UK Business Energy Market Review: Q3 2025

Q3 2025 UK Business Energy Market Review

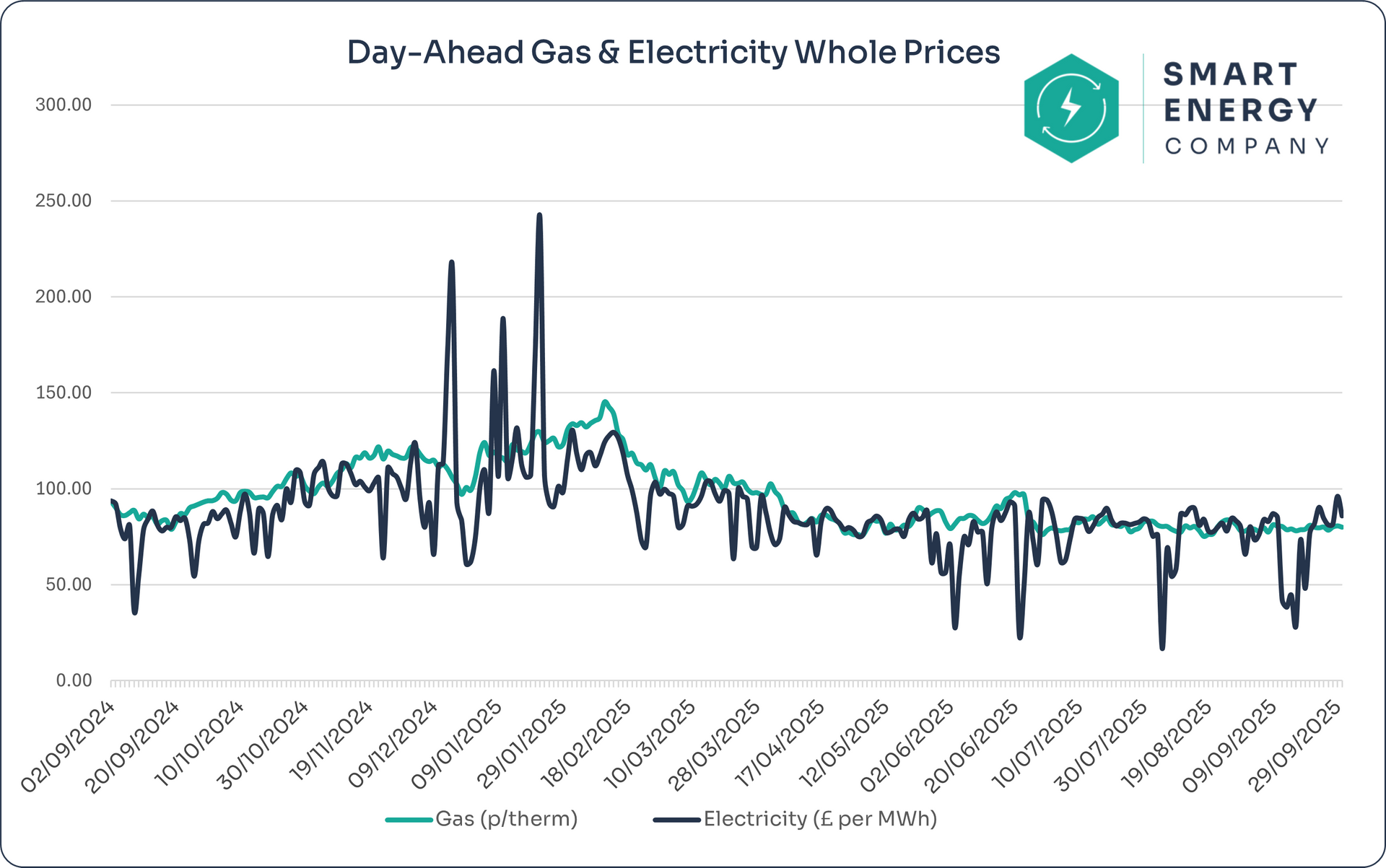

As Q3 closed, wholesale prices generally eased. Gas averaged almost exactly

80p/th for the quarter, while power averaged £76.4/MWh — helped by several

one-off day-ahead anomalies in September. Forward (contract) prices still carry a

winter premium, so timing matters.

