May 2025 UK Energy Market Trends: Gas, Power, and Oil

April brought another wave of price drops across gas, power, and oil – but not without volatility. Here’s what happened and what businesses need to know for May.

✅ At a Glance: What Happened in May?

Gas and power prices continued their downward journey in May, with volatility in the second half triggered by stalled peace talks, shifting weather forecasts, and tariff turmoil.

📉

Gas prices fell 4.2% month-on-month

📉

Electricity prices fell 4.8% on average

🛢️

Oil prices dipped, rallied, and ended almost flat

These lower averages offer a window of opportunity — especially for businesses due for renewal before winter demand builds.

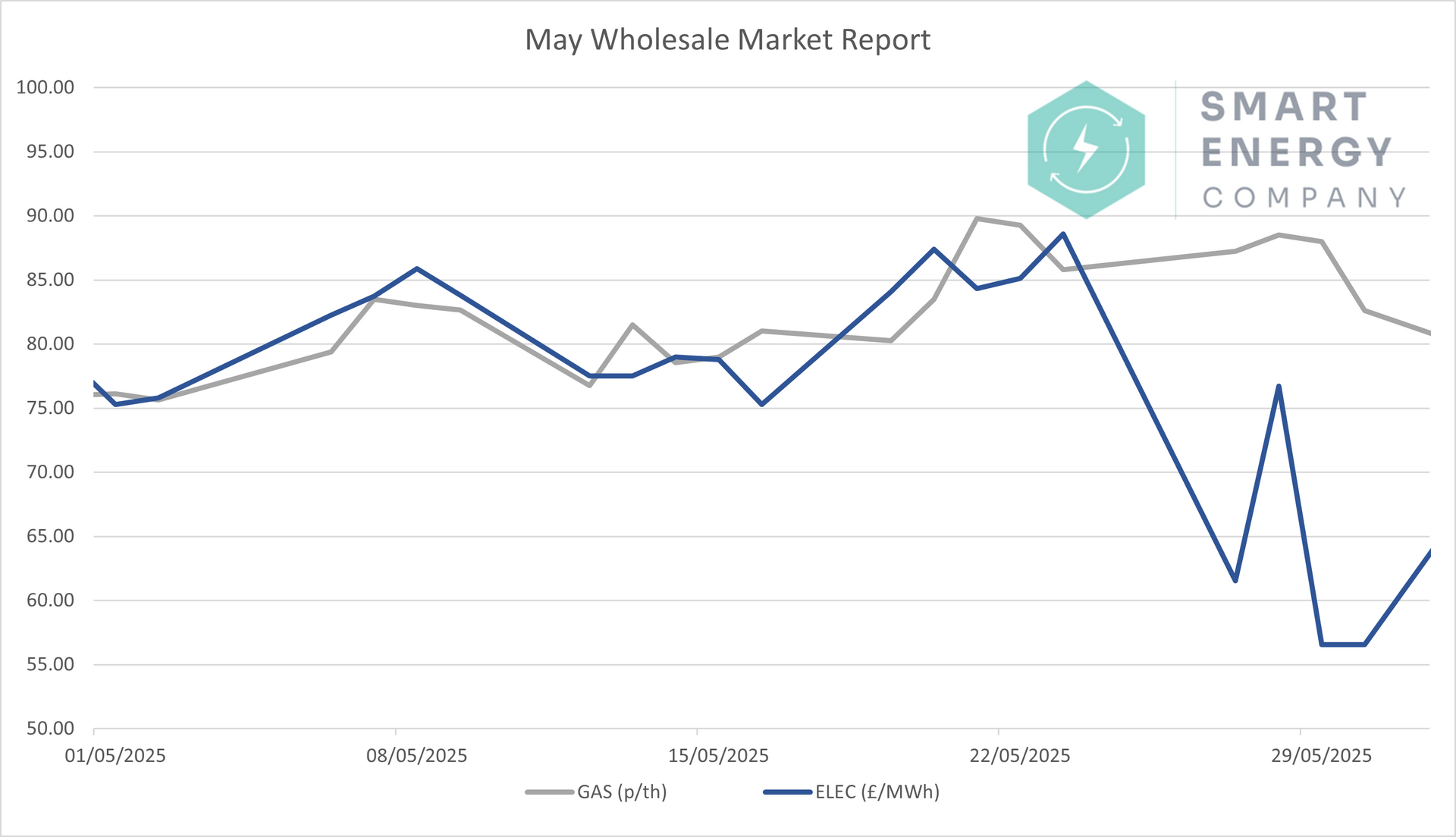

📉 Interpreting the Chart: May Market Movements

The chart above shows daily wholesale gas (grey) and electricity (blue) price movements throughout May.

Key Patterns:

- 🔼 Early Month Uptick: Prices climbed in the first week, driven by cooler weather and Norwegian outages.

- 🔁 Mid-May Volatility: Power prices peaked mid-month amid poor wind output and failed peace talks.

- 🔻 Late Month Crash: Electricity prices tumbled after wind generation surged and demand fell away.

👉 Electricity ended the month at its lowest point since December 2024.

📊 Price Comparison Table

| Commodity | May 2025 Avg | Apr 2025 Avg | Change | Change (%) |

|---|---|---|---|---|

| Gas (NBP DA) | 82.60 p/th | 86.22 p/th | ↓ 3.62 | ↓ 4.2% |

| Power (DA) | £77.78/MWh | £81.48/MWh | ↓ £3.70 | ↓ 4.8% |

📈 What Drove the Market?

🔹 Weather

- Early May saw colder-than-normal temperatures.

- Late May brought strong wind output and mild temperatures — curbing demand sharply.

🔹 Supply & Storage

- Norwegian gas flows were disrupted early on but recovered late month.

