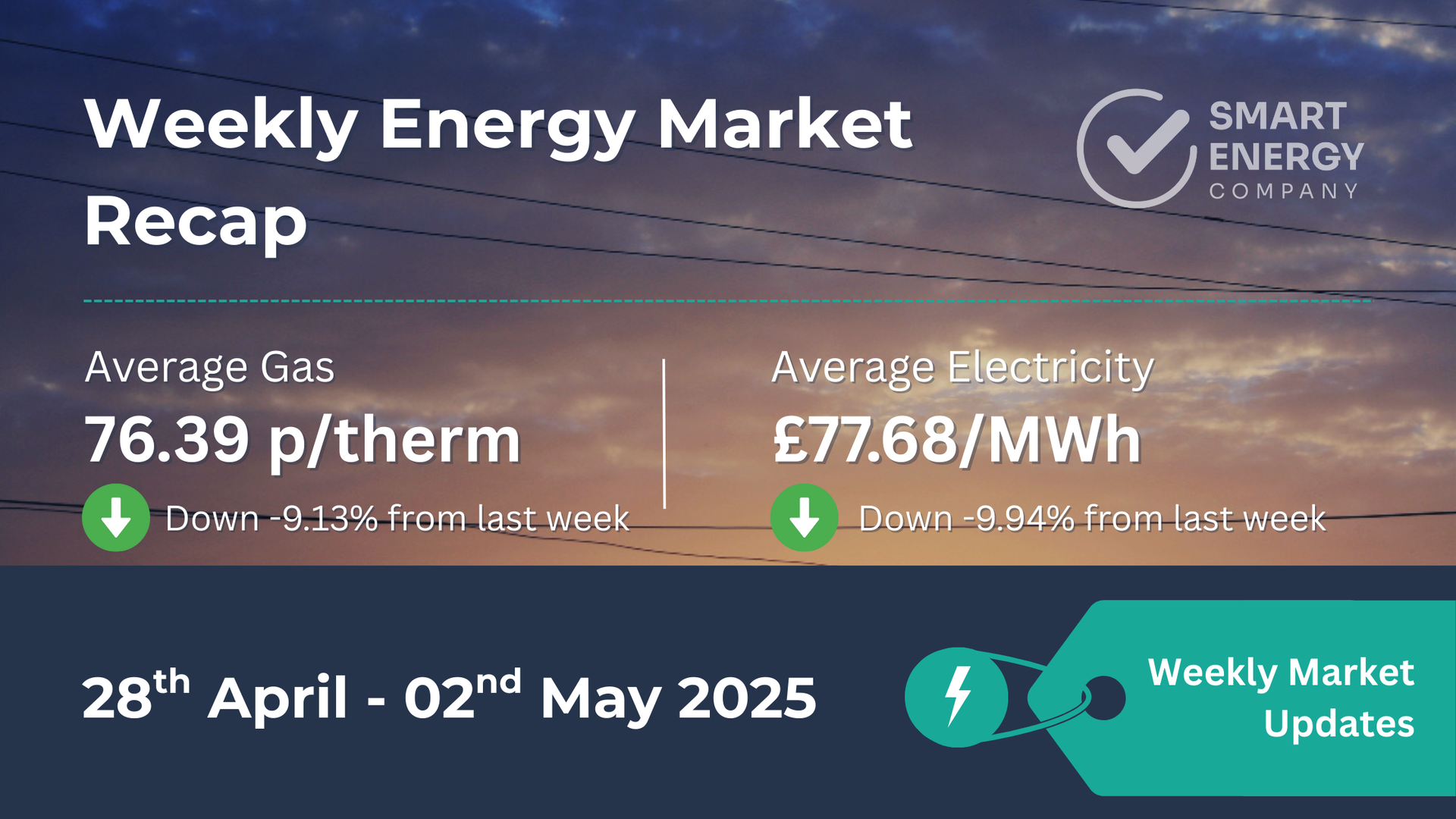

Energy Market Update: 28th April - 02nd May 2025

With the Bank Holiday cutting the week short, here’s a straightforward round-up of how wholesale gas and power prices moved last week, why they shifted, and what that might mean for businesses thinking about a fixed-price contract.

📊 Weekly Energy Market Recap

✨ Quick Snapshot

- 🔥 Average Gas (Day-Ahead): 76.39 p/therm

(Down -9.13% from last week’s 84.07 p/therm)

- ⚡ Average Electric (Day-Ahead): £77.68/MWh

(Down -9.94% from last week’s £86.25/MWh)

- 🛢️ Brent Crude: Settled around $62/bbl

(Down from ~$66/bbl last week as demand concerns and U.S.–China tensions continued)

💬 Another week of declines, as weaker demand forecasts, warm weather, and muted OPEC+ signals shaped markets. Energy prices hit their lowest levels in months.

📉 Market Overview

➤ Post-Holiday Slide

Gas and electricity prices dipped on Tuesday and Wednesday, following on from a quiet Bank Holiday Monday.

Traders reacted to economic concerns, weak demand, and slow progress on global trade talks.

➤ Storage & Supply

- EU storage rose again last week and now sits around 39% full.

- Mild temperatures and ample LNG availability have kept fundamentals relaxed.

➤ Volatility Without Follow-Through

Prices showed sharp within-day swings, especially midweek — but consistently settled flat to lower as traders held back from making bold moves.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 78.57 p/therm (28/04) | £79.88/MWh (29/04) |

| Lowest | 75.65 p/therm (02/05) | £75.30/MWh (01/05) |

| Weekly Average | 76.39 p/therm | £77.68/MWh |

| Change vs Last Week | 🔻 -9.13% | 🔻 -9.94% |

Note: Strong storage levels, muted LNG demand from Asia, and economic headwinds continue to soften pricing.

