UK Energy Market Update: 4th –8th August 2025

Last week saw day-ahead gas and power prices drift lower overall, but movements were heavily influenced by anomalies — particularly the sharp drop in day-ahead power on 5th August to just £16.79/MWh. While these DA figures look attractive, forward contract prices remained significantly higher, meaning contract quotes would not have fallen by the same amount. The positive news is that Winter 2025, Summer 2026, and Winter 2026 forward prices all eased, improving the outlook for renewals if this trend continues.

📊 Weekly Market Snapshot

| Market | Weekly Avg | Previous Week | % Change | Weekly High | Weekly Low |

|---|---|---|---|---|---|

| Gas (p/therm) | 79.63 | 81.34 | 🔻 -2.10% | 81.00 (Mon) | 77.75 (Fri) |

| Power (£/MWh) | 54.82* | 81.51 | 🔻 -32.73% | 76.00 (Mon) | 16.79 (Tue)** |

*Power average skewed by the 5th August anomaly — not reflective of real contract pricing.

*Excluding the anomaly, day-ahead power traded between £54.45–£76.00, still well below forward rates.

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Direction | Avg Power (£/MWh) | Direction |

|---|---|---|---|---|

| 01/08/2025 | 79.63 | 🔻 | £54.82* | 🔻 |

| 01/08/2025 | 81.34 | 🔻 | £81.51 | 🔻 |

| 25/07/2025 | 80.32 | 🔻 | £82.02 | 🔻 |

| 18/07/2025 | 83.75 | 🔺 | £84.09 | 🔺 |

| 11/07/2025 | 81.22 | 🔻 | £77.90 | 🔻 |

*Power average for 08/08/2025 skewed by anomaly on 5th August (£16.79/MWh).

Trend commentary: Over the past 5 weeks, both gas and power averages have eased overall. Gas is now ~5% cheaper than mid-July, while power’s decline is exaggerated by the recent anomaly but is still ~10% lower excluding that spike.

📩 Ready to Check Prices?

👉 Forward markets are softening — but only for now.

A single geopolitical or supply shock could reverse gains quickly.

🧭 What’s Driving the Market?

🔹 Gas Market Drivers

- Consistent supply from Norwegian pipelines and UK Continental Shelf kept the system well balanced.

- LNG send-out strong, with arrivals supporting European storage above seasonal norms.

- Mild summer conditions meant demand remained low, particularly for heating.

- Forward gas prices fell modestly across key periods:

- Winter 25: ~90.8p/therm 🔻

- Summer 26: ~81.9p/therm 🔻

- Winter 26: ~89.3p/therm 🔻

🔹 Power Market Drivers

- Wind generation volatility influenced DA prices — high output early week pushed prices lower, dips mid-week lifted them slightly.

- Tuesday’s extreme low of £16.79/MWh was an anomaly and did not translate into equivalent contract savings.

- Forward power prices also eased slightly:

