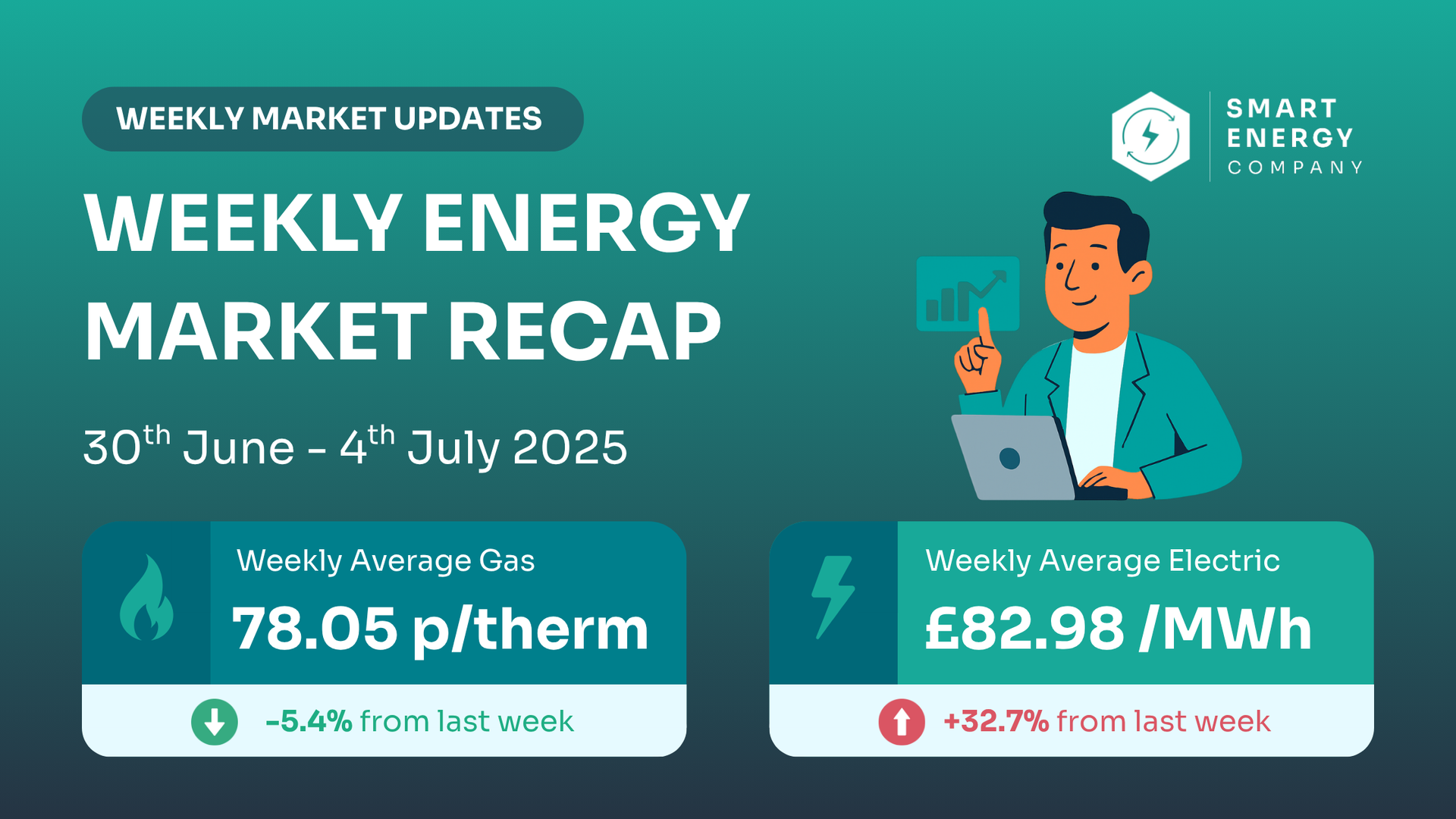

UK Energy Market Update: 30th June –4th July 2025

📉 Power prices plunge midweek, while gas holds steady near monthly average

Another volatile week in UK energy markets — while gas stayed steady, electricity prices surged, wiping out last week's anomaly. Temperatures, renewables, and storage remain key drivers as we head into July.

