July 2025 UK Energy Market Trends: Gas, Power & Oil

Gas Holds Steady, Power Costs Rise – Winter Contracts Now More Expensive

🔍 Key Takeaways for Businesses

- Power prices dipped mid-month, offering a short-lived chance to fix below £65/MWh.

- Gas remained stable, averaging 81.06p/th – only slightly higher than June.

- 📈 Forward contracts for Winter 2025 and Q1 2026 are now trending upwards.

- ❄️ Those with renewals in winter should act early to avoid higher pricing later.

📊 July at a Glance: Average Prices vs. Previous Months

| Month | Avg Gas (p/th) | Avg Elec (£/MWh) |

|---|---|---|

| May | 82.60 | 77.78 |

| June | 86.61 | 71.43 |

| July | 81.06 | 81.44 |

🔎 Market Movement Summary:

- 🔵 Gas: Down 6.4% from June, returning to May levels — a sign of ongoing summer stability.

- ⚡ Power: Up 14% from June — driven by volatility in the first half, but part of a longer-term upward trend now seen across forward contracts.

📆 Week-by-Week: What Happened in July?

| Week | Avg Gas (p/th) | Avg Elec (£/MWh) | Comment |

|---|---|---|---|

| 4–8 July | 81.06 p/th | 70.57 | 📉 Power hit its lowest point on 4th July (£61.92) |

