June 2025 UK Energy Market Trends: Gas, Power & Oil

✅ At a Glance: What Happened in June?

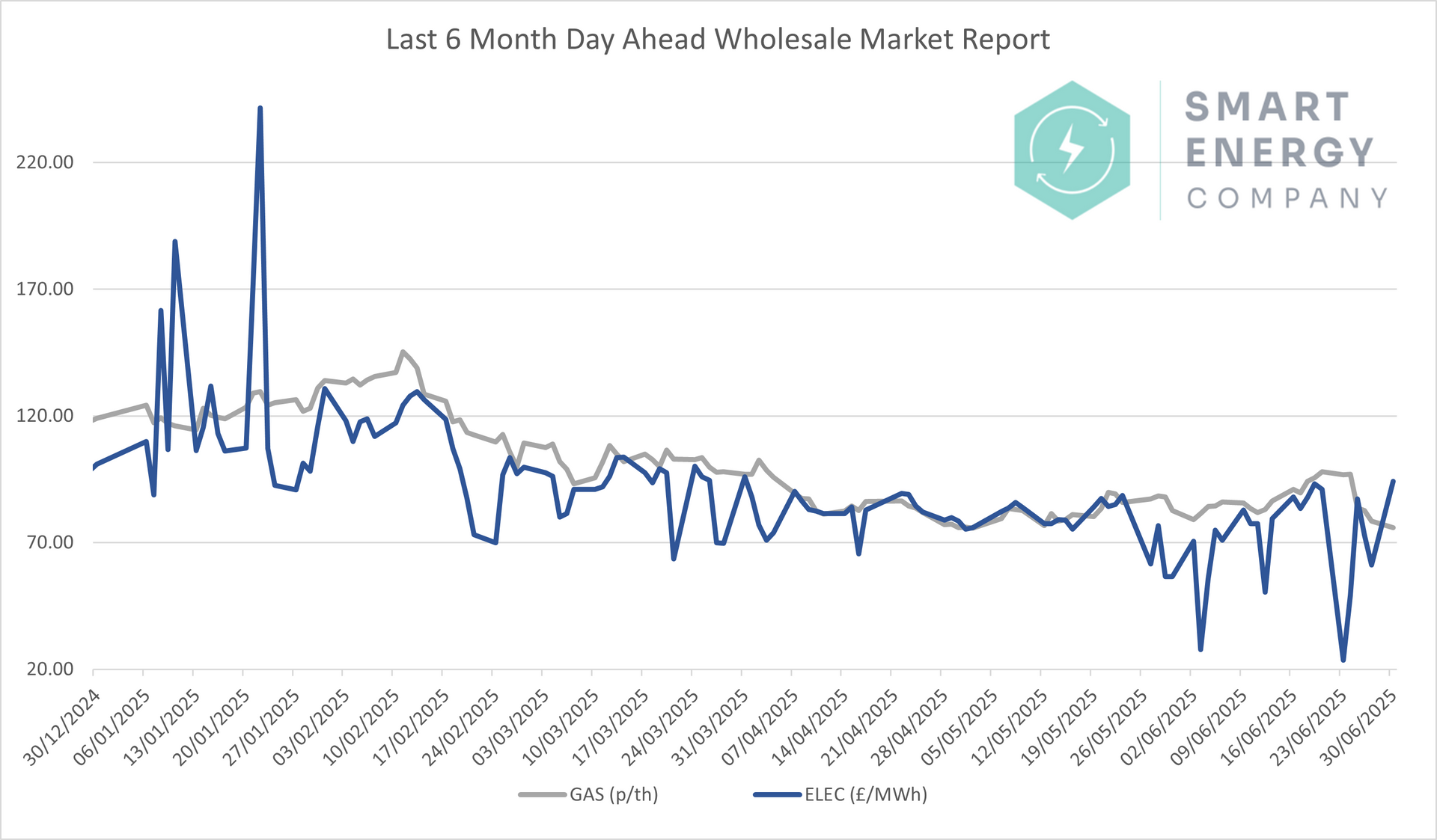

June was a rollercoaster month for wholesale energy, with geopolitical tensions, heatwaves, and ceasefire headlines all contributing to wild swings — especially in power prices.