✅ At a Glance: What Happened in Q3?

- Gas down ~2.2% quarter-on-quarter: from 81.06p/th (Jul) → 79.31p/th (Sep).

- Power down ~11.3% quarter-on-quarter: from £81.44/MWh (Jul) → £72.26/MWh (Sep), aided by transient day-ahead distortions.

- Q3 averages: Gas 80.02p/th, Power £76.43/MWh.

- Winter still pricier than summer on the forward curve (what suppliers quote from).

- Underlying drivers: steady LNG flows, Norwegian outages/maintenance periods, variable wind output, and calm carbon.

🌤️ Monthly Price Snapshot (Q2 Recap)

| Month | Gas (p/th) | Power (£/MWh) | MoM Direction |

|---|---|---|---|

| July | 81.06 | 81.44 | Baseline |

| September | 79.68 | 75.59 | ↓ both |

| June | 79.31 | 72.26* | gas ↓, power ↓ (*distorted by day-ahead anomalies) |

Key Takeaways:

- 📉 Power fell 11.3% from July to September; part of this is not reflective of real contract levels.

- 🔄 Gas slipped 2.2% across the quarter; a gentle drift lower rather than a structural break.

- ⚠️ Day-ahead volatility doesn’t equal renewal pricing — suppliers use forwards.

🔎 What Drove the Market?

Supply & LNG

- Robust LNG arrivals into NW Europe and UK terminals maintained balance.

Pipelines & Maintenance

- Norwegian works periodically tightened gas, but impacts were short-lived.

Weather & Renewables

- Mild/seasonal conditions limited gas demand; wind output was choppy, adding day-ahead power volatility.

Carbon & Fuels

Carbon steady to softer; oil range-bound — neither delivered a strong upside push.

👉 Want to secure today’s lower rates before further increases?

Get a live quote from 28+ trusted suppliers. We’ll compare the best fixed deals for you.

🔎 12-Month Market View: Are Prices Falling?

Both commodities are well below winter peaks, but spikes still occur in day-ahead power.

The trend through Q3 was broadly sideways-to-softer for gas and softer for power.

💡 Is Now a Good Time to Fix My Energy Contract?

Yes — with nuance.

- For winter start dates, forwards are still elevated vs summer, so getting options now can cap risk.

- If your start date is post-March, there’s generally better value on the curve — still, keep a trigger/target to act quickly if dips appear.

🕒 Contract Ending 0–3 months (Oct–Dec 2025)

Act now.

You’re in the winter window; quotes price the seasonal premium. Fixing removes exposure to Q4/Q1 swings.

⏳ Contract Ends 3–6 months (Jan–Mar 2026)

Shortlist and set a trigger.

Q1 carries winter uplift; secure on a dip or take a staged/laddered approach if available.

🗓️Contract Ends 6–12+ months (Apr–Sep 2026)

Receive Market UpdatesMonitor and prepare.

Summer-26 is cheaper; keep quotes live and be ready to strike if gas nudges lower toward the mid/low-70s p/th area.

💬 Expert Insight from Smart Energy Co.

"The past quarter highlighted just how unpredictable electricity pricing can be, with sharp anomalies masking the true cost of forward contracts. Businesses should focus on the sustained trend — not short-lived dips."

"Gas has held relatively steady, while electricity showed big distortions in September. This underlines the importance of looking at forward curves — especially for winter 2025 and Q1 2026 — which remain firmly higher than spring and summer pricing."

We help businesses compare over 28 suppliers, make sense of contracts, and avoid costly guesswork.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

🔮 Looking Ahead to Q4 2025

Here’s what we’re watching as we move into October:

- Weather: Early cold snaps could tighten balances quickly.

- Flows: Watch Norwegian capacity and LNG send-out rates.

- Policy/Carbon: Any carbon or network-charge moves may nudge power forwards.

- Trading: Expect higher volatility around cold forecasts and storage headlines.

🔍 Final Thoughts

Q3 delivered gently lower wholesale levels, especially for power (with help from one-off day-ahead dips). For winter start contracts, it’s smart to lock options now; for spring/summer starts, track forwards closely and fix on weakness.

📥 Ready to Review Your Options?

Don’t wait until prices climb again. Get a fresh quote today — no pressure, just clarity.