- EU gas storage sits at ~47%, still below the 5-year average — keeping some upward pressure in play.

🔹 Geopolitics & Tariffs

- Hopes for a Ukraine-Russia peace deal faded fast.

- A 90-day tariff pause between the U.S. and China helped calm oil markets — briefly.

- New sanctions and the looming threat of more trade shocks kept traders alert.

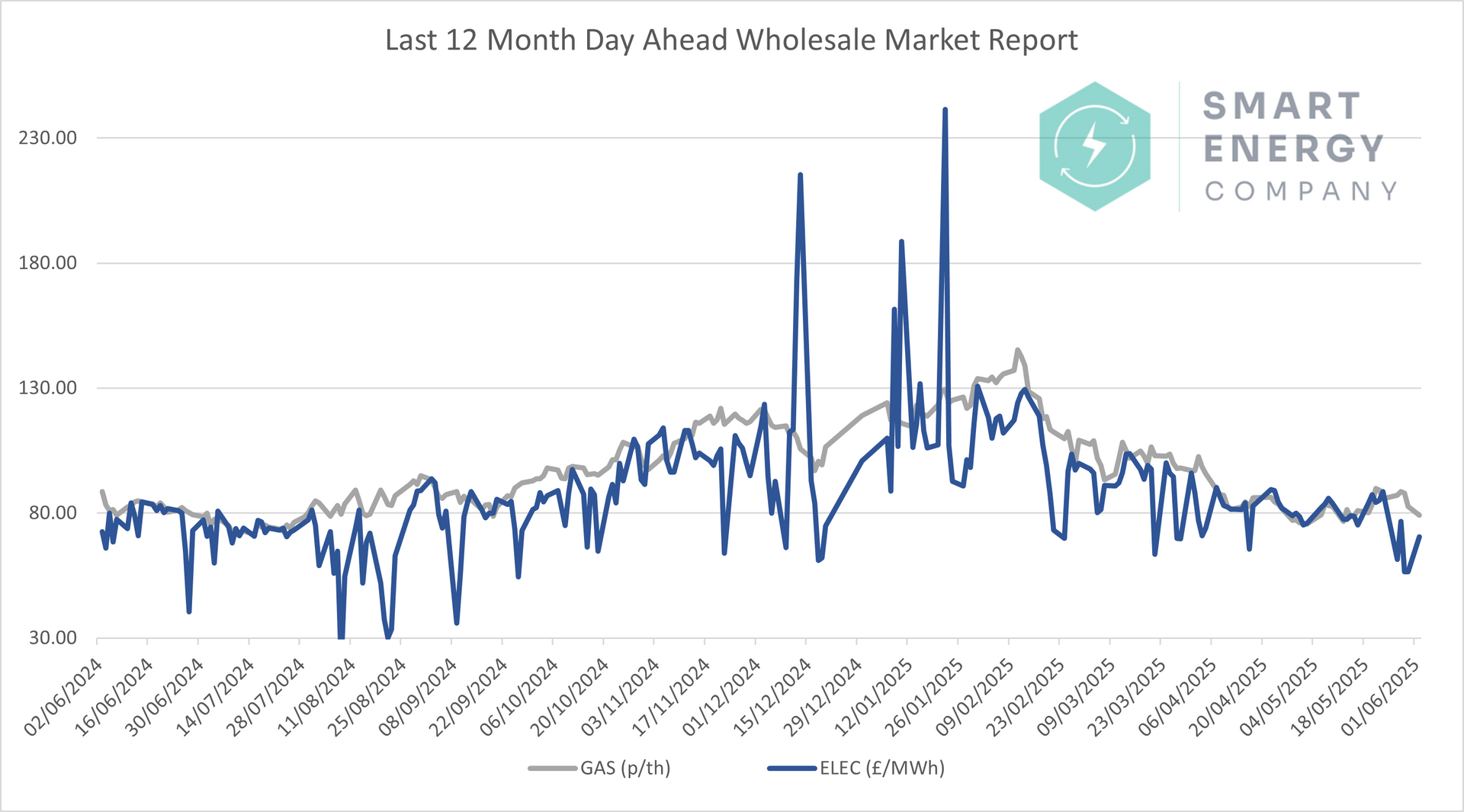

📅 12-Month Market View: Are Prices Falling?

Prices peaked over winter and have since cooled.

Summary of the Trend:

- ⬆️ Summer–Winter 2024: Upward trend driven by storage concerns and geopolitical risk.

- ⬇️ February–May 2025: Consistent downward pressure as milder weather, stronger renewables, and storage flexibility returned.

⏳ Four months of softening doesn’t guarantee a long-term trend — but it does present an opportunity to lock in while costs are low.

📈 What This Means for Contracts

💡 If your contract ends by August

Now may be the best pricing window before storage pressure or market shocks lift costs again.

💡 If you're fixed until late 2025 or 2026

Stay subscribed to market alerts — don’t let false security prevent you from locking in when pricing dips.

💡 For multi-site or heavy energy users

Consider spreading contracts or fixing key sites now, especially where cooling and gas-for-process matter.

🔮 Looking Ahead to June

Here’s what we’re watching:

- 🔧 Will OPEC+ hike oil output further?

- 🌀 Will wind generation remain strong across NWE?

- 🤝 Will any real progress emerge in Ukraine peace efforts?

- 📦 Will the U.S. stick to or roll back its latest round of tariffs?

🧠 Final Thoughts

May offered yet another dip in average energy costs, giving businesses more breathing room. But volatility remains close to the surface — and we’ve seen how fast prices can turn.

📉 Prices are lower — but risks still loom.

📅 If you’re due for renewal within 3 months, now is a smart time to act.

💼 Ready to Review Your Options?

👉

Avoid the rush. Fix before summer volatility returns.