Energy Market Update: 16th - 20th June 2025

A detailed weekly energy update — from day-ahead data to ongoing Gas, Power, Oil and commodity trends impacting business energy contracts.

We saw significant wholesale price rises this week (16th to 20th June 2025), with heavy risk premium added as the Israel-Iran conflict escalated further.

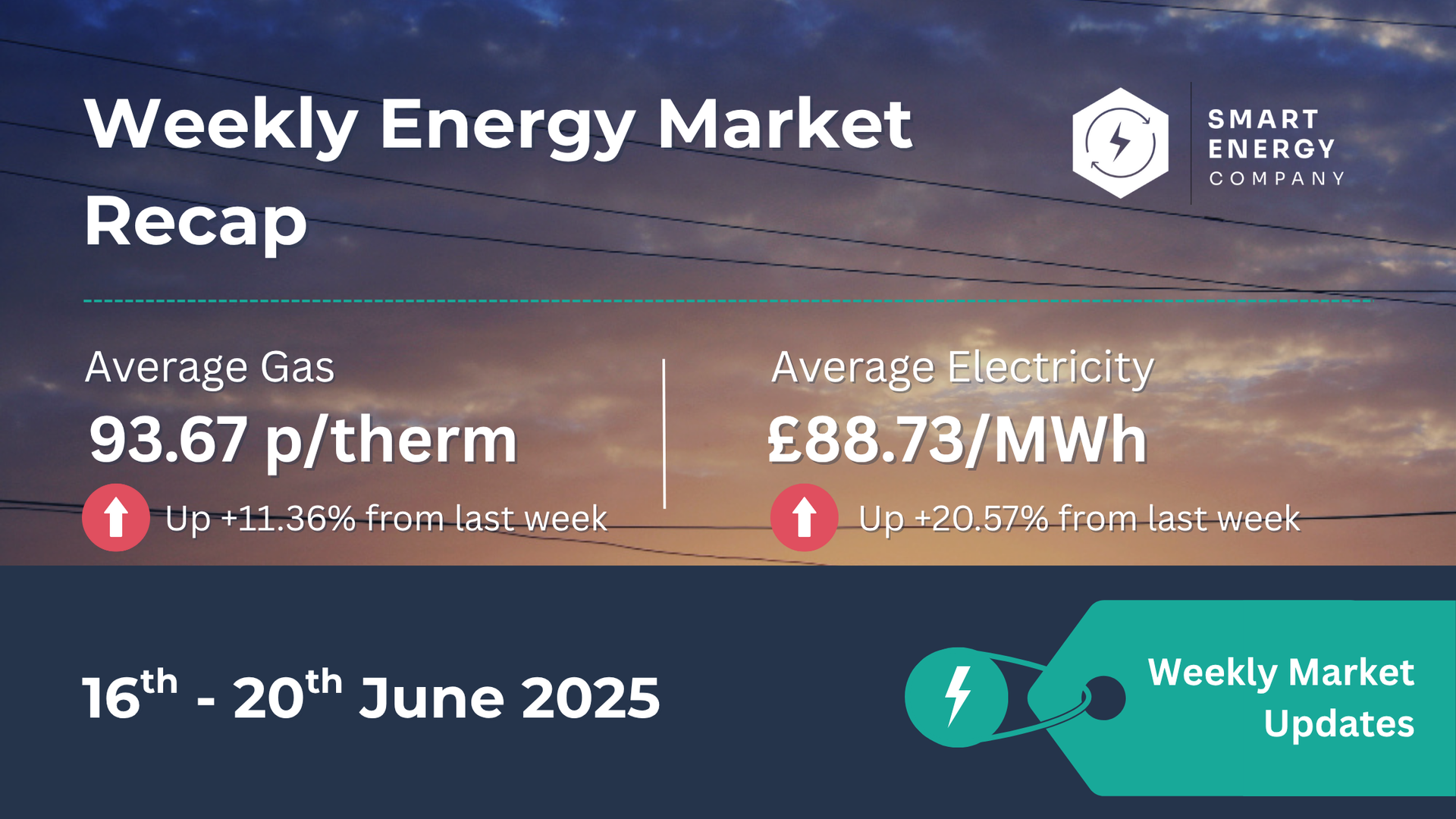

🔎 Weekly Energy Market Recap

Quick Snapshot

| Gas (p/th) | Power (£/MWh) | |

|---|---|---|

| Average This Week | 93.67 | 88.73 |

| Previous Week | 84.10 | 73.59 |

| Weekly Change | ⬆ 11.36% | ⬆ 20.57% |

This has been the largest weekly rise since tensions first began building. Forward pricing has climbed sharply, with front-month gas reaching its highest levels since early April.

