Energy Market Update: 19th - 23rd May 2025

Gas and power prices climbed again last week, rising for a second week in a row as Norwegian maintenance continued and political uncertainty lingered. Here's what moved the market and what it means for your next contract.

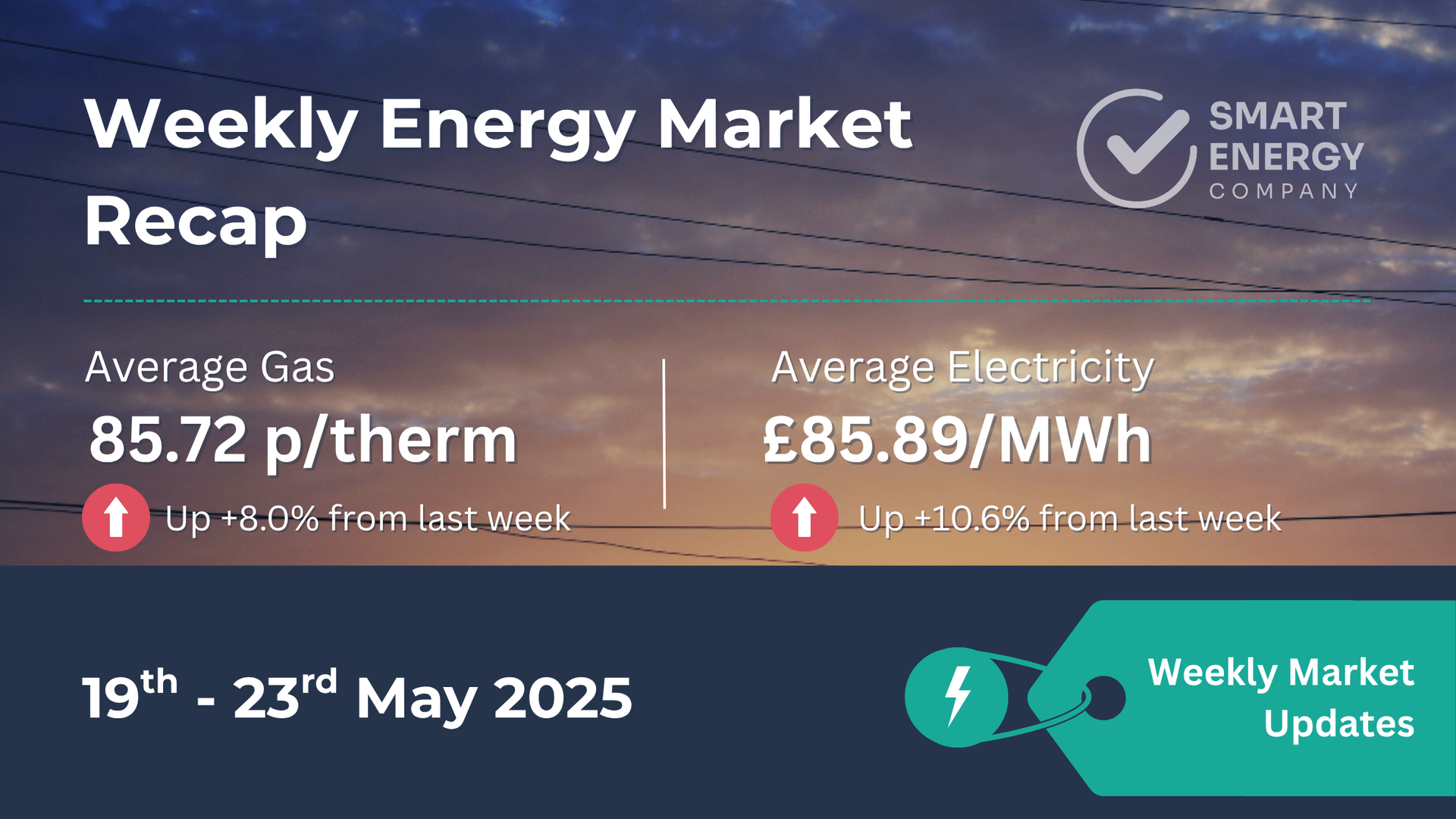

📊 Weekly Energy Market Recap

⚡ Quick Snapshot

- Day-Ahead Gas: Up from 79.36 p/therm to 85.72 p/therm

- Day-Ahead Power: Rose from £77.63 to £85.89/MWh

- Both markets reached

new 6-week highs, led by lower Norwegian flows and geopolitical risks

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 23/05/2025 | 85.72 | £85.89 |

| 16/05/2025 | 79.36 | £77.63 |

| 09/05/2025 | 82.14 | £83.91 |

| 02/05/2025 | 76.39 | £77.68 |

| 25/04/2025 | 84.07 | £86.25 |

📈 Prices are now firmly back on an upward trajectory after a brief drop mid-May.

📉 Market Overview

📌 Rangebound to Rising

Markets opened quietly but surged midweek as Norwegian gas flows dipped sharply and peace talks between Russia and Ukraine fell flat.

🌍 Political Influence

A phone call between Trump and Putin failed to yield progress, while U.S. senators proposed new penalties on Russian trade. Sentiment remains sensitive to headlines.

🧊 Weather & Storage

Slightly cooler temperatures and strong gas storage targets in the EU (~45%) added to bullish pressure.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 89.80 p/therm (21/05) | £88.58/MWh (23/05) |