✅ Gas prices held firm at 82.98 p/th

⚡

Electricity rebounded to £78.05 /MWh

📈

Power prices jumped 32.7% vs last week’s anomaly

🌀

Storage levels and weather outlooks support cautious optimism

🔎 Weekly Energy Market Recap

Quick Snapshot

| 📆 Date | ⚡ Electricity (£/MWh) | 🔥 Gas (p/th) |

|---|---|---|

| Mon 30/06 | 94.17 | 76.00 |

| Tue 01/07 | 94.17 | 78.25 |

| Wed 02/07 | 88.20 | 79.50 |

| Thu 03/07 | 76.46 | 78.50 |

| Fri 04/07 | 61.92 | 78.00 |

| Avg | £82.98 | 78.05p |

📉

Power fell 34% from Monday to Friday

📈Gas fluctuated within a tight 76–79.5 range

📊 Weekly Prices at a Glance

| Period | Avg Electricity | Avg Gas |

|---|---|---|

| This Week | £82.98 /MWh | 78.05 p/th |

| Last Week | £58.82 | 87.72 p/th |

| % Change | ↑ 32.7% | ↓ 5.4% |

🔍 Note: Last week’s electricity average was artificially low due to price anomalies. This week reflects a true reset in market direction.

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 04/07/2025 | 78.05 | £82.98 |

| 27/06/2025 | 87.72 | £58.82 ⚠️ |

| 20/06/2025 | 93.67 | £88.73 |

| 13/06/2025 | 84.10 | £73.59 |

| 07/06/2025 | 83.09 | £60.03 |

⚠️ 27/06 electricity figure was affected by anomalies. This week represents a return to standardised pricing.

📌 Key Factors This Week

🔥 Gas

- The UK system remained well-supplied thanks to strong LNG sendout, stable Norwegian flows, and the return of Easington.

- A modest drop in gas prices reflects improved system balance, with lower gas-for-power demand due to increased wind output.

- Europe’s gas storage stood at 59.44% — solid progress, with 15 LNG cargoes last week and 10 more incoming.

⚡ Power

- Electricity prices surged as data normalised, reversing the anomaly from late June.

- Strong solar output helped suppress prices midweek, but low wind on several days triggered increased gas-for-power demand.

- Power futures rose slightly, but prices remain range-bound as July weather is the main focus.

🛢 Oil & Macro

- Brent crude stayed in the $67–69 range

- EU–US trade talks and Netanyahu’s US visit added background risk

- Carbon and coal prices remained broadly stable

💡 What This Means for Your Business

❄️ If your contract ends between Oct–Jan

Fixing soon could avoid Winter premiums. Prices are currently holding — worth locking now if rates suit your budget.

📅 If you're due to renew in 3–6 months

Track closely. Power prices have risen sharply from last week’s lows. Holding a little longer could work, but it’s risky if volatility returns.

🔥 If you're already out of contract

You’re exposed to high variable rates. The current power jump means you could be overpaying — get a fixed quote today.

👉 Avoid paying more than you need to.

Fix your contract at current levels — before heatwaves or politics spark another market surge.

