Thomas McGlynn • 28 July 2025

UK Energy Market Update: 21st –25th July 2025

💡 Summary at a Glance

| Market | Weekly Avg | Previous Week | % Change | Direction |

|---|---|---|---|---|

| Gas (NBP) | 80.32p/th | 83.75 p/th | 🔻 -4.10% | Lower |

| Power (ELEC) | £82.02/MWh | £84.09/MWh | 🔻 -2.46% | Lower |

✅ A welcome dip in both gas and electricity prices after last week’s spike.

📉 Gas is down 4%, and power softened slightly — a helpful pause for those watching the market.

⚡ Day-Ahead Prices Breakdown

| 📆 Date | ⚡ Electricity (£/MWh) | 🔥 Gas (p/th) |

|---|---|---|

| 21/07/2025 | 80.66 | 81.00 |

| 22/07/2025 | 82.16 | 80.25 |

| 23/07/2025 | 82.16 | 81.50 |

| 24/07/2025 | 81.40 | 77.55 |

| 25/07/2025 | 82.04 | 78.55 |

⚠️ No sharp anomalies, but prices held firm across the week. Gas dropped midweek as Norwegian flows stabilised.

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 25/07/2025 | 80.32 | £82.02 |

| 18/07/2025 | 83.75 | £84.09 |

| 11/07/2025 | 81.22 | £77.90 |

| 04/07/2025 | 78.05 | £82.98 |

| 27/06/2025 | 87.72 | £58.82 ⚠️ |

🟢 After last week's jump, this week saw a gentle correction downward — welcome news for businesses yet to renew.ing.

📩 Ready to Check Prices?

👉 Prices have dipped — but that doesn't always last.

Now could be a smart window to explore options without pressure.

🌍 What’s Driving the Market?

🟢 Gas Market Drivers

- 🔧 Norwegian flows steadied after earlier outages; flows near 311 mcm/day from Gassco on 23 July

- 📦 UK gas storage now 85%+ full at major terminals including South Hook and Isle of Grain

- 🛬 LNG arrivals ongoing, with South Hook expecting a US cargo on 27 July

- 🌡️ Cooler weather reduced gas-for-power demand.

🔌 Power Market Drivers

- ⚛️ Nuclear outages remain heavy — Hartlepool 1 & 2, Heysham 1 & 2, and Torness units still impacting baseload

- ☀️ Solar & wind improving toward end of week — forecasted output to exceed seasonal norms

- 🔌

Interconnectors running steadily, but UK continued modest exports via BBL and IUK.

