Energy Market Update: 12th - 16th May 2025

After a week of early optimism and midweek retracement, gas and power prices closed lower overall. Below is your full market recap, including this week’s new 5-week trend view to help you spot the direction of travel more clearly.

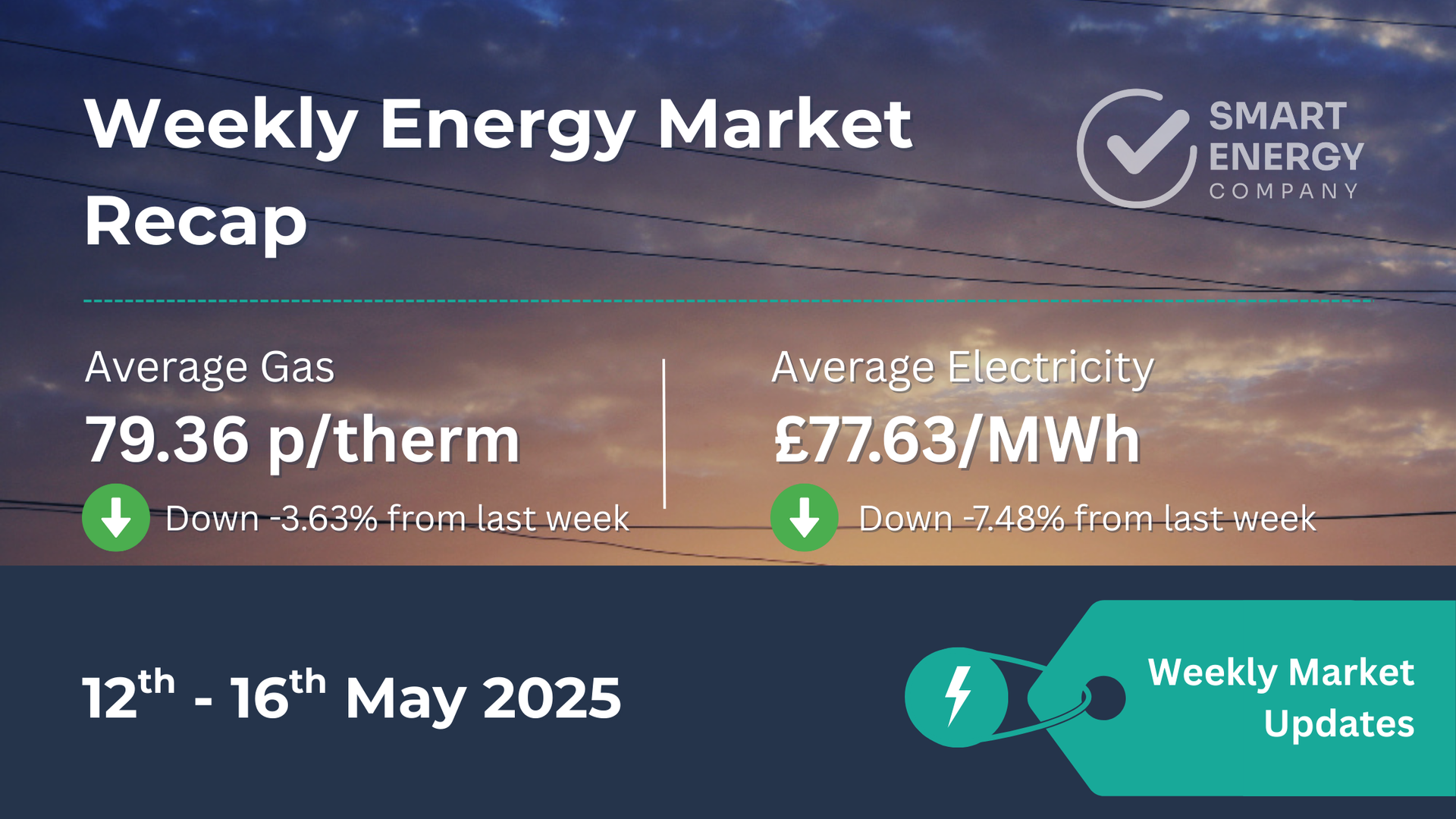

📊 Weekly Energy Market Recap

✨ Quick Snapshot

- 🔥 Average Gas (Day-Ahead): 79.36 p/therm

(Down 3.63% from last week’s 82.14 p/therm)