🔍 Key Factors This Week

🔺 Trade Tensions & Recession Fears

Markets remain sensitive to White House headlines, with traders reacting sharply to the lack of clarity on U.S.–China negotiations.

📦 Storage Progress

Above-average injections helped stabilise the market.

European stocks continue to fill steadily, reducing panic around injection season risks.

🌤️ Weather Conditions

Mild temperatures and improved solar generation have eased gas-for-power demand.

Wind output was variable, with some short-term uplift late in the week.

🏢 Implications for Your Business

📅 Contracts Ending Soon (0–3 Months)

Prices have dropped to the lowest levels seen in months — this could be a smart time to fix and remove uncertainty.

⏳ Medium-Term (3–6 Months)

With prices falling and fundamentals stable, there may still be room to fix lower, but monitor the geopolitical headlines closely.

🗓️ Long-Term (6+ Months)

Now is a good time to review your options, especially if your contract ends later in 2025. Fixing early could help you avoid future spikes.

🛢️ Oil Market Brief

Brent crude had a rough week, falling to ~$62/bbl amid economic concerns and signs of global demand slowdown.

Key Drivers:

- Tariff Worries: U.S.–China trade stalemate continued, weighing on sentiment.

- OPEC+ Uncertainty: Output hikes remain likely, but not yet confirmed.

- Iran Sanctions: Fresh sanctions briefly lifted prices, but not enough to reverse the week’s broader losses.

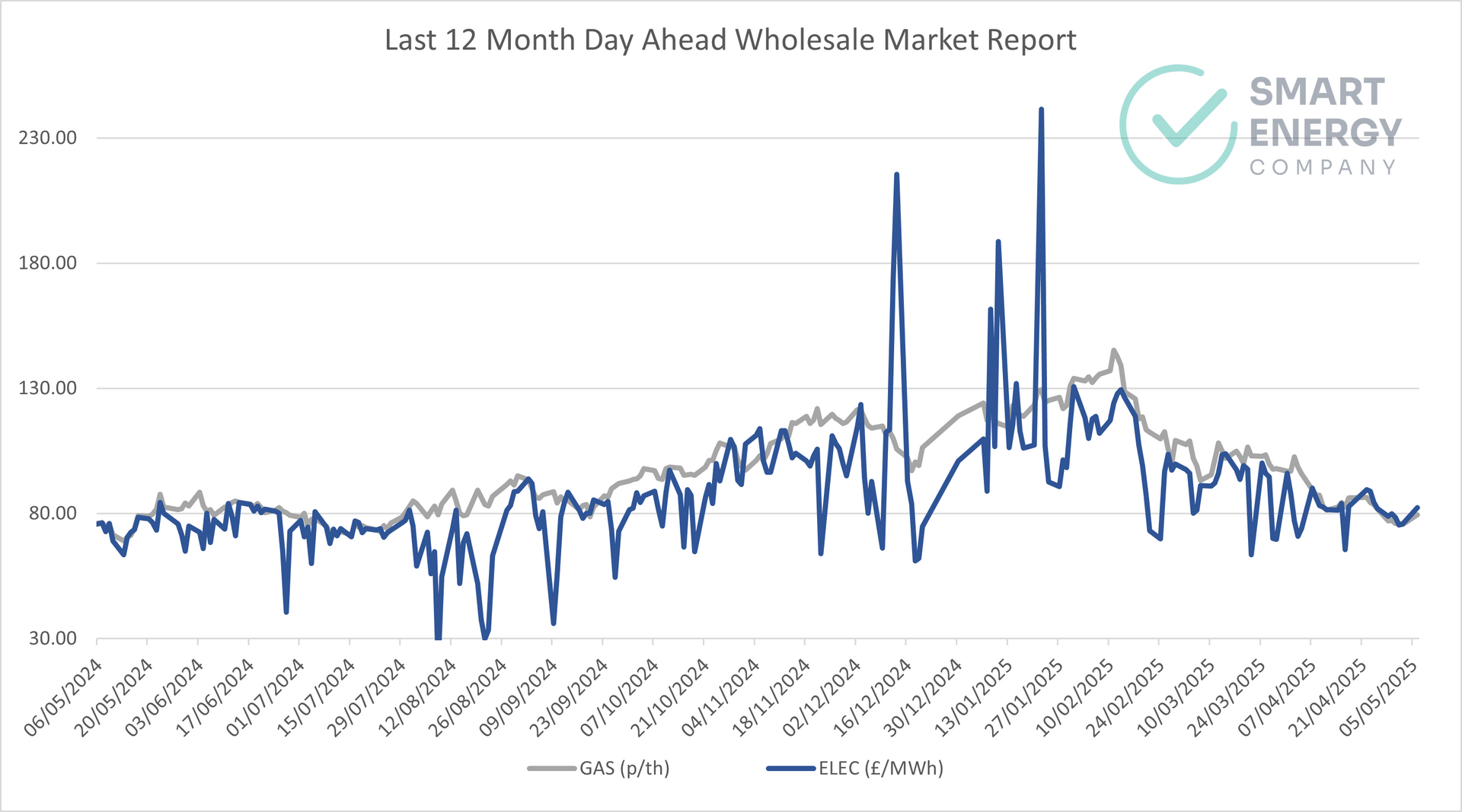

📈 12-Month Energy Market Trends

Gas and power remain well below winter highs. While the chart still reflects sharp spikes from earlier in the year, current trends suggest a more stable outlook — for now.

📉

Gas is now at its lowest level since late October 2023

📉

Electricity has also eased back to levels last seen in early autumn

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

A week of cooling prices gives businesses a moment to breathe.

If your contract is due for renewal soon, now could be a smart time to act.

Volatility hasn’t gone away — but for now, pricing is calmer, and opportunity exists for those who move early.