| Lowest | 80.25 p/therm (19/05) | £84.08/MWh (19/05) |

| Weekly Average | 85.72 p/therm | £85.89/MWh |

| Change vs Last Week | 🔺 +8.0% | 🔺 +10.6% |

🔍 Key Factors This Week

🟨 Soft Fundamentals

- 📉 Norwegian gas flows hit a low due to Kollsnes maintenance

- 🌡️ Weather cooled midweek, raising gas-for-heating demand

- 🔋 EU storage hit 45%, still behind seasonal average

🌍 Geopolitical & Trade Headlines

- 🧾 Failed Russia–Ukraine peace talks dragged on

- 📞 Trump–Putin call offered no breakthrough

- 🇺🇸 New U.S. legislation proposed trade penalties on countries buying Russian energy

- 🌏 LNG demand in Asia picked up, raising competition for supply

📣 What This Means for Your Business

🔹 Contracts Ending Soon (0–3 Months)

Now is a sensible time to fix. The market has been climbing and recent dips are being erased. Locking in now could protect you from any further short-term spikes.

🔹 Contracts Ending Mid-Term (3–6 Months)

Request a quote and set a trigger point. You may want to wait — but prices are rising, and a dual quote (for now vs. later) can help you make a clear choice.

🔹 Long-Term Renewals (6+ Months)

No rush, but monitor closely. If we see another Norwegian outage, or if peace talks fall apart, prices could creep up. Set price alerts and review quarterly.

👉 Avoid paying more than you need to.

If your contract’s due soon, now could be a smart time to get a fixed quote while prices are still below winter highs.

