Energy Market Update: 9th - 13th June 2025

A volatile week for energy markets — from midweek dips to a sharp surge by Friday. Gas and power climbed on nuclear concerns in France and rising Middle East tensions, with prices opening even higher this morning after weekend strikes in Iran.

📌 Note: An unusually low power price on 12th June (£50.52/MWh) slightly skews this week’s average and doesn’t reflect real contract values.

⚡ Weekly Energy Market Update: 9th – 13th June 2025

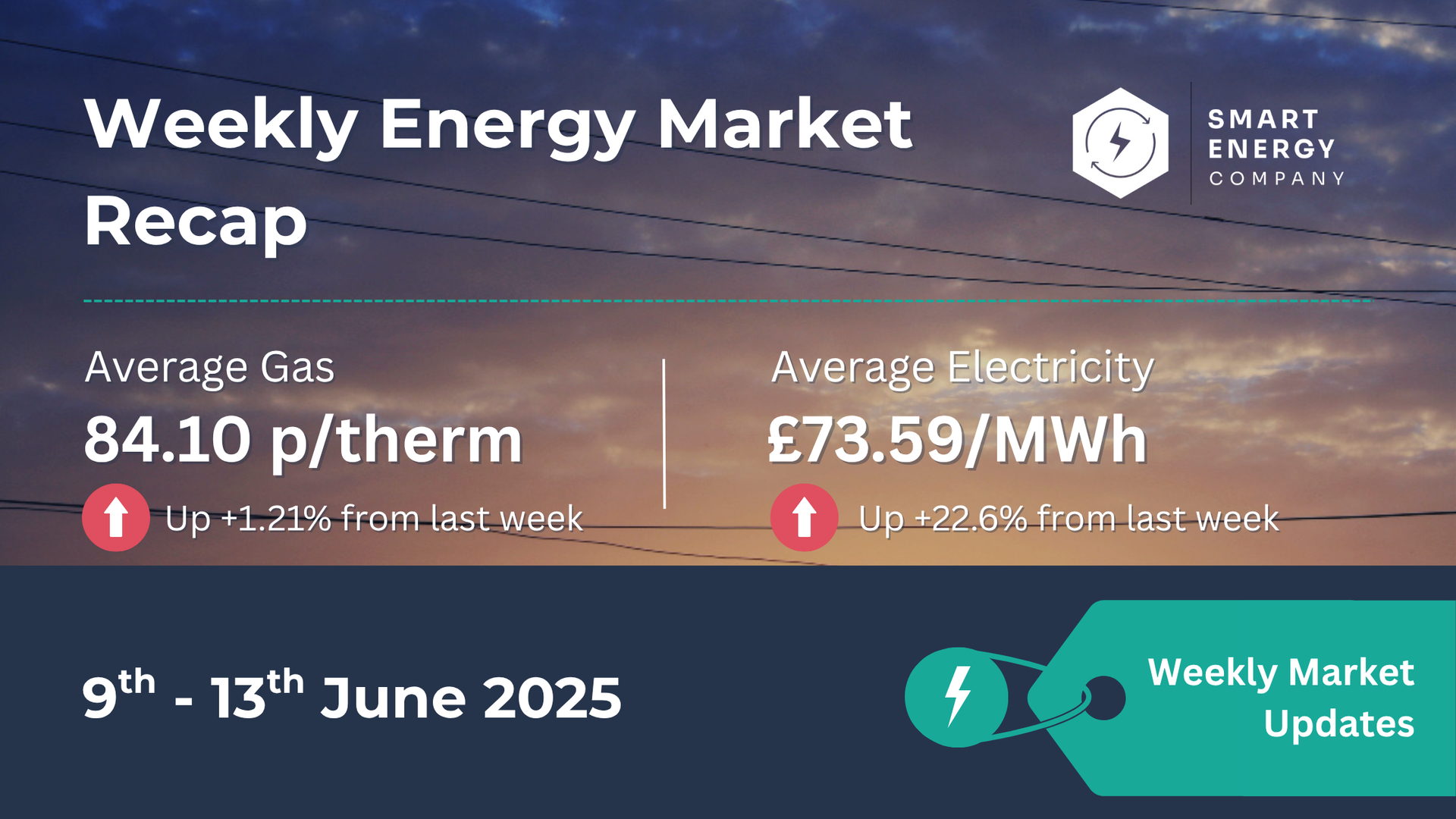

Weekly Energy Market Recap

📊 Quick Snapshot

- Day-Ahead Gas averaged 84.10 p/therm — up slightly from the previous week.