- ⚡ Average Electric (Day-Ahead): £77.63/MWh

(Down 7.48% from last week’s £83.91/MWh)

- 🛢️ Brent Crude: Ended the week at

$64.53/bbl

(Down ~3.7% as optimism around global trade talks cooled off)

💬 Prices drifted lower as peace talks lost momentum, demand remained soft, and renewables held firm.

📅 5-Week Price Trend

| Week Ending | Avg Gas (p/th) | Avg Power (£/MWh) |

|---|---|---|

| 16 May 2025 | 79.36 | £77.63 |

| 09 May 2025 | 82.14 | £83.91 |

| 02 May 2025 | 76.39 | £77.68 |

| 25 April 2025 | 84.07 | £86.25 |

| 18 April 2025 | 83.94 | £78.44 |

📉 Gas has eased from early-May highs. Power dipped sharply this week, following more stable generation conditions.

📉 Market Overview

➤ Early Gains, But No Follow-Through

Gas and power prices ticked up early in the week on U.S.–China tariff relief and speculation around potential ceasefire negotiations in Turkey.

➤ Sentiment Shift Midweek

By Thursday, reality kicked in: Putin wasn’t attending talks, solar output surged, and demand stayed muted. Prices quickly corrected, and the week closed weaker overall.

➤ Volatility Without Direction

The market remains

rangebound, trading up and down on headlines, but without a strong trend. This makes short-term timing trickier — but helps highlight good entry points when prices settle.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 81.50 p/therm (13/05) | £79.00/MWh (14/05) |

| Lowest | 76.75 p/therm (12/05) | £75.27/MWh (16/05) |

| Weekly Average | 79.36 p/therm | £77.63/MWh |

| Change vs Last Week | 🔻 -3.63% | 🔻 -7.48% |

Note: This marks the biggest weekly rise since early March, driven by both fundamental and political uncertainty.

🔍 Key Factors This Week

⚖️ Soft Fundamentals

- Milder weather and strong solar output limited gas-for-power demand.

- Wind picked up by the end of the week, easing pressure on the grid.

🌍 Geopolitical & Trade Headlines

- Temporary U.S.–China tariff pauses boosted markets early on.

- Peace talks in Turkey lost momentum as key leaders dropped out — cooling sentiment by week’s end.

🧾 Russian Energy Outlook

- News around Nord Stream 2 debt restructuring suggests the project isn't completely written off — but EU plans to unwind Russian contracts remain unchanged.

🏢 Implications for Your Business

📅 Contracts Ending Soon (0–3 Months)

Prices have pulled back from recent highs. If you didn’t fix earlier this month, now could still be a good window — especially with the market showing signs of hesitation.

⏳ Medium-Term (3–6 Months)

Plenty of price risk remains heading into summer. Global headlines could quickly drive volatility again. Locking in while the market is quiet may prove beneficial.

🗓️ Long-Term (6+ Months)

Still time to monitor, but price ranges are narrowing. If you’re planning ahead for Q4 or early 2026, it's worth reviewing options while things are relatively steady.

👉 Avoid paying more than you need to.

If your contract’s due soon, now could be a smart time to get a fixed quote while prices are still below winter highs.

📈 12-Month Energy Market Trends

- Gas: Still well below winter peaks, now fluctuating between 76–83 p/therm.

- Power: Also off highs, but more reactive to renewables and short-term supply swings.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

While this week lacked a clear price direction, the market’s relatively calm compared to earlier this year.

That makes now a good time to plan ahead — and possibly fix if your contract is due in the next few months.