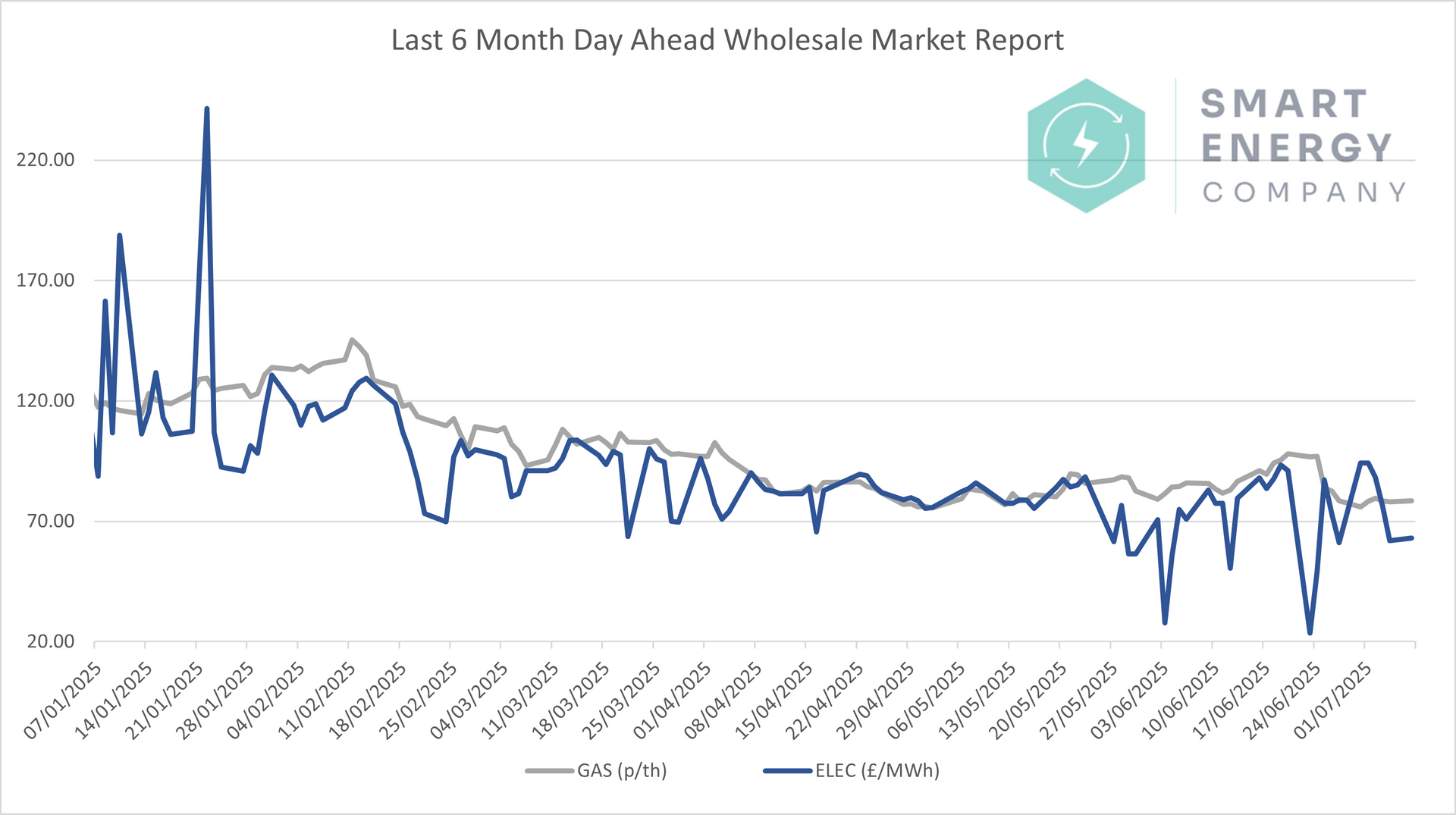

📈 6–Month Energy Market Trends

Gas is now sitting close to its 6-month low — while electricity saw a sharp correction this week.

📌 We’re in a low range — but the next heatwave or supply disruption could reverse that quickly.

🔍 Looking Ahead

- Will high temps drive gas-for-power demand back up?

- Could trade talks or geopolitical shifts trigger volatility?

- Are current power levels the “new normal” after data anomalies?

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

✅ Final Thoughts

Gas has stabilised, but power has surged again after a short-lived dip. If you’re renewing this summer or worried about Winter costs, don’t delay.

🟢 If you're out of contract, act now to avoid premium rates.

🟡 If you're mid-term, monitor daily — rates are bouncing around.

🔴 If you're due before winter, now’s a key window.

📌 If your contract ends this quarter — now is a solid time to review.