UK Energy Market Update: 23rd–27th June 2025

Weekly Summary:

A volatile week for energy markets as Middle East tensions faded with a ceasefire between Israel and Iran — only to reignite briefly with U.S. airstrikes. Despite this, gas and power prices corrected downward midweek, with clear anomalies mid-week due to contract rebalancing and geopolitics.

Average Day-Ahead Prices:

📉

Gas: 87.72 p/therm

📉

Power: £58.82/MWh

✅ Good news: prices ended the week lower than they started, offering some renewed confidence for buyers waiting on market stability.

🔎 Weekly Energy Market Recap

Quick Snapshot

| Gas (p/th) | Power (£/MWh) | |

|---|---|---|

| Average This Week | 87.72 | 58.82 |

| Previous Week | 93.67 | 88.73 |

| Weekly Change | ▼ -5.95% | ▼ -6.11% |

⚠️ Note: Price anomalies on 23rd & 24th June reflect short-term volatility triggered by ceasefire headlines and trading repositions.

🔍 Market Overview

🔵 Gas

Gas prices started high on Monday as traders priced in the risk of further Middle East escalation. But peace talks and confirmed ceasefire between Israel and Iran sent prices tumbling.

By Wednesday, prices had fallen nearly 13%, marking one of the sharpest corrections this year. Norwegian flows recovered post-maintenance, and UK temperatures remained mild, capping any bullish momentum.

🔌 Power

Power markets mirrored gas, but with added volatility.

Tuesday’s £49.20 was swiftly followed by a rare

87.27 spike on Wednesday — a near 78% jump — before stabilising again.

The midweek surge was likely driven by unplanned outages, coupled with shifting interconnector availability and market repositioning. By Friday, prices cooled back to a more realistic £61.09.

🛢️ Oil & Carbon

Oil markets were reactive but ultimately flat. Brent closed Friday at $67.73/bbl after fluctuating on U.S. military activity in Iran.

Carbon prices softened slightly, with the UK ETS ending the week around £47.65/t, offering marginal relief for generators.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Monday | 96.70 | 23.66 ⚠️ |

| Tuesday | 97.00 | 49.20 ⚠️ |

| Wednesday | 83.75 | 87.27 |

| Thursday | 82.60 | 72.90 |

| Friday | 78.55 | 61.09 |

⚠️ Anomalies: Early week price lows on 23rd–24th June were temporary and likely due to market reshuffling, not structural risk.

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 27/06/2025 | 87.72 | £58.82 |

| 20/06/2025 | 93.67 | £88.73 |

| 13/06/2025 | 84.10 | £73.59 |

| 07/06/2025 | 83.09 | £60.03 |

| 31/05/2025 | 86.59 | £62.83 |

🔻 Weekly averages dipped — signalling a break from the recent upward run.

📌 Key Factors This Week

- Ceasefire Announced: Israel–Iran de-escalation led to sharp midweek corrections.

- U.S. Strikes & Hormuz Watch: Temporary spike as U.S. joined airstrikes; fears of Strait closure subsided.

- Norwegian Flows: Maintenance wrap-up brought supply back online.

- Crude Prices: Flat, despite geopolitical churn.

- Carbon Markets: UK ETS dipped to £47.65/t by week-end.

💡 What This Means for Your Business

- Fixing for 3–6 months?

Rates are better than they’ve been in weeks — now’s a smart time to compare.

- Reviewing Winter 2025 deals?

Forward rates dipped slightly but still carry premium — worth watching closely.

- On out-of-contract rates?

You’re likely paying 50–70% more than you need to.

👉 Avoid paying more than you need to.

If your contract’s due soon, now could be a smart time to get a fixed quote while prices are still below winter highs.

