Energy Market Update: 6th - 9th May 2025

After a quiet start due to the Bank Holiday, energy markets picked up sharply midweek. Below is your round-up of what moved gas and power prices last week — and what that might mean for your next fixed energy contract.

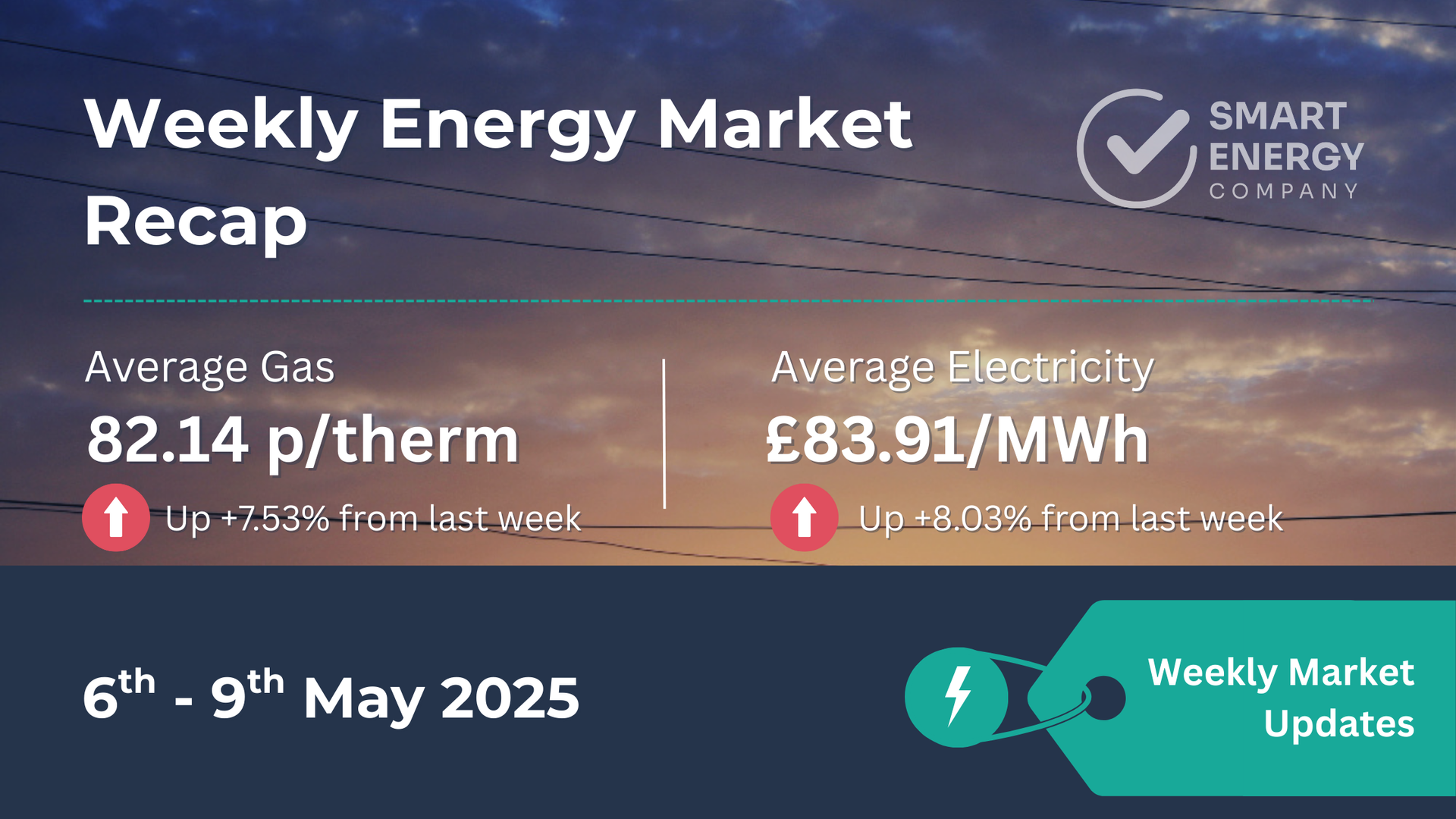

📊 Weekly Energy Market Recap

✨ Quick Snapshot

- 🔥

Average Gas (Day-Ahead): 82.14 p/therm

(Up 7.53% from last week’s 76.39 p/therm)

