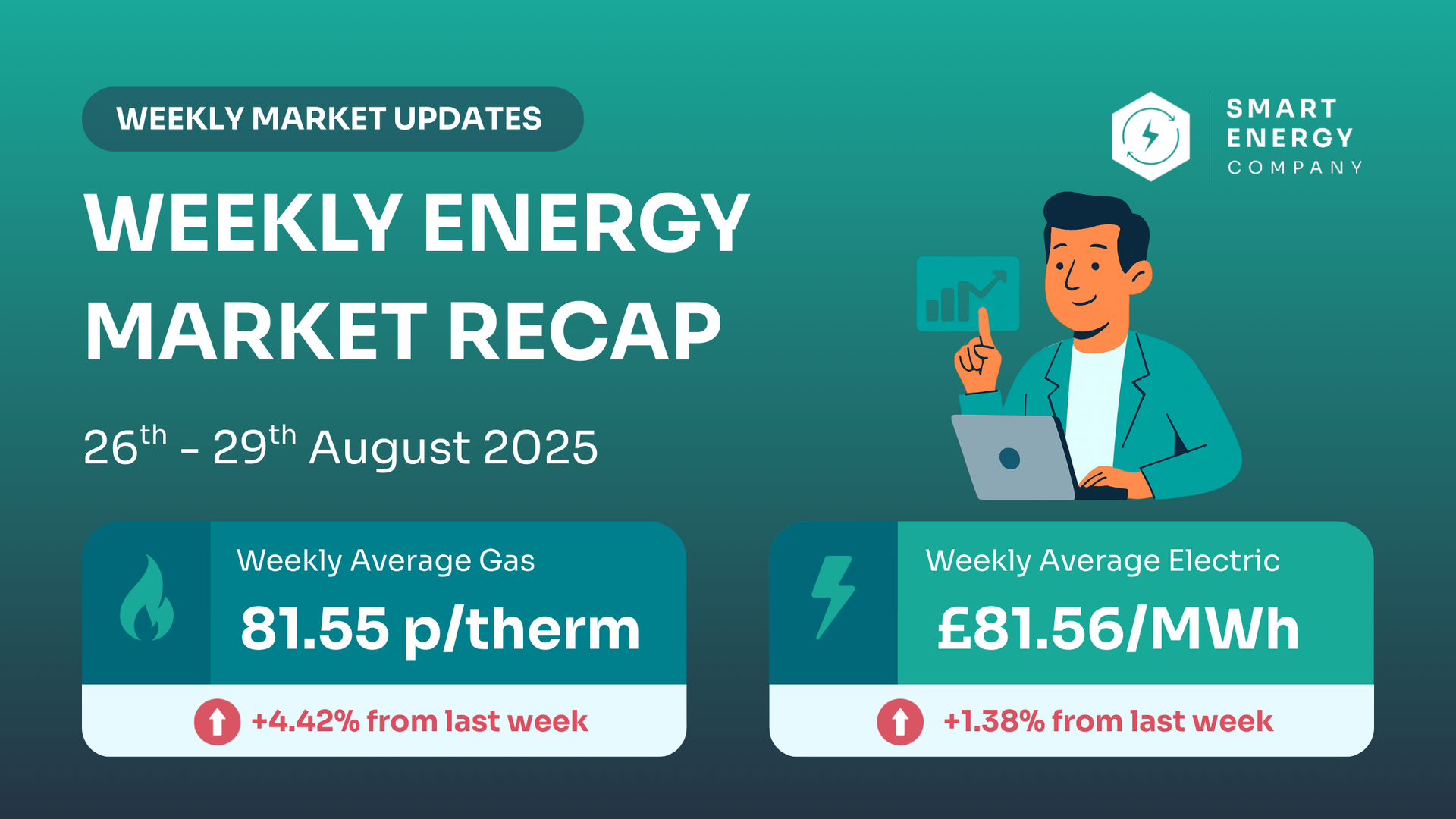

UK Energy Market Update: 25th - 29th August 2025

A holiday-short week with a mid-week lift and a soft finish. Forwards keep winter quotes above summer.

It was a four-day trading week after the Bank Holiday. Day-ahead prices started firm, then eased into Friday. On the whole, weekly averages ticked up vs last week, but Friday’s pullback means there’s a decent window to grab prices—especially for September/October starts.

📊 Weekly Market Snapshot

| Commodity | Weekly avg | Previous Week | % Change | Weekly High | Weekly Low |

|---|---|---|---|---|---|

| Gas (UK NBP) | 81.55 p/therm | 78.10 | 🔺 4.42% | 83.75 (Tue | 78.00 (Fri) |

| Power (UK Base) | £81.56/MWh | 80.44 | 🔺1.38% | 84.63 (Wed) | 78.04 (Mon) |

Why this matters: These are wholesale prices (what suppliers pay before margins). They set the tone for quotes—but your contract is priced off the forward curve, not tomorrow’s delivery.

Why prices moved this week

Gas market (26-29 Aug)

🇳🇴 Norwegian flows: maintenance early week kept prices supported; improving flows helped Friday’s dip.

⛴ LNG arrivals: uneven scheduling kept a risk premium mid-week.

🧱 Storage: Europe remains >90%, limiting big upside—helpful into September.

Power market

🌬 Wind output recovered mid-week → less gas burn early, more stability later.

🔌 Interconnectors steady (notably France–UK), cushioning price spikes.

♻ Carbon prices drifted → small reduction in generation costs.

