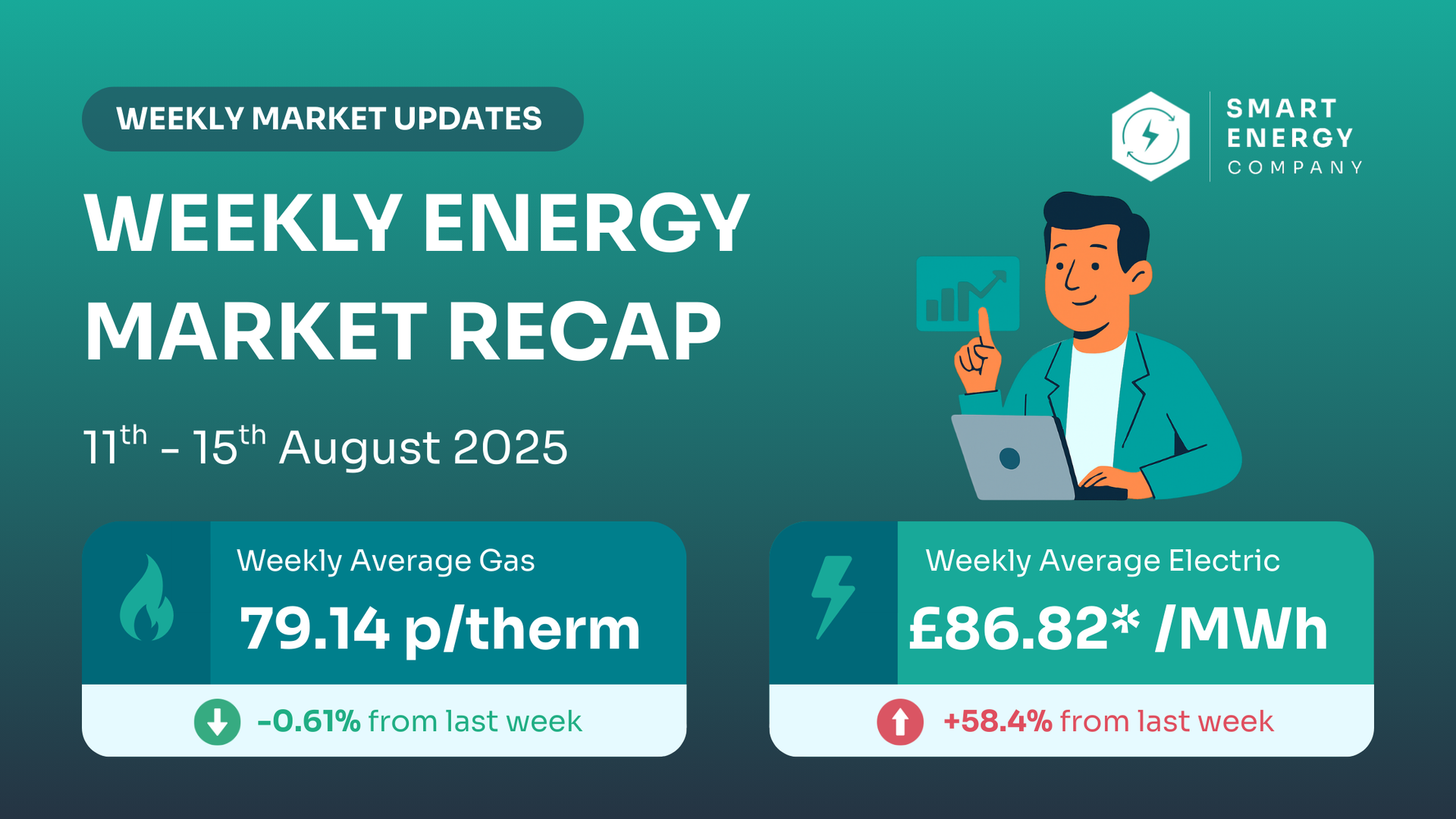

UK Energy Market Update: 11th - 15th August 2025

Stability returns after August’s shock — but what does it really mean for your contracts?

After one of the most volatile weeks of the summer, wholesale markets calmed down. Gas slipped quietly lower, while power bounced back into its usual £80–90/MWh range after the extreme system event on 5th August.

For businesses, the big question is: does this stability mark a turning point, or just a pause in an unpredictable market?