- ⚡ Average Electric (Day-Ahead): £83.91/MWh

(Up 8.03% from last week’s £77.68/MWh)

- 🛢️

Brent Crude:

Ended the week at $62.84/bbl

(Lifted by trade deal optimism and rising demand signals)

💬 Prices rebounded across the board, fuelled by geopolitical developments, lingering supply uncertainty, and ongoing trade war headlines.

📉 Market Overview

➤ Strong Midweek Rally

After a flat Tuesday, wholesale gas and power prices jumped sharply midweek — gas hit 83.50 p/th and power reached £85.87/MWh by Thursday.

➤ EU’s Russian Gas Ban Plan

The EU announced plans to phase out all Russian gas by 2027 and ban new contracts from 2025. Traders responded quickly, despite little short-term impact on 2025 prices.

➤ Talk of Peace, But Not Yet

Ceasefire chatter and U.S.–China trade negotiations added to market movement. Despite little actual progress, hopes for de-escalation buoyed sentiment late in the week.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 83.50 p/therm (07/05) | £85.87/MWh (08/05) |

| Lowest | 79.40 p/therm (06/05) | £82.26/MWh (06/05) |

| Weekly Average | 82.14 p/therm | £83.91/MWh |

| Change vs Last Week | 🔺 +7.53% | 🔺 +8.03% |

Note: This marks the biggest weekly rise since early March, driven by both fundamental and political uncertainty.

🔍 Key Factors This Week

🇪🇺 Russian Gas Phase-Out

The EU’s formal proposal to ban new Russian gas contracts (by 2025) and wind down existing ones by 2027 caught market attention, adding upward pressure to near-term sentiment.

🌍 Trade Talk Optimism

U.S.–China discussions signalled possible easing of trade barriers, helping lift energy prices mid-to-late week. That said, Beijing’s messaging remains mixed.

🛠️ Infrastructure & Supply

Norwegian gas flows are improving, but capacity constraints at Kollsnes remain.

Wind generation stayed below seasonal norms, increasing gas-for-power usage.

🏢 Implications for Your Business

📅 Contracts Ending Soon (0–3 Months)

Last week’s bounce suggests we may have passed the recent price floor. If you’ve been holding off, this could be your signal to consider fixing while rates remain under winter highs.

⏳ Medium-Term (3–6 Months)

Plenty of risk ahead — with policy uncertainty and EU supply changes looming. Locking in now could provide budget certainty through summer.

🗓️ Long-Term (6+ Months)

Keep watching. If global negotiations break down, volatility could return. A fixed contract gives you price protection in an otherwise unpredictable market.

🛢️ Oil Market Brief

Brent crude climbed to $62.84/bbl on Friday after a volatile start to the week.

Key Drivers:

- U.S.–China trade talks show promise — both sides met in Switzerland.

- OPEC+ remains on track to increase output, but cuts could return if prices fall further.

- U.S. GDP slipped last quarter, sparking mild recession fears and mixed messages for oil demand.

📈 12-Month Energy Market Trends

Gas and electricity prices have now bounced off recent lows, with midweek peaks approaching mid-April levels.

🔹Gas remains well below winter highs but climbed ~7% week-on-week.

🔹

Power rose almost 8%, following gas and supported by low wind and higher weekday demand.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

This week reminded us how quickly markets can turn. Just one EU policy shift or diplomatic headline can move gas and power by 5–10% in a few days. If you’ve been on the fence, now might be a smart time to secure pricing and take the guesswork out of what’s next.