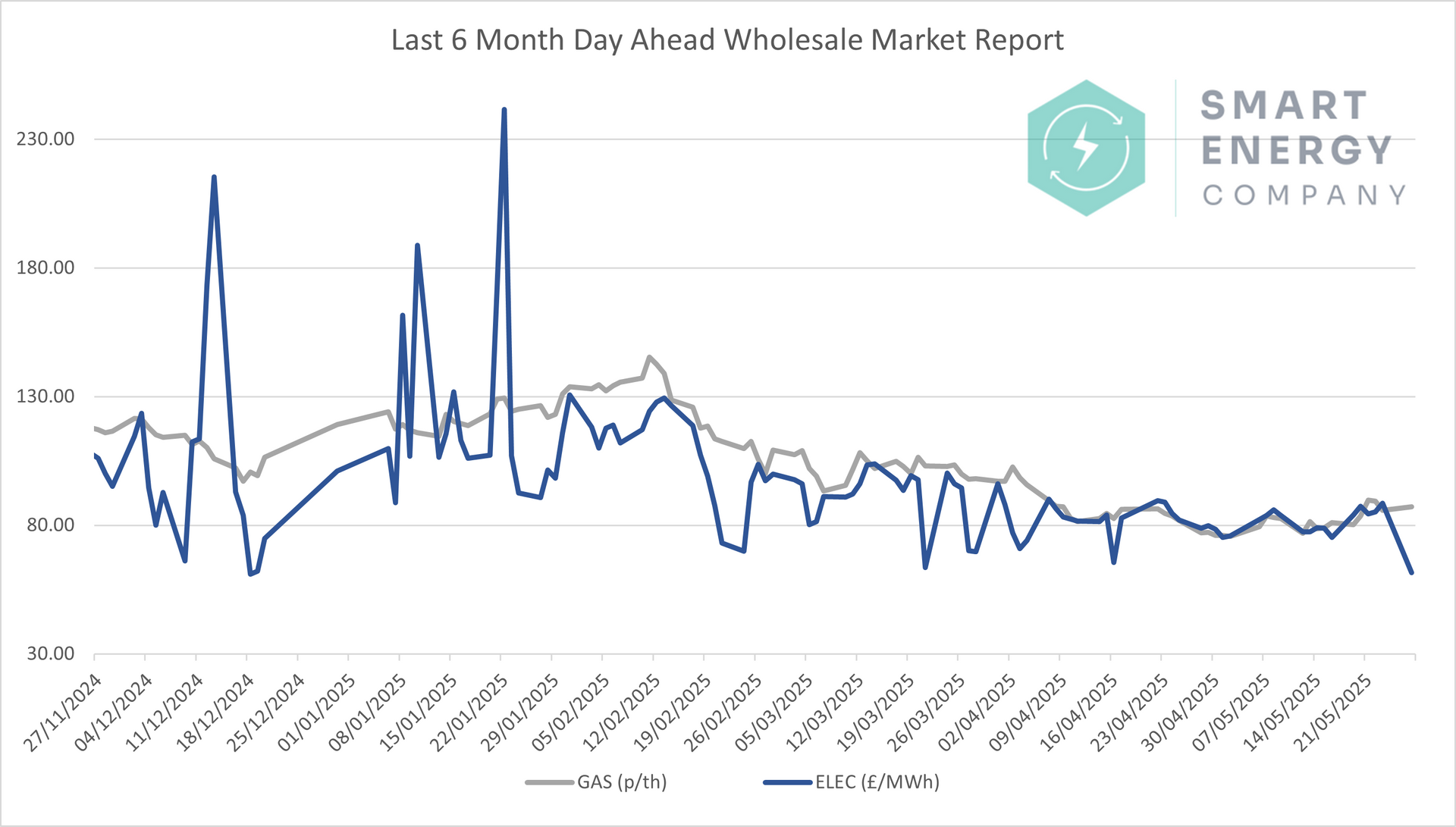

📈 6-Month Energy Market Trends

Gas and power prices bounced sharply after weeks of sideways movement.

We’re now seeing prices at their highest since late March.

📈

Gas is nearing 90 p/therm again, a level last seen in mid-Q1.

📈

Power is back near £90/MWh, driven by supply fears and tightness in LNG and renewables.

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🔮 Looking Ahead

- 🔧 Norwegian flows expected to return to normal — could ease pressure

- 🧊 Cooler weather across Northern Europe may increase short-term demand

- 📅 All eyes remain on whether any progress will be made on Russia–Ukraine peace

- 🧾 New U.S. sanctions could spark more volatility depending on timing

🤝 Final Thoughts

The market continues to react more to politics than physical shortages.

But prices are clearly rising, and the risk of doing nothing is growing.

If you’ve got a renewal due before summer — now is a good time to review it.