Energy Market Update: 14th - 17th April 2025

Because UK and European exchanges were closed on Good Friday (18 April), this report covers Monday–Thursday. Below you’ll find a clear round‑up of wholesale gas, power and oil prices, why they moved, and what they could mean for your next fully‑fixed contract.

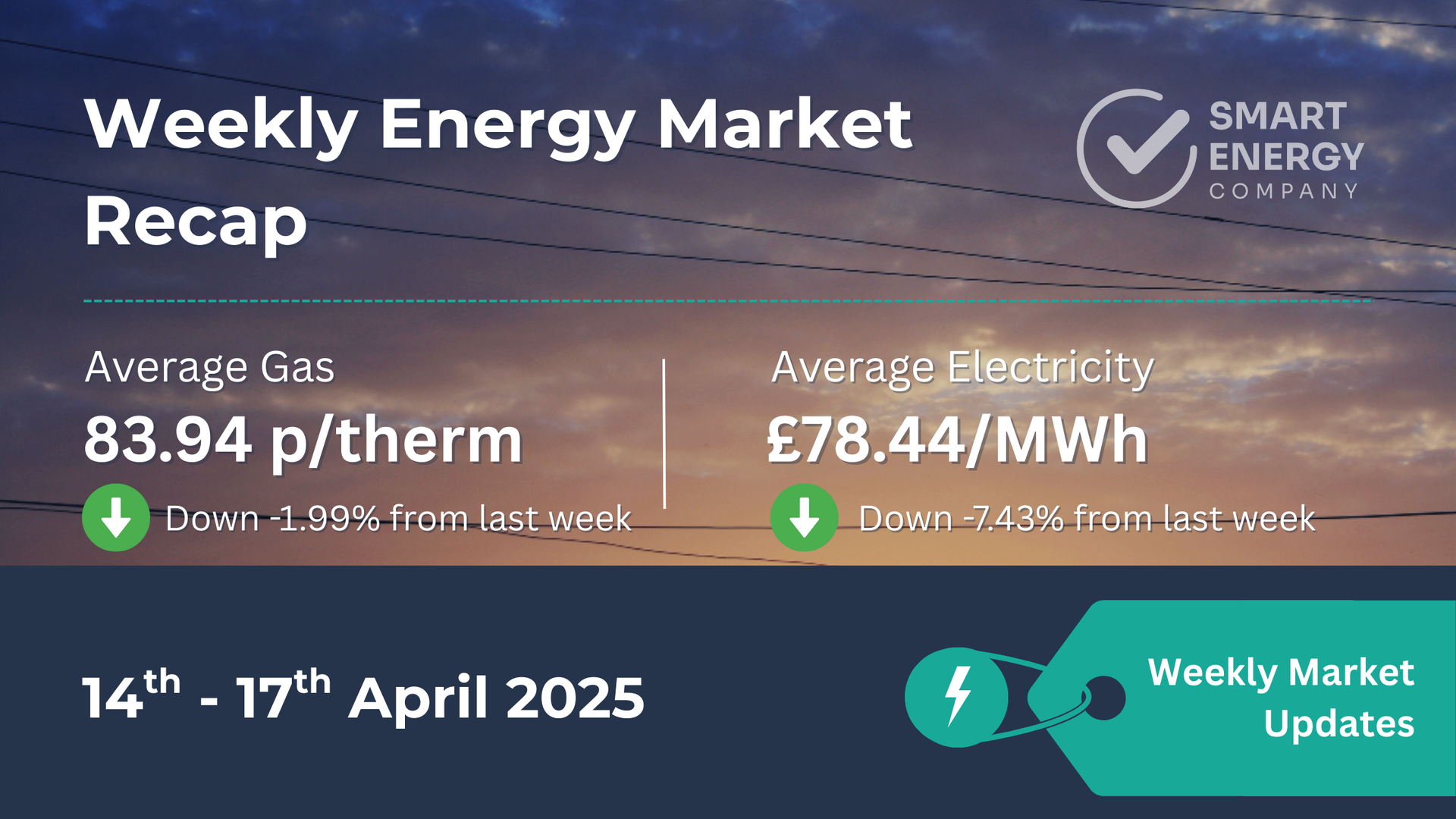

Weekly Energy Market Recap

✨ Quick Snapshot

- 🔥

Average Gas (Day‑Ahead): 83.94 p/therm

Down 1.99 % from last week’s 85.64 p/therm

- ⚡

Average Electricity (Day‑Ahead): £78.44/MWh

Down 7.43 % from last week’s £84.74/MWh

- 🛢️ Brent Crude: Traded around $65 → $66/bbl, buoyed mid‑week by fresh US sanctions on Iran but still shadowed by recession worries.

Take‑away: Gas nudged to a new six‑month low while power slumped sharply on Wednesday’s wind surge. Trade‑war headlines continue to whip prices around day‑to‑day.

⚡ Market Overview

Tariff Turbulence Eases—Then Returns

- Markets opened the week on edge after China’s latest retaliatory tariffs.

- A brief lift came when US electronics imports were exempted, but optimism faded once more tariffs surfaced.

Weather & Renewables Help Push Prices Lower

- Mild temperatures plus a jump in wind output (from ~2 GW to 17 GW in 24 hours) trimmed gas‑for‑power demand.

- EU talk of relaxing gas‑storage targets added further downward pressure.

Pre‑Easter Position‑Tidying

- Ahead of the long Easter break, traders

closed short‑term positions and some speculative buying nudged prices up on Thursday—but the weekly average still finished lower.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 86.15 p/therm (17 Apr) | £84.06/MWh (15 Apr) |

| Lowest | 82.50 p/therm (14 Apr) | £65.49/MWh (16 Apr) |

| Weekly Average | 83.94 p/therm | £78.44/MWh |

| Change vs Last Week | ‑1.99 % | ‑7.43 % |

Power’s sharp mid‑week drop was driven by a surge in cheap wind generation.

🔎 Key Factors This Week