- Day-Ahead Power averaged £73.59/MWh — although this included an anomalous low on 12th June.

- Prices surged at open this morning (16/06/2025) following weekend strikes in Iran that hit LNG infrastructure, sending risk premiums higher.

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 13/06/2025 | 84.10 | £73.59 |

| 07/06/2025 | 83.09 | £60.03 |

| 31/05/2025 | 86.59 | £62.83 |

| 24/05/2025 | 85.72 | £85.89 |

| 17/05/2025 | 79.36 | £77.63 |

⚠️ Note: Power prices for the week ending 13/06/2025 were pulled lower midweek due to an anomalous dip on Tuesday (12th June), when day-ahead dropped to £50.52/MWh.

🌍 Market Overview

Gas:

It was a mixed but tense week for gas. Prices dipped midweek on healthy wind output and mild weather before

rebounding Thursday and Friday on nuclear concerns in France.

The

EDF Civaux-2 reactor corrosion issue sparked fears of wider nuclear limitations this summer. While the unit was already offline, traders grew wary of other reactors with the same design being next.

Power:

Power tracked the volatility in gas, with strong solar and wind midweek providing brief relief. But expectations of lower wind generation into the weekend, combined with bullish gas movements, sent contracts higher by Friday.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 91.00 | £88.01 |

| Lowest | 81.75 | £50.52 ⚠️ |

| Weekly Average | 84.10 | £73.59 |

| W-o-W Change | ▲ +1.21% | ▲ +22.6% |

🔑 Key Factors This Week

✅ Soft Fundamentals Midweek

- Healthy wind and solar reduced demand for gas-for-power early in the week.

- Temperatures remained above seasonal norms, reducing heating needs.

⚠️ Bullish Reversal Late Week

- French nuclear concerns led to higher power prices and dragged gas up too.

- Middle East tensions escalated Friday and over the weekend, adding risk premium.

🌍 Geopolitical Shock Over the Weekend

- Israeli airstrikes hit Iran’s South Pars LNG complex, damaging infrastructure.

- South Pars (aka Qatar's “North Field”) is the largest gas field in the world.

- As of this morning (16/06),

European gas is up ~5% and

power up ~10% on the day.

💡 What This Means for Your Business

Contract Timeline Suggested Action

0–3 Months

If your renewal is due soon, act fast. Prices have surged on Monday following weekend events.

3–6 Months

Consider locking part of your volume if you’re risk-averse — the market is increasingly reactive.

6+ Months

Monitor the situation closely. This level of geopolitical uncertainty may last — but corrections could also come fast.

👉 Avoid paying more than you need to.

If your contract’s due soon, now could be a smart time to get a fixed quote while prices are still below winter highs.

