Thomas McGlynn • 4 August 2025

UK Energy Market Update: 28th July –1st August 2025

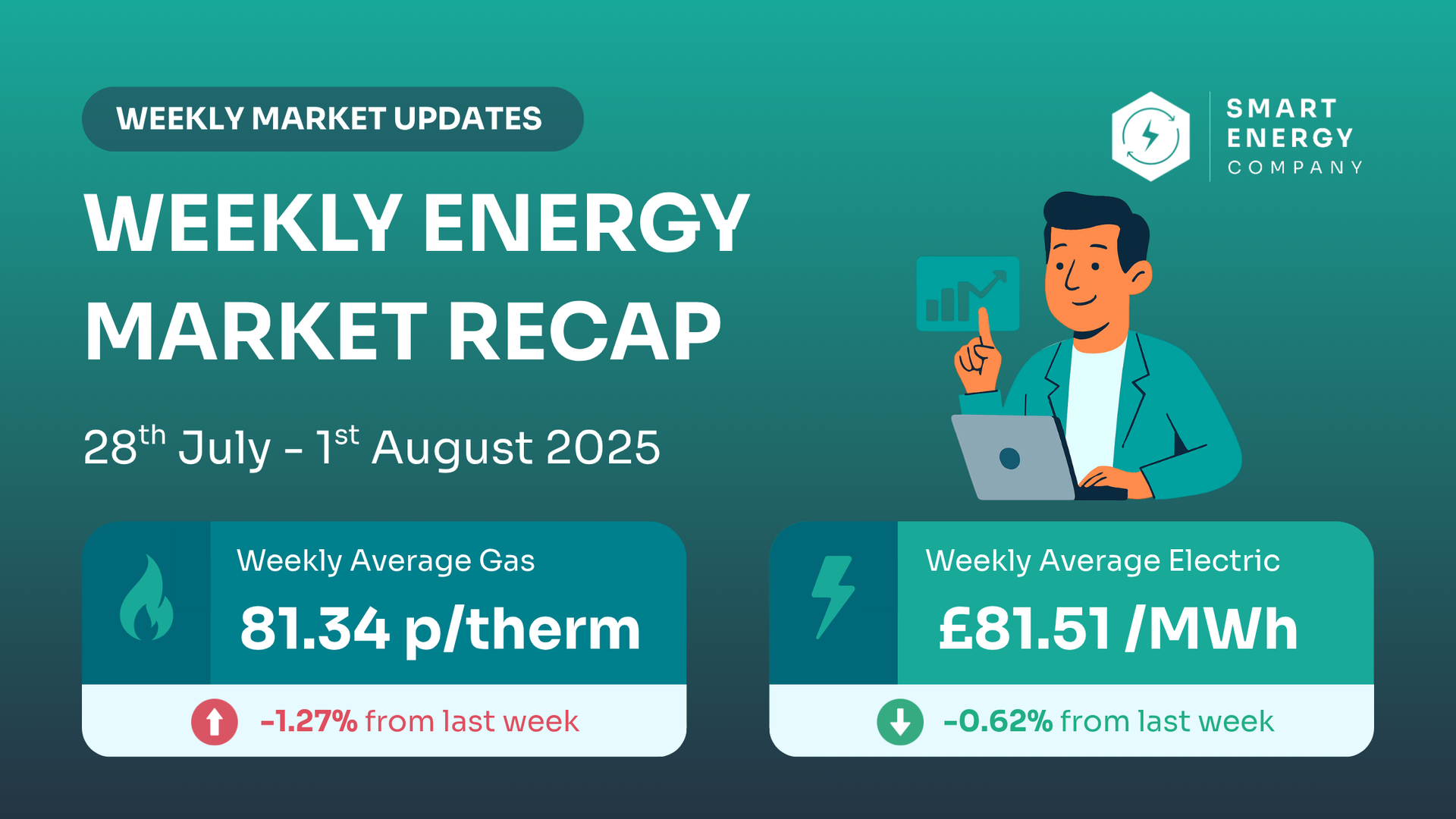

💡 Summary at a Glance

| Market | Weekly Avg | Previous Week | % Change | Direction |

|---|---|---|---|---|

| Gas (NBP) | 81.34p/th | 80.32p/th | ▲ 1.27% | 🔺 Up |

| Power (ELEC) | £81.51/MWh | £82.02/MWh | ▼ 0.62% | 🔻 Down |

📈 Gas: Prices continued to climb slightly, with most sessions holding above 81p.

⚡ Power: Volatility persisted but the overall average dipped after early-week highs.

⚡ Day-Ahead Prices Breakdown

| 📆 Date | ⚡ Electricity (£/MWh) | 🔥 Gas (p/th) |

|---|---|---|

| 01/08/2025 | 83.00 | 75.23 |

| 31/07/2025 | 83.00 | 83.00 |

| 30/07/2025 | 82.65 | 84.45 |

| 29/07/2025 | 79.50 | 82.81 |

| 28/07/2025 | 78.55 | 82.04 |

🧮 After last week’s volatility, this week saw a gentler overall upward trend — especially on gas, with electricity retreating from its recent highs.

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 01/08/2025 | 81.34 | £81.51 |

| 25/07/2025 | 80.32 | £82.02 |

| 18/07/2025 | 83.75 | £84.09 |

| 11/07/2025 | 81.22 | £77.90 |

| 04/07/2025 | 78.05 | £82.98 |

📉 Gas: Trending upward but still well below mid-July levels.

📉Power: Pulling back after a sharp spike in early July.

📩 Ready to Check Prices?

👉 Prices have dipped — but that doesn't always last.

Now could be a smart window to explore options without pressure.

🧭 What’s Driving the Market?

🛢️ Gas Market Drivers

- Norwegian outages: Ongoing capacity restrictions maintained firm prices.

- Storage: European reserves remain high, but exports and forecasts are now under scrutiny.

- LNG arrivals: Consistent, but weaker than spring levels, keeping risk premiums active.

⚡ Power Market Drivers

- Reduced wind generation: Especially midweek, lifted peak pricing.

- Demand variation: End-of-month consumption fell slightly, helping ease later prices.

- Firmer gas inputs: Continues to impact generation costs and therefore electricity pricing.

📈 6–Month Energy Market Trends

⚠️ While gas stabilised, electricity saw renewed volatility — particularly in late July highs.

Historic power prices above £90/MWh appear to be short-lived for now.

💡 What This Means for Your Business

| Time Until Contract Ends | Fixed Contract Advice |

|---|---|

| 0–3 Months | ✅ Fix now — gas remains firm, and lower electricity levels are not guaranteed to last. |

| 3–6 Months | 👀 Monitor closely — if electricity dips further, there may be an opportunity to fix both fuels smartly. |

| 6–12 Months | 🔍 Prepare benchmarking strategies — suppliers are watching winter trends closely. |

| 12+ Months | 🧭 No urgency – but build a plan for your renewal quarter and subscribe to alerts. |

📅 What to Watch Next Week

- 📊 UK and EU gas storage developments and balance of LNG deliveries.

- 🔌 Wind generation and temperature forecast impacts on daily power volatility.

- 📈 Forward contracts as we approach Q4 contract shaping.

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🧭 Final Thoughts

It’s still a mixed bag — gas showing strength, power showing weakness.

💬 Our advice:

- If you're inside 3 months, get quotes now — gas is rising.

- If you're later into winter, monitor weekly — electricity could still offer dips.

- Longer-term? Use this window to benchmark risk-free, especially before Q4 demand hits.