- Winter 25: ~£83.9/MWh 🔻

- Summer 26: ~£72.4/MWh ➖

- Winter 26: ~£81.2/MWh 🔻

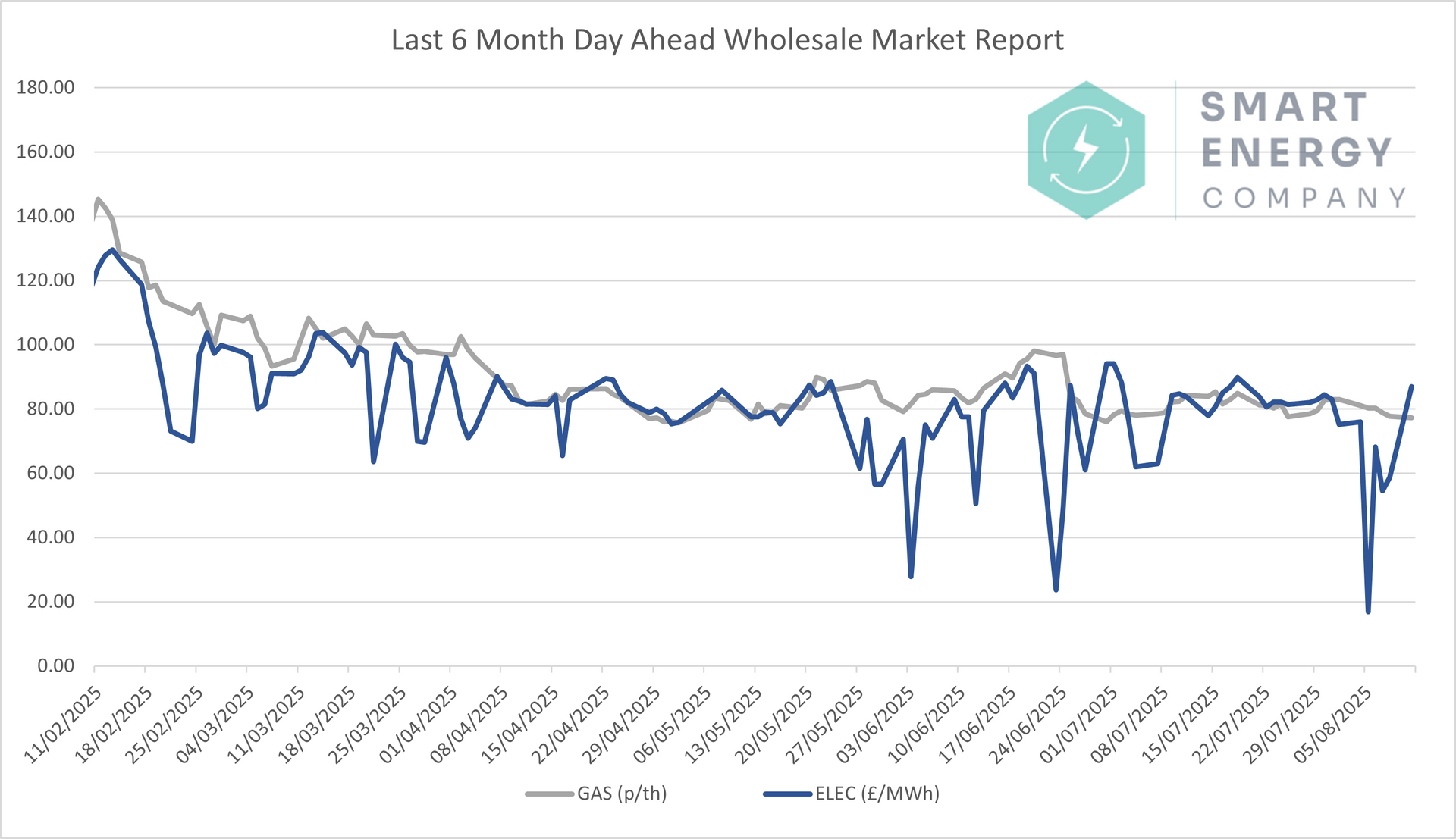

📈 6–Month Energy Market Trends

The chart shows:

- Both gas and power remain well below their February–April peaks.

- August DA pricing sits beneath forward levels, indicating current contract quotes remain higher than spot market lows.

- Sustained forward market declines would be the key driver of cheaper renewal quotes.

💡 What This Means for Your Business

| Time Until Contract Ends | Fixed Contract Advice |

|---|---|

| 0–3 Months | ⚠ Actively monitor now — Forward prices are softening but remain higher than DA. Locking in during a forward market dip could avoid Winter 25 tightening. |

| 3–6 Months | 🔍 Track closely — You’ll likely catch Winter 25 or Summer 26 pricing. Both have eased, improving the chance of value if this trend holds into September. |

| 6–12 Months | 📅 Wait and watch — Summer and Winter 26 are both trending down. Sign up for alerts so you can move quickly if a larger drop occurs. |

🔭 Looking Ahead

- Wind output forecast to drop in the UK & NW Europe early this week, which may lift DA power prices temporarily.

- LNG delivery schedules remain strong, but any disruption could firm up forward gas.

- Global energy sentiment still influenced by oil prices and geopolitical headlines — both can sway forwards quickly.

📢 Final Thoughts

This was a week where day-ahead prices looked better than they truly were for contract buyers. Forward markets are the real driver of your renewal cost, and those are finally showing signs of easing. If you’re within 6 months of renewal, now is the time to actively monitor and be ready to strike on dips.

📉 Forward prices are finally softening —

Are you ready to take advantage?

The wholesale market is giving rare opportunities for businesses to cut costs,

but dips can vanish overnight if supply tightens or global events turn.

Whether you’re weeks or months away from renewal, knowing your trigger point could save thousands.