🌍 Market Overview

Gas:

Gas prices surged midweek, driven by heightened conflict risk between Israel and Iran. While supply flows remain unaffected for now, markets priced in higher probability of disruptions to LNG shipping routes via the Strait of Hormuz. UK NBP front-month briefly pushed above 98 p/th — the highest since early April. Stronger Norwegian flows and healthy storage levels helped cap some of the gains late week.

Power:

Power markets tracked gas price movements closely, with additional upside pressure from reduced wind output and stronger cooling demand due to above-average temperatures across Europe. Concerns also lingered over French nuclear capacity with ongoing reactor issues and extreme heat impacting cooling water levels.

Oil:

Oil markets rallied sharply on growing fears of U.S. involvement escalating the Middle East conflict. Brent crude reached $78.85 /bbl — its highest close since January — before easing slightly at the week’s end as direct U.S. strikes remained limited.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 98.00 | £93.30 |

| Lowest | 89.60 | £83.51 |

| Weekly Average | 93.67 | £88.73 |

| W-o-W Change | ▲ +11.36% | ▲ +20.57% |

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 20/06/2025 | 93.67 | £88.73 |

| 13/06/2025 | 84.10 | £73.59 |

| 07/06/2025 | 83.09 | £60.03 |

| 31/05/2025 | 86.59 | £62.83 |

| 24/05/2025 | 85.72 | £85.89 |

Direction: Prices are now rising sharply across both gas and power contracts following conflict escalations.

📝 Key Factors This Week

- 🇮🇷 Middle East Escalation: Israel-Iran conflict entered second week with increased missile strikes and military posturing.

- 🚢 Strait of Hormuz Risk: Qatar advised LNG vessels to delay transit; markets pricing potential shipping disruptions.

- 🇳🇴 Norwegian Outages: Partial Norwegian maintenance ongoing; Langeled flows fluctuated.

- 🔥 Heatwave Impact: UK and mainland Europe saw higher demand for gas-for-power generation due to low wind and rising temperatures.

- ⚛ French Nuclear Concerns: Ongoing corrosion issues at Civaux reactor raised fresh capacity questions.

- 📊 U.S. Positioning: Markets reacting daily to shifting signals on potential American military involvement.

💡 What This Means for Your Business

⏳ Contract Timing Suggestions

- 0–6 months: Secure now — heightened volatility and premiums building into short-term contracts.

- 6–12 months: Monitor closely — any further conflict escalation could drive fresh upward price spikes.

- 12+ months: Still reasonable — longer-term pricing remains more stable but rising slightly on increased global supply risks.

👉 Don’t wait if your renewal is due. Even minor escalations are having outsized pricing impacts.

👉 Avoid paying more than you need to.

If your contract’s due soon, now could be a smart time to get a fixed quote while prices are still below winter highs.

📊 6-Month Energy Market Trends

Looking at the 6-month wholesale market:

- Gas prices have steadily climbed throughout June, now sitting close to their highest levels since early April 2025. After reaching lows of around 79 p/th in early May, prices have risen sharply due to renewed geopolitical risks.

- Power prices have followed closely, rebounding strongly from May’s temporary dip. The surge over recent weeks reflects both higher gas-for-power demand and concerns over nuclear generation capacity in France.

- Despite healthy European storage levels, market sentiment has shifted heavily to risk premium pricing as traders react to every development in the Middle East.

With gas now approaching levels not seen since April and power back towards late-March averages, it’s a clear warning for businesses with upcoming renewals.

🔭 Looking Ahead

- Middle East tensions will remain the single largest driver of volatility in the coming weeks.

- The Strait of Hormuz remains open, but any disruption could trigger sharp upward price spikes.

- Norwegian maintenance schedules are easing but remain a key factor on daily flows into Europe.

- Weather forecasts point to continued hot conditions, increasing cooling demand and gas-for-power reliance.

- French nuclear capacity concerns could intensify if heat impacts cooling operations further.

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

💡 Final Thoughts

Geopolitical risk remains firmly embedded in the market outlook as we enter summer. While supply flows remain stable today, every headline out of the Middle East has the potential to create sharp price shifts. Buyers should remain vigilant and proactive.