📊 Weekly Market Snapshot

| Commodity | Weekly avg | Previous Week | % Change | Weekly High | Weekly Low |

|---|---|---|---|---|---|

| Gas (UK NBP) | 79.14 | 79.63 | 🔻 -0.61% | 80.60 (Tue) | 77.25 (Mon) |

| Power (UK Base) | 86.82 | 54.82* | 🔺 +58.4% | 89.63 (Wed/Thu) | 81.04 (Fri) |

*Previous week’s power average was skewed by the £16.79/MWh crash on 5th August — excluding this, prices actually sat closer to £80–90/MWh.

What's Driving Wholesale Energy Prices This Week?

Gas: A Quiet Downtrend

Gas has been edging lower since mid-July:

- Norwegian flows were reduced by outages, but steady LNG arrivals into NW Europe softened the impact.

- Storage levels sit around 72%, slightly behind 2022 but still healthy for this time of year.

- Demand rose as low wind output lifted gas-for-power needs, but fundamentals were strong enough to absorb the pressure.

👉 Bottom line: Gas is proving resilient. Even with outages, prices are trending gently downwards into the high 70s.

Power: Volatile but Normalising

Power painted a sharper picture:

- Midweek values jumped above £89/MWh as gas plants filled the gap left by low wind and reduced nuclear availability in France.

- The Gravelines reactors — offline again — reminded markets how fragile continental nuclear supply can be.

- By Friday, prices slipped to £81/MWh, proving just how reactive power remains to day-to-day conditions.

👉 Bottom line: Power has normalised back to seasonal levels, but the swings show it remains the most unpredictable element of business energy costs.

📉 6-Month Market Trend

Looking at the past six months of wholesale energy prices reveals important patterns:

📈 Gas: Down from winter highs above 120p/th to today’s ~79p/th. The trend is gradual, not dramatic — reflecting stronger supply balance.

⚡ Power: A rollercoaster. Deep troughs (£30s) followed by sudden rebounds (£90+). The August 5th plunge to £16/MWh is visible on the chart, but it was a day-ahead anomaly, not a true reflection of forward pricing.

Key learning: Renewal offers are based on forward curves, which are far more stable than the day-ahead volatility you see in headlines.

📈 5 Week Price Trend

| Week Ending | Average Gas (p/th) | Direction | Avg Power (£/MWh) | Direction |

|---|---|---|---|---|

| 15/08/2025 | 79.14 | 🔻 | 86.82 | 🔺 |

| 08/08/2025 | 79.63 | 🔻 | 54.82* | 🔻 |

| 01/08/2025 | 81.34 | 🔺 | 82.02 | 🔻 |

| 25/07/2025 | 80.32 | 🔻 | 84.09 | 🔺 |

| 18/07/2025 | 83.75 | 🔺 | 77.90 | 🔻 |

*Distorted by the Aug 5 anomaly.

Gas shows a steady softening. Power, by contrast, has ricocheted between extremes — a reminder not to read too much into a single week’s data.

👉 Avoid Overpaying on Your Next Renewal

👉 Forward markets are softening — but only for now.

A single geopolitical or supply shock could reverse gains quickly.

💡 What This Means for Your Business

| Renewal Window | Market View | Guidance |

|---|---|---|

| Next 3 Months | Gas near a six-month low; power stable but volatile. | A good window to explore fixes, but don’t expect day-ahead dips to filter directly into quotes. |

| 3–6 Months | Winter contracts holding a premium over spot. | Partial cover could reduce risk, while keeping flexibility for further improvements. |

| 6+ Months | Forwards show mild premiums but calmer structure than 2022–23. | Consider early positioning for certainty, but longer timelines allow more watch-and-wait. |

📅 Looking Ahead

- Repairs at Ormen Lange due mid-August.

- European wind forecasts for late August — stronger winds usually ease power prices.

- French nuclear availability, particularly Gravelines.

- Forward curve signals — early signs suggest winter premiums may be softening.

Learning Corner – The Disconnect That Matters

The August 5th collapse in power prices to £16/MWh grabbed headlines. But forward contracts — which suppliers use to price renewals — barely moved.

That’s the crucial point for businesses: day-ahead volatility doesn’t dictate your renewal price. Suppliers hedge forward, so contract costs are influenced by curve trends, not one-off events.

📝 Final Thoughts

This week confirmed two things:

- Gas is quietly stable, supported by supply and storage.

- Power is volatile but not unanchored — forward pricing remains steadier than the daily swings.

For procurement, that means contracts should be judged against the forward curve, not the noise of day-ahead headlines.

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

Not Ready to Lock In?

Subscribe for Daily, Weekly, Monthly or Quarterly insights - no pressure, just clarity!