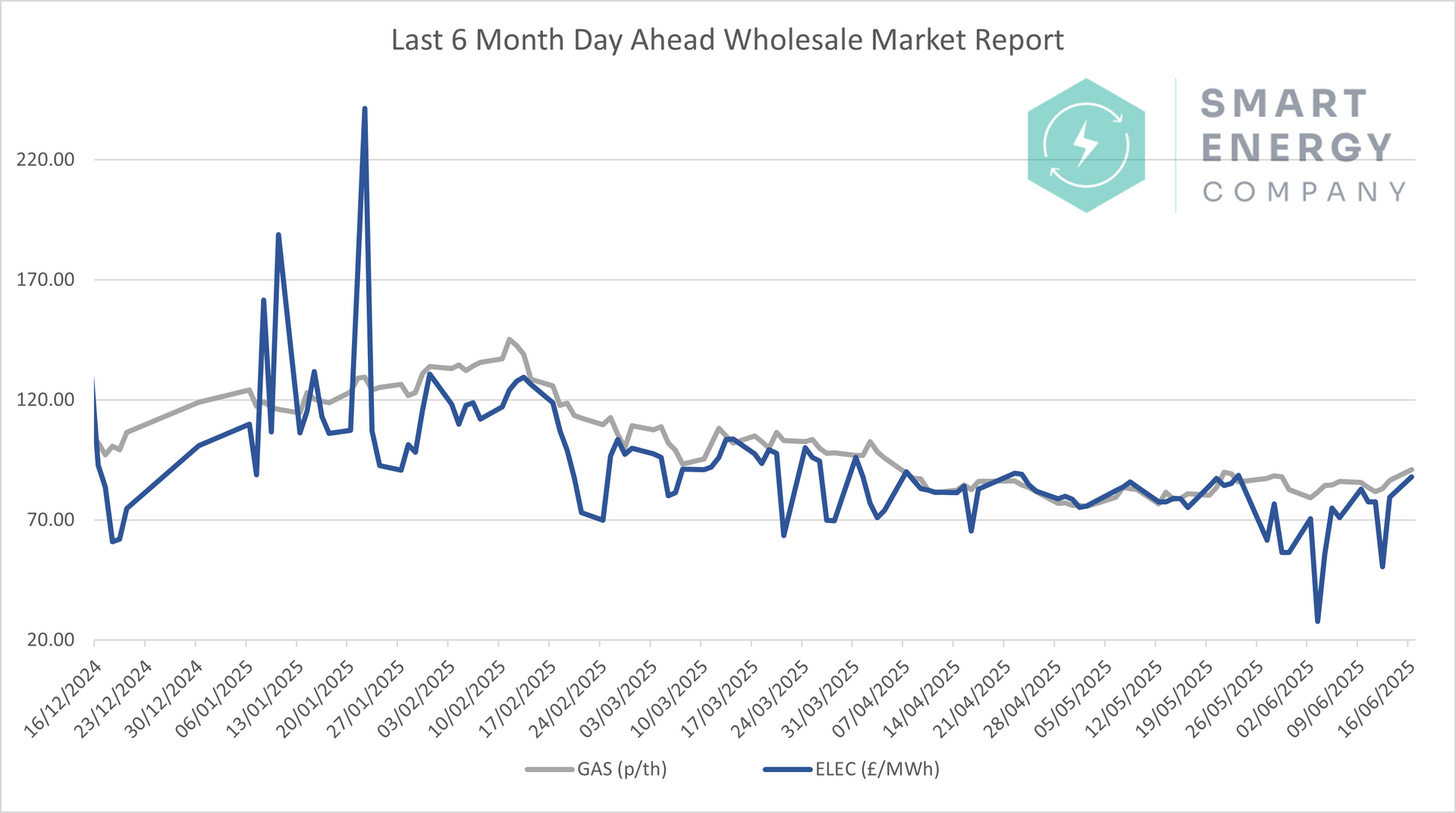

📈 6-Month Energy Market Trends

Gas and power had been trending lower for much of May and early June. However, this trend reversed sharply as of Friday 14th and into Monday 16th June due to:

- LNG supply threats via the Strait of Hormuz

- Fire damage at South Pars

- Ongoing fears around French nuclear capacity

- Low wind forecasts this week

-

📊 Here’s how the market has moved:

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🧭 Looking Ahead

- Expect continued price volatility this week, especially as markets react to further developments in Iran.

- Watch out for:

- News from the Strait of Hormuz (Qatar LNG export route)

- Any French nuclear outage updates

- EU Russian gas deal phase-out proposal due this week

- If prices continue climbing, we may see suppliers revise fixed-term quotes

upwards by end of week.

✅ Final Thoughts

The market was already tense — and this weekend’s events have only intensified things. If you're due for renewal, don’t delay. Many suppliers will factor in global events quickly, and prices can change overnight.