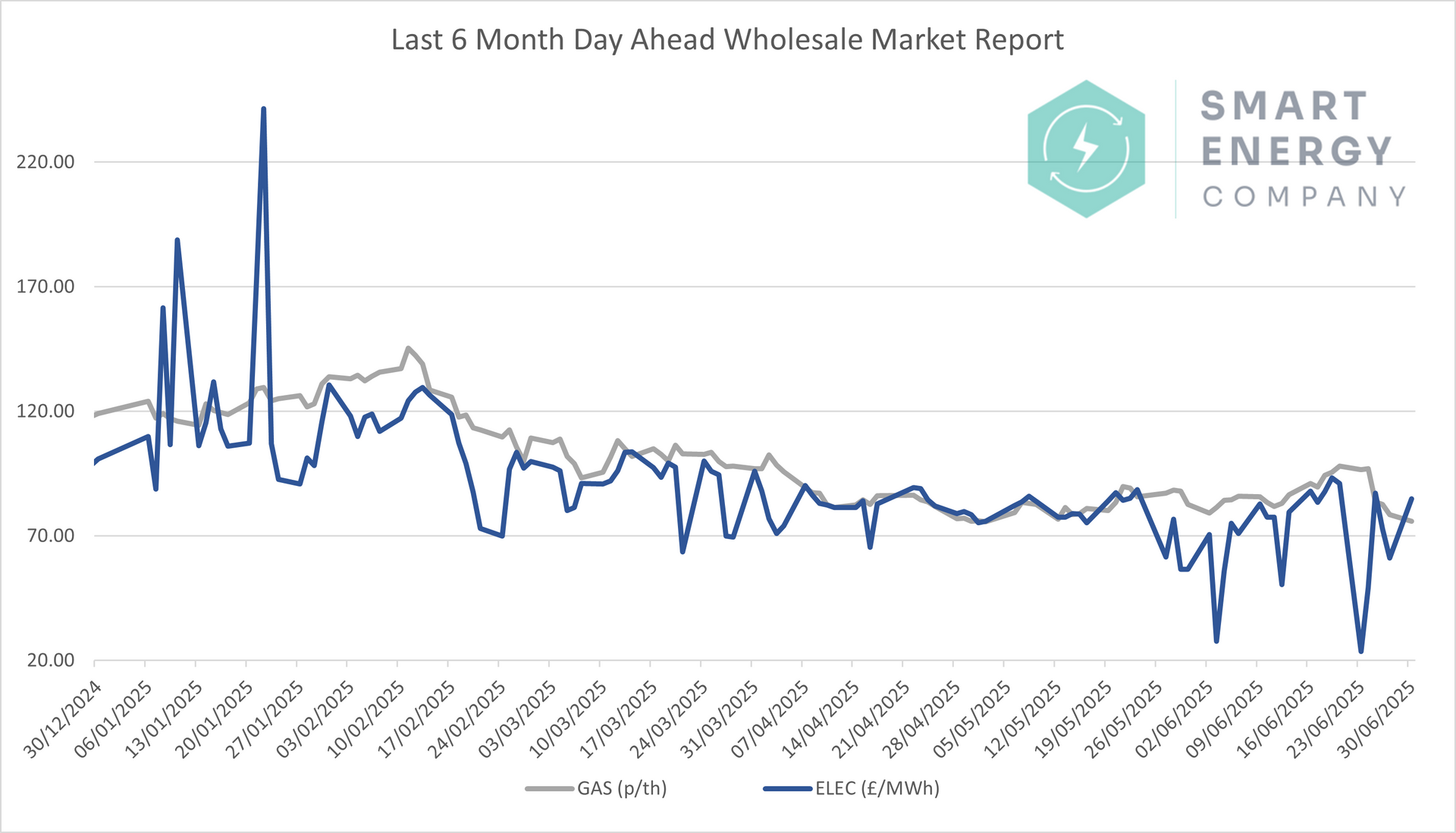

📈 6–Month Energy Market Trends

Markets appear to be normalising after the most recent conflict scare. Here’s how things have evolved:

📉 After peaking above 130 p/th during conflict uncertainty, prices have corrected by over 40 p/th — a significant reset for buyers.

👀 Looking Ahead

- Watch for Phase 2 of Norwegian Maintenance in August.

- U.S.–Iran nuclear negotiations could reintroduce volatility.

- Carbon price trends may impact winter power contracts.

Now’s the time to revisit your quotes if you held off during June’s turbulence.

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

💡 Final Thoughts

Despite one of the most volatile midweeks this year, the market corrected fast and is now trading at more buyer-friendly levels. Geopolitical events are being absorbed more calmly, and fundamentals are pointing to a steadier summer outlook.

🔍 If your quote is over 7 days old, it's worth checking again.

📉 Friday’s closing prices were

17% below Monday’s open — don’t leave that saving on the table.