- ✅ Gas prices averaged 86.61 p/th – ⬆️ 4.9% from May

- ⚡ Electricity averaged £71.43/MWh – ⬇️ 8.15% from May

- 📉 Power hit extreme lows mid-month due to short-lived demand collapse

- 🔥 Gas markets soared mid-June following Israeli strikes on Iran

- 🛢️ Oil rose then dropped on conflict risk, with Brent peaking near $79

📌 Despite volatility, forward prices trended down overall, improving fixed contract opportunities.

📊 Monthly Recap Snapshot

June 2025 Recap

Average Gas:

86.61 p/th ⬆️

Average Power:

£71.43 /MWh ⬇️

📉 Interpreting the Chart: Key Market Movements

Key Patterns:

- 📈 Mid-June Gas Spike: Prices surged following Israeli strikes on Iran’s infrastructure, raising fears over LNG disruption via the Strait of Hormuz.

- ⚠️ Electricity Volatility: Record lows hit on 23rd & 24th June due to weak demand and strong wind, skewing the monthly average.

- 💡 Late June Softening: Ceasefire announcements and resumed Norwegian flows eased prices lower to close the month.

📊 Price Comparison Table

| Commodity | June 2025 Avg | May 2025 Avg | Change |

|---|---|---|---|

| Gas (p/therm) | 86.61 | 82.60 | ⬆️ +4.9% |

| Power (£/MWh) | 71.43 | 77.78 | ⬇️ -8.15% |

🌍 What Drove the Market?

🔥 Geopolitics:

- Mid-June saw Israeli strikes on Iranian nuclear sites and a brief oil price surge as the U.S. signalled possible intervention.

- A ceasefire was later announced, but markets remained cautious, especially around LNG flows through the Strait of Hormuz.

☀️ Weather & Renewables:

- June was hotter than average, increasing cooling demand but failing to significantly lift prices.

- Strong wind output (especially late June) suppressed power prices — leading to record lows on 23rd & 24th June.

🏭 Supply & Storage:

- Norwegian maintenance disrupted gas flows early in the month but resumed by month-end.

- EU storage continued filling steadily, sitting near seasonal norms.

👉 Want to secure today’s lower rates before further increases?

Get a live quote from 28+ trusted suppliers. We’ll compare the best fixed deals for you.

🔎 12-Month Market View: Are Prices Falling?

Summary:

- 🧊 Winter 24–25 Prices Dropped: Good for early fixers

- 📈 Gas prices briefly spiked mid-June on conflict risk

- ⚠️ Power volatility remains high — timing is critical for power fixers

💡 What This Means for Your Business

📅 If your contract ends by August

Now’s your chance. Forward prices for Autumn 2025 are down ~20% compared to June’s highs. Lock in early and avoid the next spike.

📆 If you're fixed until 2026 or 2027

It’s worth comparing prices anyway. Winter 2026 has dropped 7–9% this month — consider re-tendering early if you use significant volume.

🧾 For multi-site or heavy energy users

Receive Market UpdatesElectricity volatility makes comparisons harder — send us your data and we’ll map the most stable contract windows.

🔭 Looking Ahead to July

Here’s what we’re watching:

- 🌡️ Will cooling demand remain weak?

- 🇮🇱 Will Israel–Iran ceasefire hold or collapse again?

- 🔁 When will the second round of Norwegian maintenance hit?

- 🧊 Are storage levels on track for winter security?

Why Business Work With Us

Rated 5 Stars by UK Businesses

“Tom’s updates on energy prices have saved us money year after year. Highly recommend the Smart Energy Company.”

🏁 Final Thoughts

June delivered a volatile mix of headlines, drops, spikes, and sudden reversals. But the overall trend is more positive for energy buyers — particularly on long-term fixed deals.

✅ Fixing your rates during calmer spells like this can protect your business from renewed volatility later in the year.

📥 Ready to Review Your Options?

Don’t wait until prices climb again. Get a fresh quote today — no pressure, just clarity.