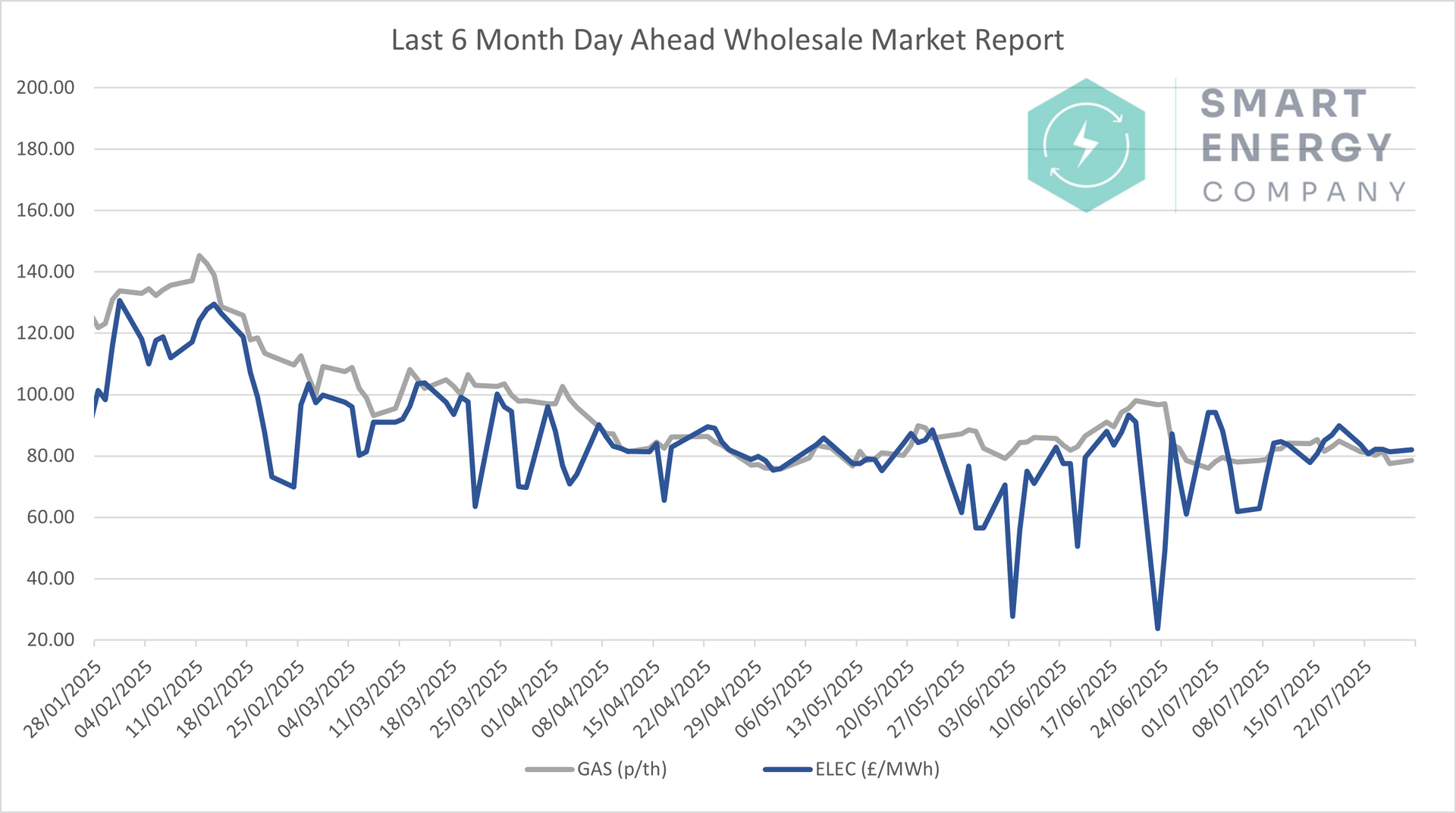

📈 6–Month Energy Market Trends

Both gas and power prices remain well below their 6-month highs, but volatility remains likely through August.

⏳ This may be a short-lived plateau before the next move — especially with nuclear shortfalls and global energy risk.

💡 What This Means for Your Business

| Time Until Contract Ends | Fixed Contract Advice |

|---|---|

| 0–3 Months | ✅ Get quotes now – this week offers a price window worth exploring. |

| 3–6 Months | ⚖️ Monitor closely – we’re in a dip, but don’t get caught if the market rebounds. |

| 6–12 Months | 👀 Track weekly – if your business likes price certainty, start soft market testing. |

| 12+ Months | 🧭 No urgency – but build a plan for your renewal quarter and subscribe to alerts. |

🔭 What to Watch Next Week

- 🛬 New LNG cargoes expected from the US and Panama

- ⚛️ Heysham and Torness outages continue — delays could pressure prices

- 🌬️ Wind generation forecast to climb sharply

- 🏦 Global oil & carbon markets reacting to wider geopolitical and inflationary signals

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

💬 Final Thoughts

It’s not often we see a softening in both gas and power during summer — but here we are.

- 📉 Both markets fell, offering a useful window to review contract options

- 🛠️ Norwegian gas and nuclear issues are still unresolved — this could reverse quickly

- ⏳ If you’re within 3 months of renewal, now may be a smart time to fix

Let’s help you take advantage of the current dip — or track it for when you’re ready.