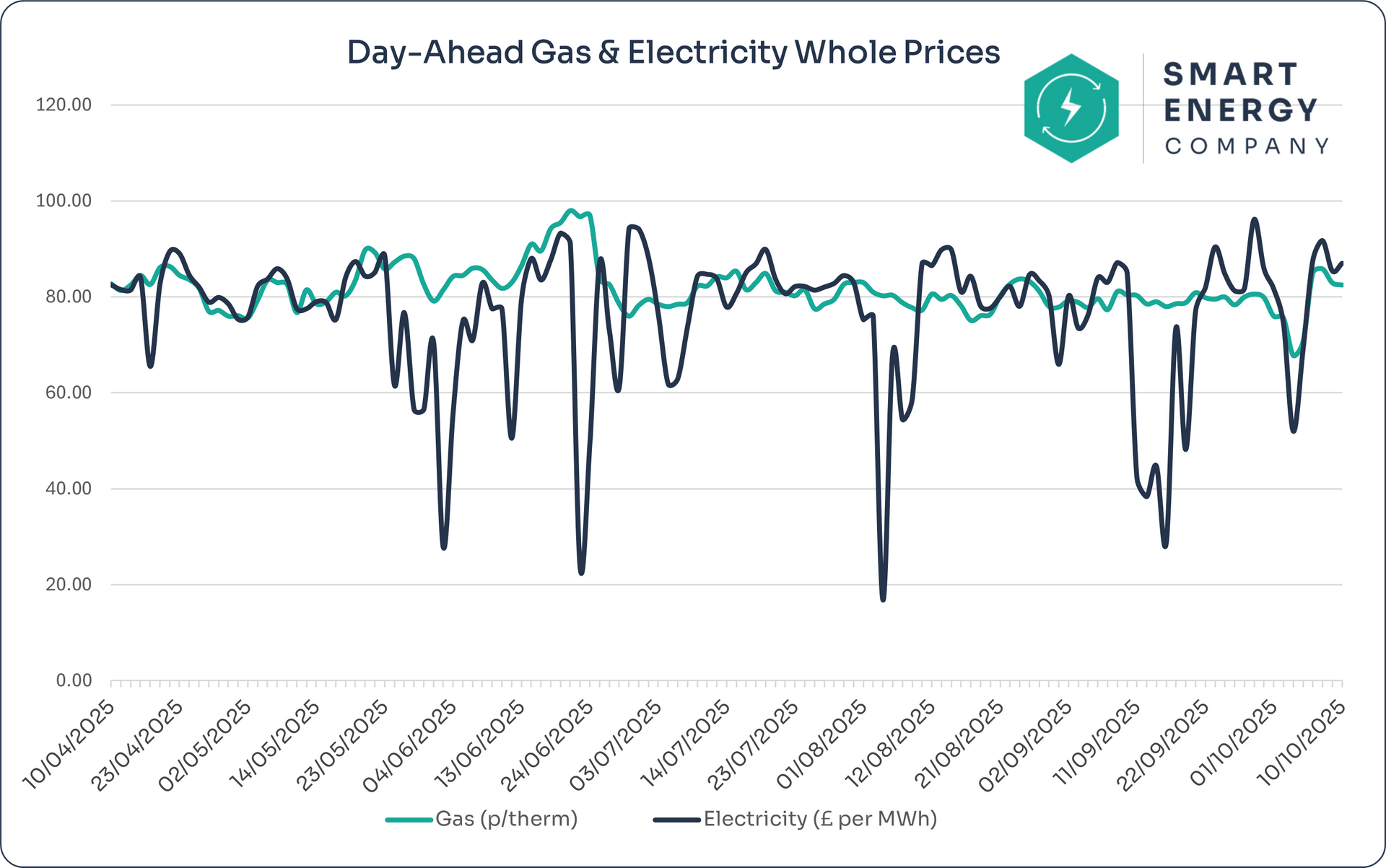

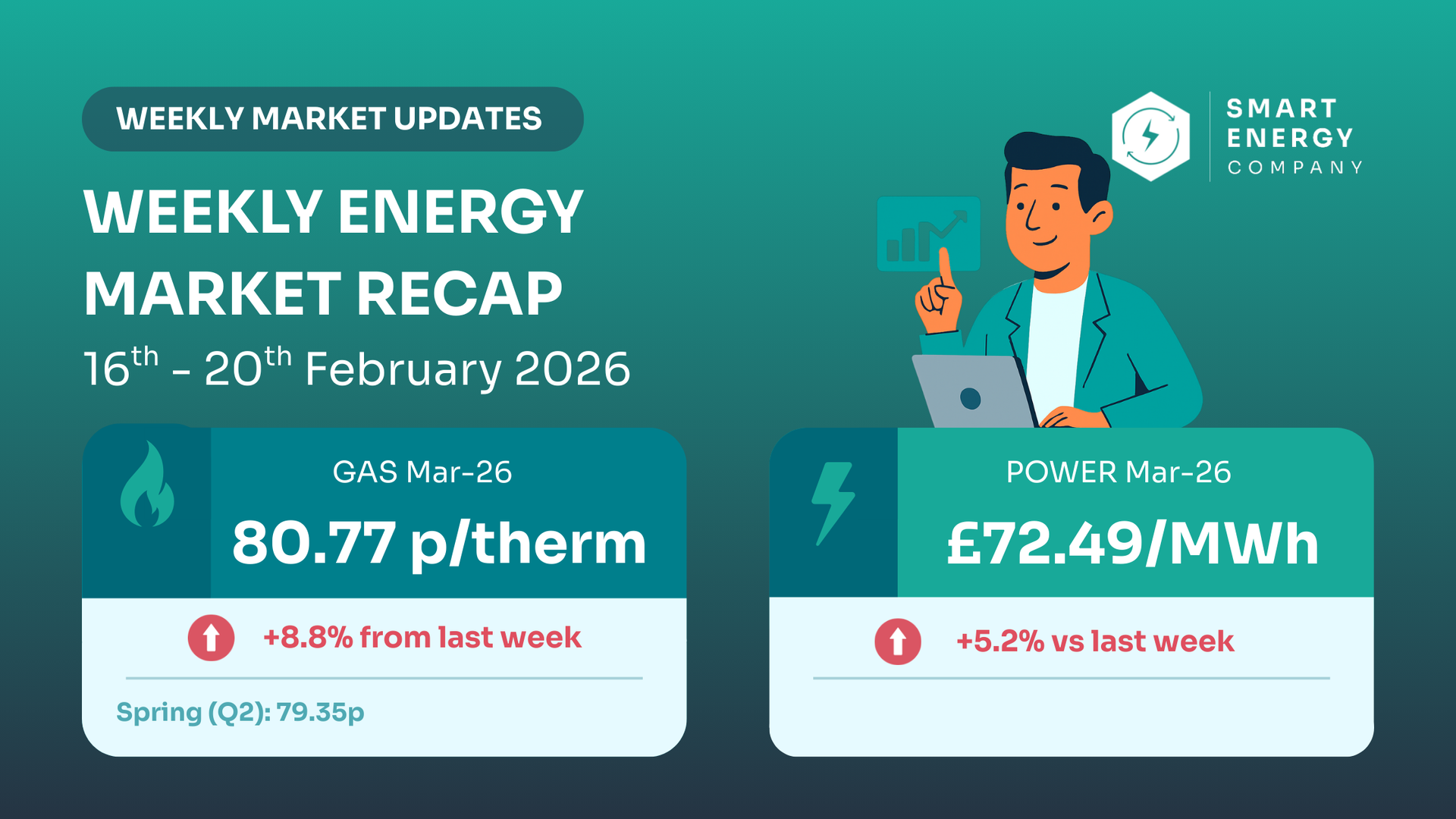

Benchmark urgently. With gas at 81.39p/th and power at £84.11/MWh, both up slightly this week, winter forwards are rising again. Delaying further could mean locking in higher seasonal rates.

You’re in the final renewal window — secure quotes while prices remain moderate before peak winter demand.

Get Your Quote Now