August 2025 UK Energy Market Trends: Gas, Power & Oil

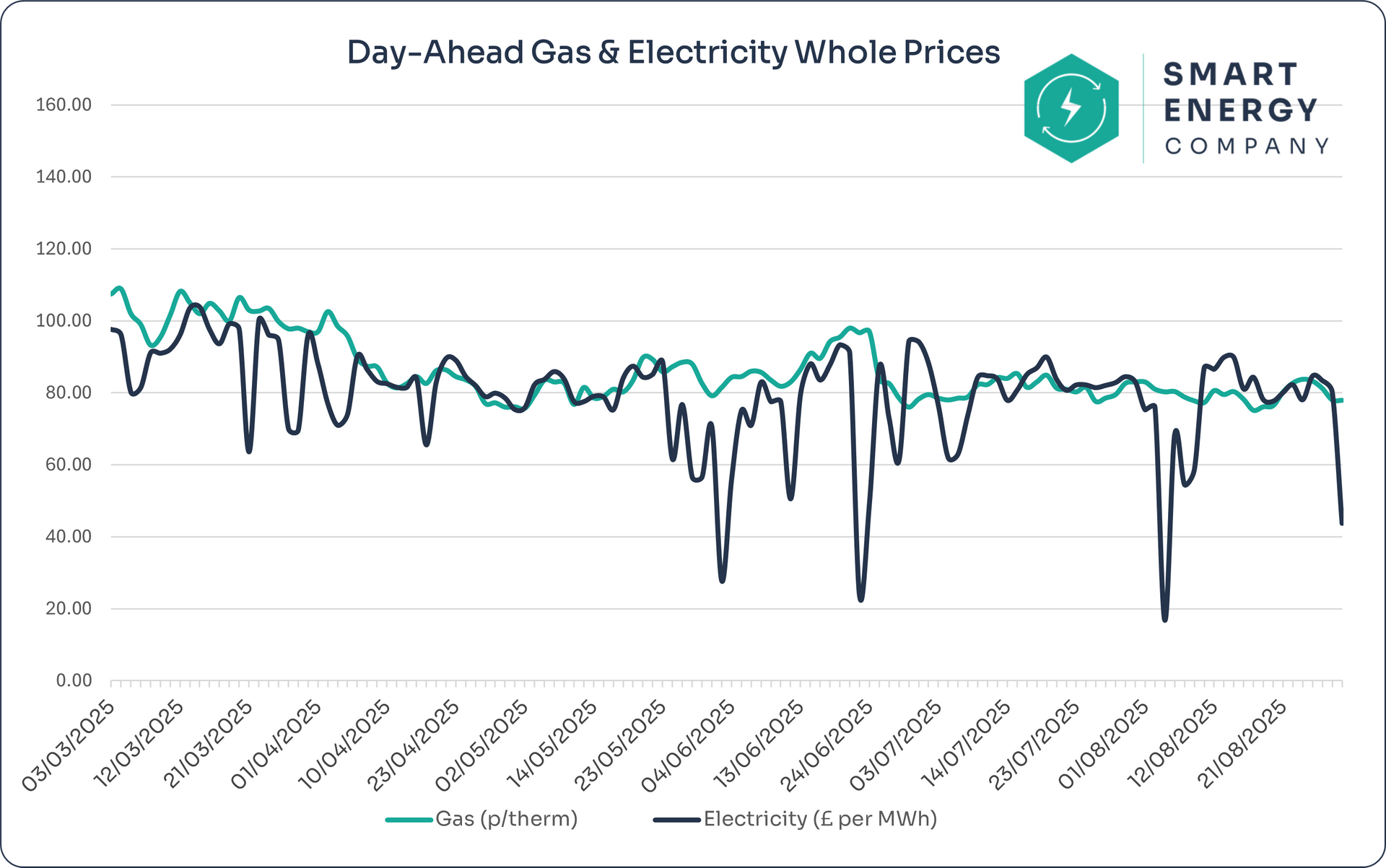

Gas stayed steady; electricity looked cheaper on a few days, but those were short-lived quirks — not real contract levels. Winter delivery is still pricier than spring/summer.

🔑 Key Takeaways for Businesses

- Gas stayed steady between 75–84p/therm, averaging 79.68p/therm (↓ 1.7% vs July).

- Electricity looked cheaper on paper (average £75.59/MWh, ↓ 7.2% vs July) but this was skewed by a handful of ultra-low days — including £16.79/MWh on 5 Aug — that weren’t available as fixed contract prices.

