faster output hikes and recession talk resurfaced.

- OPEC and the IEA both trimmed 2025 demand estimates.

While oil doesn’t set UK gas or power outright, its swings reflect underlying economic sentiment—and that mood remains unsettled.

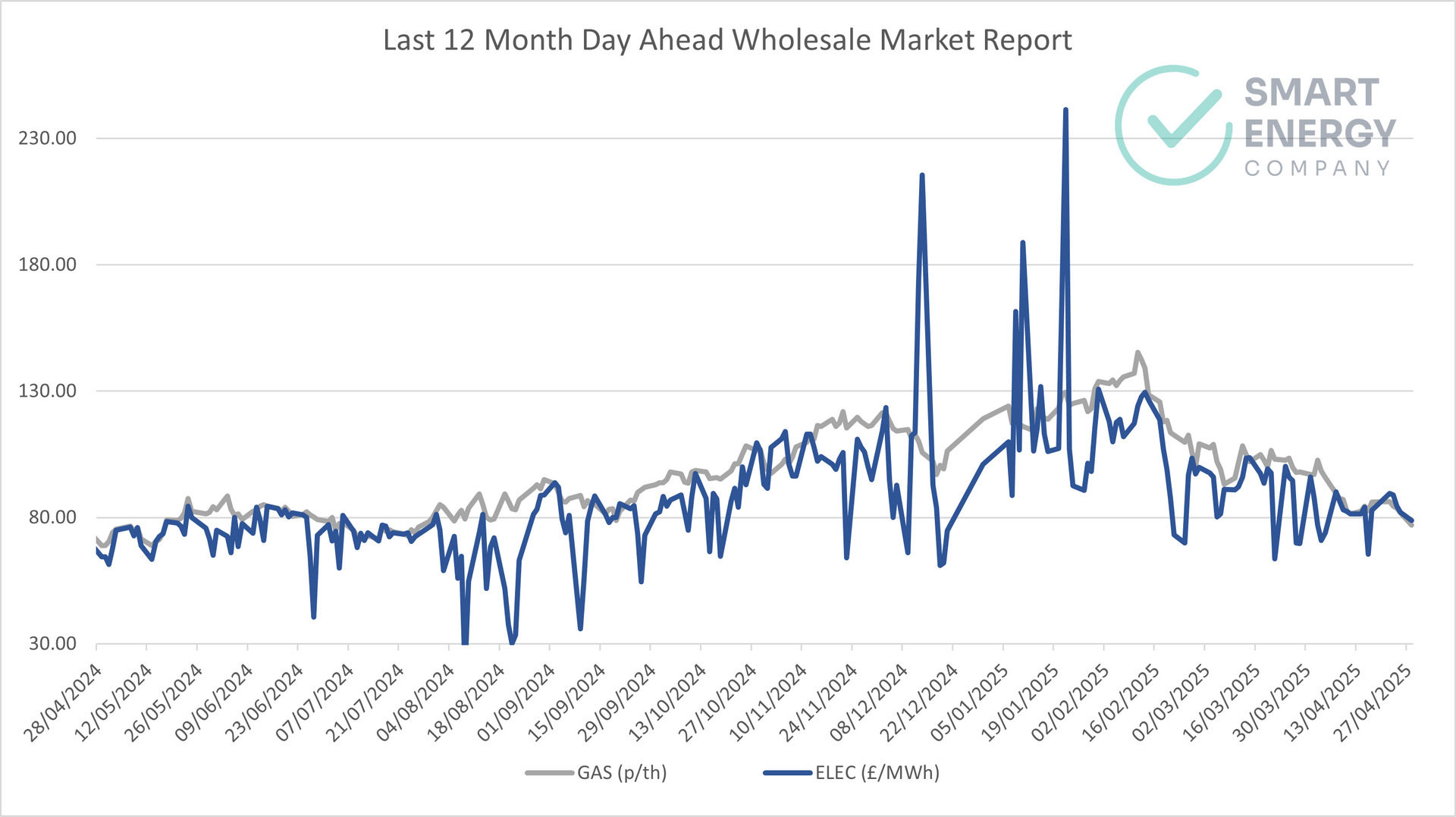

📈 12-Month Energy Market Trends

Gas and power remain well below winter highs, but the chart still shows sharp spikes on tariff or supply headlines. Expect choppy sessions until trade policy stabilises.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

Last week showed that prices can pivot on a single headline. Gas stayed level; power leapt. If you’d rather not ride the next round of volatility, a fully-fixed contract now could give welcome peace of mind.