| 11–15 July | 82.98 | 78.05 | ↗️ Power began to rise, gas climbed slightly |

| 18–22 July | 82.27 | 83.99 | ⚡ High power volatility due to low wind |

| 25–29 July | 80.25 | 82.10 | ↔️ Market steadied |

| 31 July | 83.00 | 83.00 | ⬆️ Slight uptick to close the month |

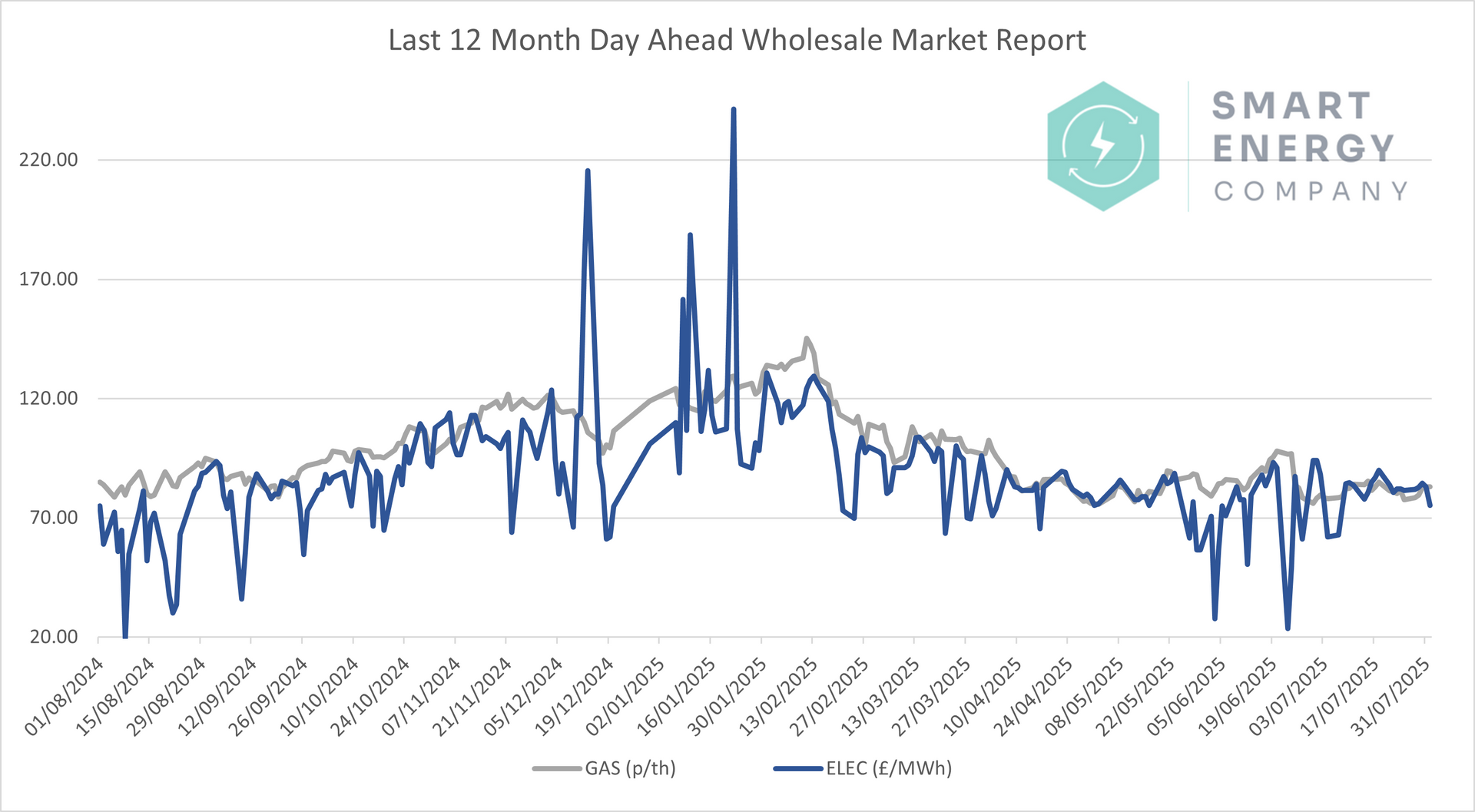

📉 Wholesale Gas and Electricity Price Trends – July 2025

6-Month Price Trend Overview

🔹 Electricity dipped to its lowest level since January on 4th July before rebounding.

🔹 Gas prices remained range-bound between

78–85p/th, suggesting limited short-term risk.

🌍 What’s Driving UK Business Energy Prices?

🛰️ Geopolitical Events

- Ongoing tensions in the Middle East and Ukraine led to minor price reactions, especially in oil and LNG forward sentiment.

- The US–EU trade policy shift mid-month caused speculative jitters in global gas contracts.

🌬️ Weather & Renewables

- Low wind output during the second week of July drove power volatility.

- Later weeks saw more stable generation, helping prices settle.

🛢️ Storage & LNG

- EU gas storage remains above 80% full, ahead of seasonal average.

- LNG deliveries into NW Europe were steady, though some August outages are forecast.

🔍 Forward Market Outlook

| Contract | Change Since June | Comment |

|---|---|---|

| Winter 25 | 🔺 Up ~3.4% | Early upward trend – act sooner if you renew in Q4 |

| Q1 26 | 🔺 Up ~2.1% | Costs creeping up for early 2026 contracts |

| Summer 26 | ↔️ Steady | Still favourable – good long-term fix option |

💡 Is Now a Good Time to Fix My Energy Contract?

| Renewal Window | Advice |

|---|---|

| 0–3 Months | ✅ Fix now. Day-ahead and forward rates are still cheaper than Jan–Apr. |

| 3–6 Months | ⚠️ Get quotes soon. Winter 25 forward contracts are already rising. Waiting could cost more. |

| 6–12 Months | 📊 Monitor monthly. Q1 2026 prices are showing early signs of climbing — request a quote to compare now vs later. |

👉 Want to secure today’s lower rates before winter increases?

Rates are rising again — especially for Winter 25 contracts.

📉 Don’t miss out on cheaper power and steady gas rates.

📉 12-Month Market Context

🗓️ The cheapest electricity price of the month was £61.92 on 4th July

📉 Gas remains below early 2025 levels but is showing signs of stabilisation.

🔮 Looking Ahead to August

- ☀️ Warm, calm weather forecast – could limit wind generation.

- 🛢️ LNG outage concerns in August may support gas prices.

- 📅 Forward prices for Winter 25 will be closely watched — early movers may win.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

💬 Final Thoughts

July gave businesses a solid opportunity to fix electricity at a seasonal low.

While gas has stabilised,

forward contracts are slowly rising again.

If your contract ends before next spring, we recommend reviewing your options now — while summer pricing still holds.

Secure a better rate.

Or stay informed with free updates.

We'll help you make the right decision at the right time — no pressure, just expert advice.