- Trade‑War Headlines

- New US tariffs and China’s responses moved prices almost hourly.

- Electronics exemptions gave a brief lift; later tariff rumours reversed gains.

- Wind Surge & Mild Weather

- A 750 % jump in UK wind output slashed short‑term gas demand for power.

- Forecasts show above‑average temperatures into May, easing late‑season heating needs.

- Speculative Activity before Easter

- Some traders bought the dip late Thursday, keen to lock in positions before the three‑day exchange closure.

🏢 Implications for Your Business

- Contracts Ending Soon (0–3 Months)

- Gas is flirting with multi‑month lows: a sensible time to fully fix and lock in certainty before more tariff twists.

- Medium-Term (3–6 Months)

- Keep watching storage policy news and trade talks. A breakthrough deal could bounce prices; prolonged disputes may keep them soft.

- Long-Term (6+ Months)

- Set price alerts—extended economic slowdown could pull prices lower, but any supply hiccup (e.g., LNG, Norway maintenance) could reverse the trend.

🛢️ Oil Market Brief

- Brent rose to $65.85/bbl mid‑week after new US sanctions aimed at cutting Iran’s exports “to zero”.

- Gains stalled as fears of weaker demand under a deepening trade war resurfaced.

- Both the IEA and OPEC trimmed demand forecasts for 2025.

Oil’s path is a barometer for global growth sentiment—continued weakness signals caution for broader energy demand.

📈 12-Month Energy Market Trends

Gas and power remain well below winter highs, but the chart still shows sharp spikes whenever political news breaks. Volatility may persist while tariff negotiations drag on.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

This Good Friday week delivered lower average prices—even with a Thursday bounce—as tariff noise and strong renewables kept markets subdued. If you value certainty,

fully fixing now while gas is near six‑month lows could be a smart move.