Energy Market Update: 27th - 30th May 2025

With a shorter trading week due to the late May Bank Holiday, wholesale energy markets saw some sharp daily movements — especially in electricity — but forward prices stayed relatively steady, suggesting retail contract rates may not yet reflect the full drop.

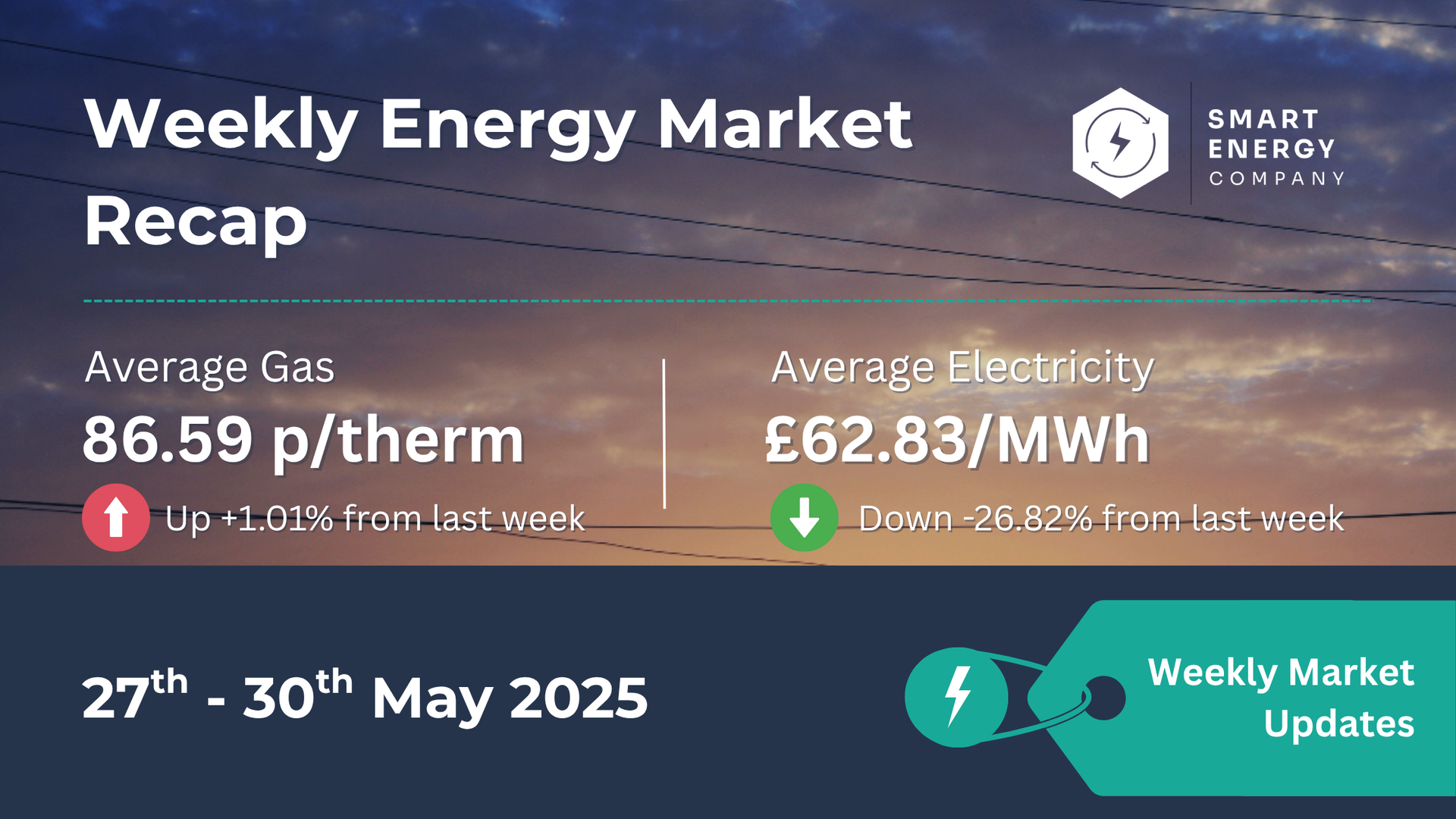

📊 Weekly Energy Market Recap

🔹 Quick Snapshot

- Day-Ahead Gas: 86.59 p/therm (🔺 -1.01% from last week)

- Day-Ahead Power: £62.83/MWh (🔻 -26.82% from last week)

- Today’s Open (03/06): Gas: 79.15 p/th | Power: £70.57/MWh

- Forward Pricing: Largely unchanged

- Notable Shift: Power saw its sharpest weekly drop in 12+ months

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 31/05/2025 | 86.59 | £62.83 |

| 24/05/2025 | 85.72 | £85.89 |

| 17/05/2025 | 79.36 | £77.63 |

| 10/05/2025 | 82.14 | £83.91 |

| 03/05/2025 | 76.39 | £77.68 |

🧾 Gas prices remain in a stable range. Power dropped sharply this week after strong renewable output and low demand.

📉 Market Overview

🔻 A Quiet Week for Gas

Prices fell back under 85 p/th by Friday, helped by warmer weather and higher Norwegian flows midweek.

🔌 Power Under Pressure

Electricity averaged just £62.83/MWh — the lowest since spring 2023 — driven by strong wind generation and low weekday demand.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 88.50 (28 May) | £76.71 (28 May) |

| Lowest | 82.60 (30 May) | £56.54 (29–30 May) |

| Weekly Average | 86.59 | £62.83 |

| Change vs Last Week | 🔻 -0.27% | 🔻 -26.82% |

⚠️ Electricity saw a sharp drop this week – one of the steepest falls in recent months. Gas held steady, finishing slightly higher.

🔎 Key Factors This Week

🟧 Soft Fundamentals

- High wind output slashed power prices midweek

- Warmer weather and easing maintenance helped soften gas demand

- EU gas storage at ~47% — still well below 5-year average

🌍 Geopolitical Headlines

- Trump delayed 50% EU tariffs until July, reducing trade pressure

- Peace talks stalled as Trump–Putin deadlines passed with little progress

- U.S. weighing further Russian sanctions, but no fresh action taken yet

📣 What This Means for Your Business

🔹 Contracts Ending Soon (0–3 Months)

Power prices are at the lowest levels in over a year — now could be a great time to explore quotes.

🔹 Contracts Ending Mid-Term (3–6 Months)

Gas prices remain steady. Consider reviewing rates now if you're looking to avoid mid-summer volatility.

🔹 Long-Term Renewals (6+ Months)

Forward rates have stayed flat. If you're not due until Q4 or later, keep monitoring — prices may soften again if storage improves.

👉 Avoid paying more than you need to.

If your contract’s due soon, now could be a smart time to get a fixed quote while prices are still below winter highs.

📈 6-Month Energy Market Trends

Gas and power both dropped last week. Power showed a much sharper decline, reflecting milder weather and low demand.

Gas continues to trade in the 85–90 p/th band, showing limited volatility compared to electricity.

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🧭 Looking Ahead

- Norwegian flows expected to fully recover post-maintenance

- EU gas storage remains a key watch point — still 10% behind seasonal norms

- U.S.–Russia tension remains unresolved, but not driving daily prices right now

- Power volatility could return if renewable output dips

💬 Final Thoughts

Last week’s drop in power was a surprise — and a clear opportunity for those close to renewal.

If you’re unsure, get a quote or sense-check your current deal.

No pressure — just smart timing.