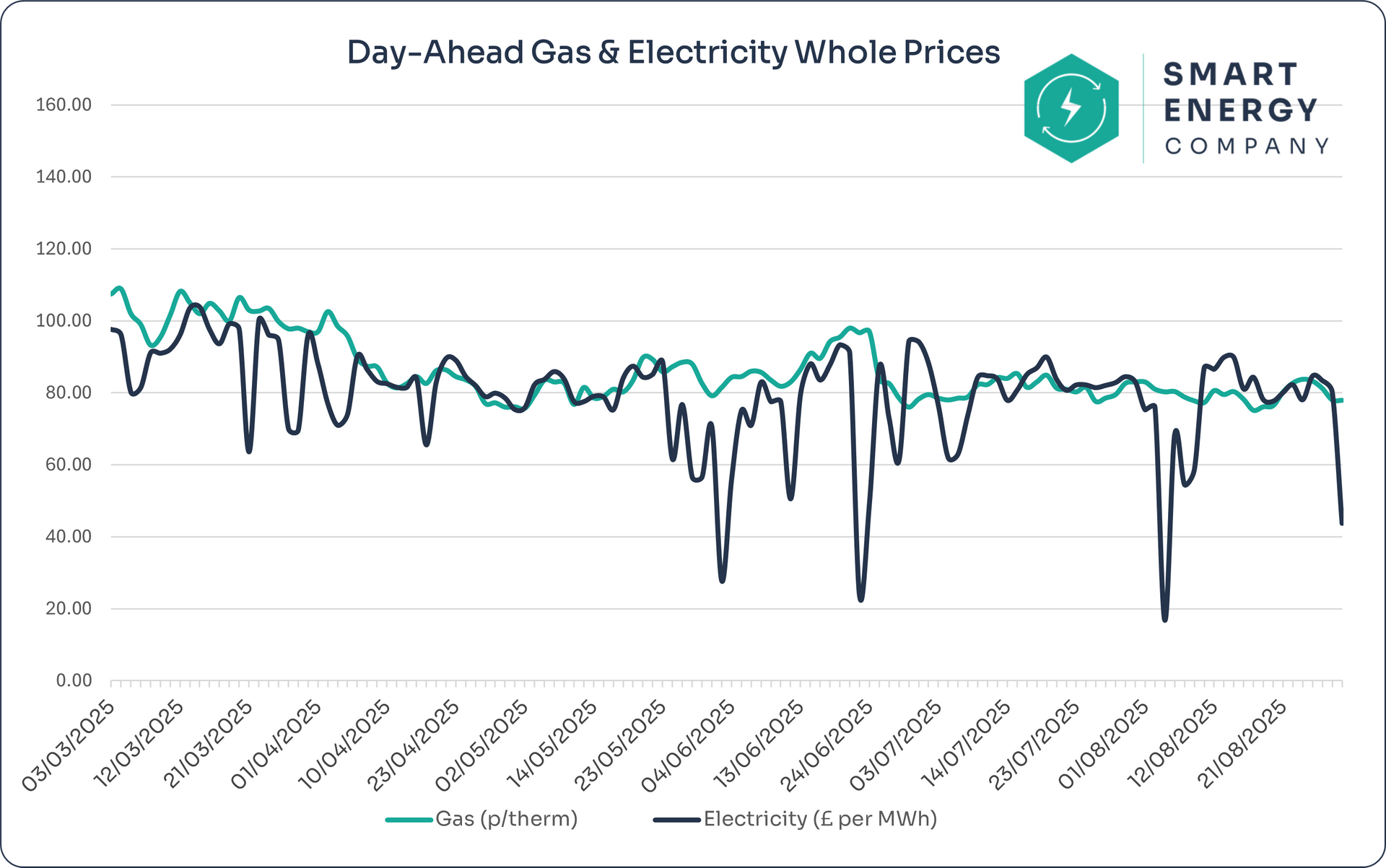

📉 6-Month Market Trend

Looking at the past six months of wholesale energy prices reveals important patterns:

The 6-month chart shows both fuels trading in the middle of their recent ranges: well below June spikes, but above early-August lows. That usually means quieter daily movement—until supply weather or system headlines hit.

📈 5 Week Price Trend

| Week Ending | Average Gas (p/th) | Direction | Avg Power (£/MWh) | Direction |

|---|---|---|---|---|

| 29/08/2025 | 81.55 | 🔺 | 81.56 | 🔺 |

| 22/08/2025 | 78.10 | 🔻 | 80.44 | 🔺 |

| 15/08/2025 | 79.14 | 🔻 | 86.82 | 🔻 |

| 08/08/2025 | 79.63 | 🔻 | 54.82* | 🔻 |

| 01/08/2025 | 81.34 | 🔺 | 82.02 | 🔺 |

*Power on week of 4–8 Aug was skewed by a pricing anomaly (5 Aug); not reflective of real contract pricing.

👉 Avoid Overpaying on Your Next Renewal

👉 Forward markets are softening — but only for now.

A single geopolitical or supply shock could reverse gains quickly.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

✅ Is now a good time to get prices?

Yes. Despite higher weekly averages, Friday’s drop created a more favourable entry point than mid-week. If your start date is September–November, checking prices now can capture some of that late-week softness before winter contracts nudge again.

👀 If you’re not ready to sign yet—watch these

Watch Norwegian outages, LNG cargoes, UK wind, and carbon—they’re the fastest movers of short-dated quotes.

Want alerts? We’ll email concise daily movers and a weekly wrap.

🧠 Final thoughts

A short week with a mid-week lift, but Friday’s softer close offers a practical window to test prices—especially for contracts covering winter months. We’ll compare suppliers and structure the hedge to your season mix.

Need help timing it?

Not Ready to Lock In?

Subscribe for Daily, Weekly, Monthly or Quarterly insights - no pressure, just clarity!