- Winter 2025 contracts are still more expensive than spring 2026. Businesses with renewals covering winter should be looking at quotes now.

📊 August at a Glance: Average Prices vs. Previous Months

| Month | Avg Gas (p/th) | Avg Elec (£/MWh) |

|---|---|---|

| June | 86.61 | 71.43 |

| July | 81.06 | 81.44 |

| August | 79.68 | 75.59 |

🔎 Market Movement Summary:

- Gas (Day-Ahead): average 79.68 | min 75.10 | max 83.75 | median 80.23

- Power (Day-Ahead): average £75.59 (with anomalies) | min £16.79 | max £89.83 | median £80.11

Important: Those ultra-low electricity days were not representative of contractable forward prices (intermittent spikes/dips driven by short-run system conditions).

📆 Week-by-Week: What Happened in August?

| Week | Avg Gas (p/th) | Avg Elec (£/MWh) | Comment |

|---|---|---|---|

| 28 Jul - 1 Aug | 81.34 | 81.51 | Gas edged up slightly; power steady mid-£70s–£80s. |

| 4 - 8 Aug | 79.63 | 54.82* | Power anomaly week. Daily lows not reflective of real contract quotes. |

| 11 - 15 Aug | 79.14 | 86.82 | Power bounced back to typical levels; gas held steady. |

| 18 - 22 Aug | 78.10 | 80.44 | A quieter week heading into the Bank Holiday. |

| 25 - 29 Aug | 81.55 | 81.56 | Mid-week lift, softer finish; winter contracts still priced higher than spring. |

💡 Is Now a Good Time to Fix My Energy Contract?

| Renewal Window | Advice |

|---|---|

| 0–3 Months | Quotes include winter months, which are priced higher. If your budget allows, it makes sense to secure a fixed deal now to avoid paying more later. |

| 3–6 Months | Deep winter is expensive. Get a quote now to benchmark. If you’re not ready to fix, keep monitoring weekly and be ready to act quickly on dips. |

| 6–12 Months | These are generally cheaper months. You don’t need to rush, but now is the time to set up price alerts so you’re notified when the forward market moves in your favour. |

👉 Want to secure today’s lower rates before winter increases?

Rates are rising again — especially for Winter 25 contracts.

📉 Don’t miss out on cheaper power and steady gas rates.

🧭 What’s Driving Prices?

🔷 Gas — why it stayed steady

- Healthy European storage going into autumn → less panic buying.

- Norway maintenance broadly as planned → short bumps, no sustained squeeze.

- Weather/demand typical for summer → fewer surprises.

Why this matters: Stable gas helps keep a lid on quotes, but winter is still the pricey part of any contract.

⚡ Power — why the odd dips didn’t mean cheaper contracts

- Windy days + good system availability = a few very low half-hourly prices (the £16.79/MWh day).

- Interconnectors & plant timing nudged day-ahead prints, but forwards (the basis for fixed quotes) stayed far higher.

Why this matters: Those dips make headlines, but suppliers price your fixed deal off forward months/seasons, not a few cheap hours.

📉 6-Month Price Trend Overview

- Gas: Eased from 86.61 (Jun) → 81.06 (Jul) → 79.68 (Aug). A gentle summer softening.

- Power: Rose in July and appeared lower in August, but after removing early-Aug outliers the underlying average is ~£81/MWh, so broadly flat.

- Read-through: Gas has drifted lower; power hasn’t budged much.

Winter is still the expensive part of any fixed contract.

🔍 Forward Market Outlook

- Winter strips still carry a premium to shoulder months.

- After the early-August distortion in day-ahead power, forwards normalised through mid/late month.

- Net read: Mild softening at times, but winter delivery remains comparatively expensive; shoulder periods look more forgiving.

👀 Looking Ahead to September

- Wind & weather: Watch for sustained low-wind spells (pressure on power) vs. windy periods (relief).

- Norway maintenance & LNG schedules: Any extended outage gaps could nudge gas higher; steady arrivals should cap spikes.

- Interconnector flows & carbon: Ongoing factors for UK power costs and winter differentials.

- Geopolitics: Background risk remains elevated; any supply-route headlines can move winter pricing quickly.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

💬 Final Thoughts

If your renewal includes Nov–Feb, fixing sooner can avoid winter bumps.

Spring/summer renewals have more breathing room, but it’s still smart to get a quote now so you know your numbers.

We compare

28+ suppliers and only present

fully-fixed options with a clear “what’s included” breakdown.

Secure a better rate.

Or stay informed with free updates.

We'll help you make the right decision at the right time — no pressure, just expert advice.